Bitcoin Surpasses $90,000 Mark Amid Increased Market Activity

Bitcoin has surpassed the $90,000 price mark, indicating a significant moment in its bullish rally. This price increase has attracted both existing investors and new market participants.

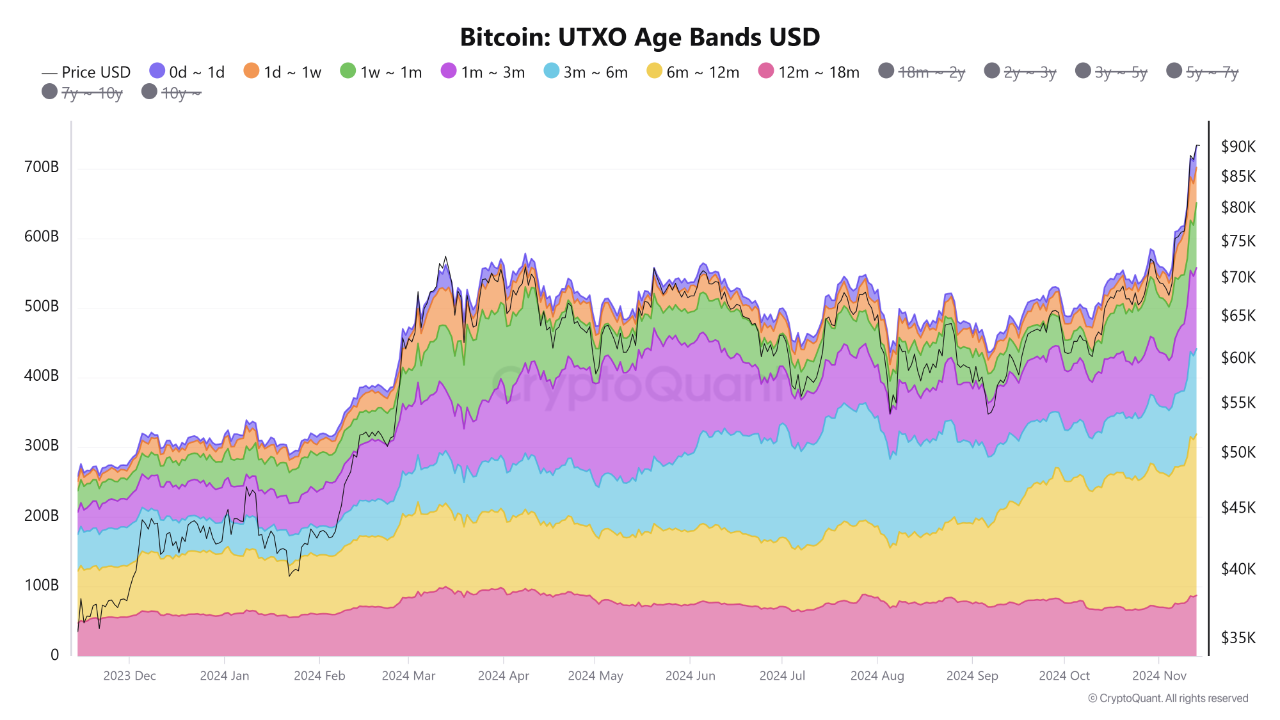

The rise is reflected in the increase of UTXO (Unspent Transaction Output) Age Bands, which tracks Bitcoin holdings by age, as analyzed by CryptoQuant analyst Shiven Moodley. This indicates heightened interest and engagement in the market.

Moodley's analysis shows a high percentage of market participants are currently profitable, as indicated by the UTXO profit percentage metric.

Despite strong performance, long-term holders maintain their positions while the derivatives market becomes increasingly leveraged.

