Bitcoin Surpasses $97,200 Amid Optimism for Trump’s Crypto Policies

Bitcoin (BTC) surpassed $97,200 during Asian trading on Thursday, driven by investor optimism regarding regulatory reforms under President-elect Donald Trump. This rise brings Bitcoin closer to the $100,000 mark, reflecting increasing confidence in its potential under the new administration.

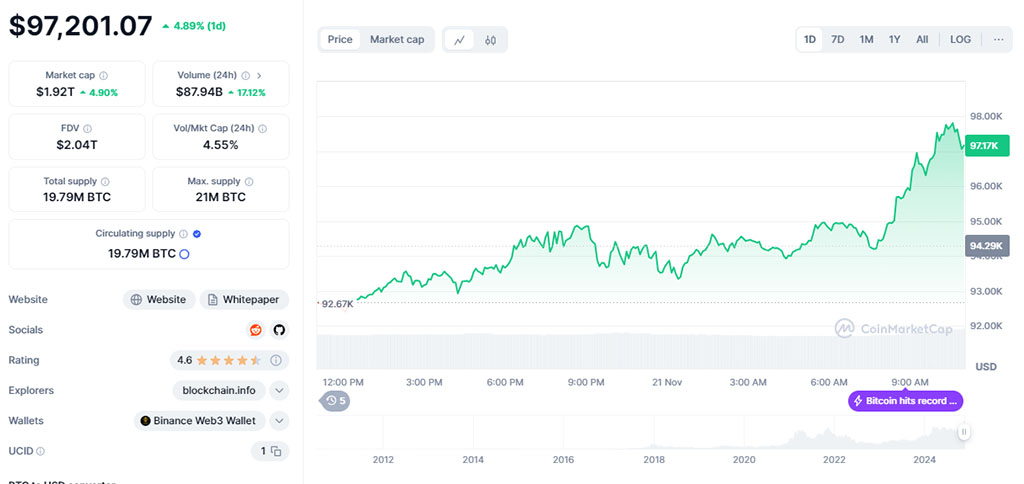

Source: CoinMarketCap

Over the past year, Bitcoin’s value has more than doubled, with a 40% increase in just two weeks following Trump's election. The introduction of pro-crypto lawmakers in Congress suggests stronger legislative support for cryptocurrencies. Investors expect policies that will promote growth in digital assets.

Analyst Tony Sycamore from IG Markets noted that while Bitcoin is now in overbought territory, it is being drawn toward the $100,000 level, driven by technical and market forces as traders maintain a bullish outlook.

Trump Pledges to Make US Crypto Hub

During his campaign, Trump supported digital currencies, promising to establish the United States as the “crypto capital of the planet.” He proposed creating a national Bitcoin reserve, indicating a commitment to integrating cryptocurrencies into the financial framework. This has led to significant investments in US-listed Bitcoin exchange-traded funds (ETFs).

Since the election, over $4 billion has been invested in ETFs, highlighting increased interest from institutional investors. Recently, options for BlackRock’s iShares Bitcoin Trust (IBIT) launched, with call options outpacing puts, indicating optimism about Bitcoin's price increase.

Bitcoin-related stocks have also risen. Shares of MARA Holdings, a major Bitcoin miner, increased nearly 14%. MicroStrategy, recognized for its substantial Bitcoin holdings, saw its stock rise 10%, elevating its market value above $100 billion, indicative of growing confidence in Bitcoin’s upward trend.

Will US Crypto Policies Gain Clarity Soon?

Will Peck, head of digital assets at WisdomTree, noted rising interest in whether the current administration will provide the long-awaited regulatory clarity for the crypto sector. He expressed cautious optimism about potential progress in regulatory matters amid uncertainty about achieving concrete results.

Nathan McCauley, CEO and Co-Founder of Anchorage Digital, remarked that with the approval of options on Bitcoin ETFs, the crypto ETF market is maturing, positioning Bitcoin alongside traditional investments like stocks, bonds, and commodities.

The recent surge in Bitcoin’s price is linked to Trump’s election win on November 5 against Vice President Kamala Harris. Reports suggest the administration may create a dedicated crypto policy position, potentially signaling a more structured approach to cryptocurrency regulation.