Profitability Metrics Signal Market Momentum

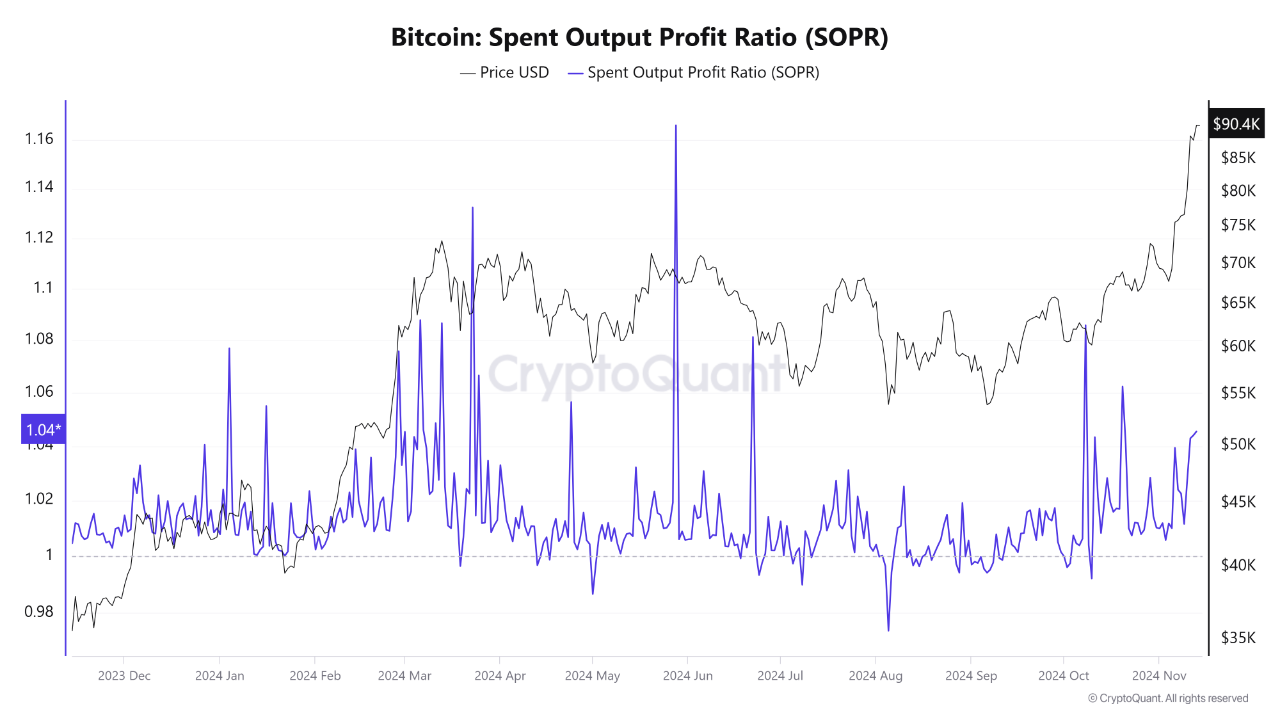

Moodley highlighted the positive Spent Output Profit Ratio (SOPR), indicating many transactions occur at a profit, reflecting optimistic market sentiment and suggesting potential for further price increases.

Moodley noted a developing "mania phase," evidenced by an increase in options market call contracts expiring in the next two months, suggesting many traders anticipate continued upward momentum.

According to probability models tracking Bitcoin’s price movements, with a lag of 500 days, Bitcoin has breached two standard deviations at the $90,000 level. The next significant price marker is projected at around $101,000.

Bitcoin Market Performance

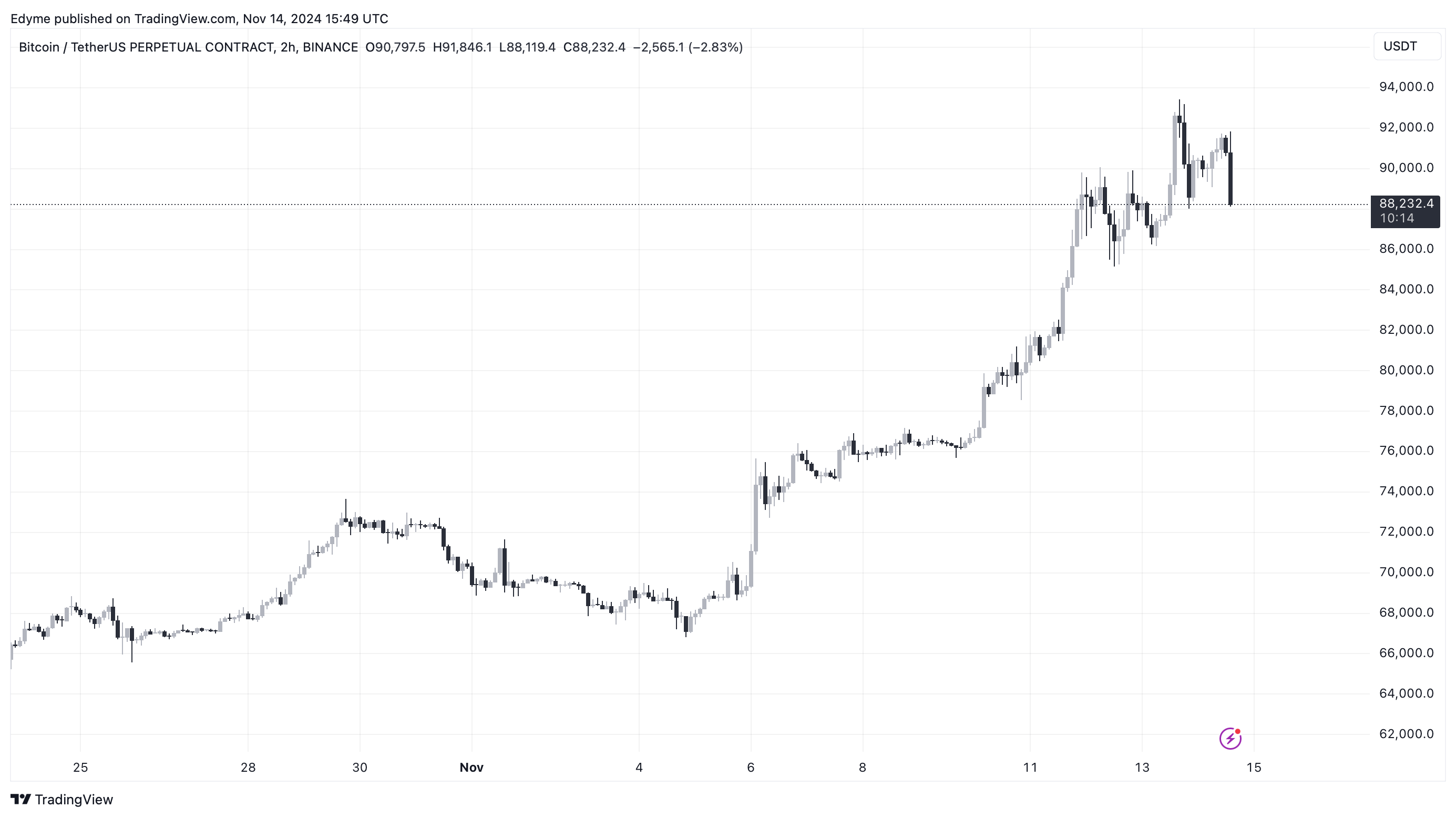

Currently, Bitcoin has seen a cooling off from its recent bullish momentum. After peaking at $93,477, BTC has faced a pullback, trading below $89,000.

As of now, the asset trades at $88,878, down 2.9% in the past day, but has shown nearly 20% growth over the past week. Despite strong bullish sentiment, increased leverage in the derivatives market and rising call options activity may lead to heightened volatility in the BTC market.

Overleveraged markets historically face corrections, especially with rapid shifts in market sentiment. While many participants may be in profit, caution is advisable.

Featured image created with DALL-E, Chart from TradingView