Bitcoin Taker Buy/Sell Ratio Surges as Whales Purchase 40,000 BTC

The price of Bitcoin has faced challenges in reaching the $100,000 mark following a strong bullish trend. Despite recent price stagnation, investor interest remains high.

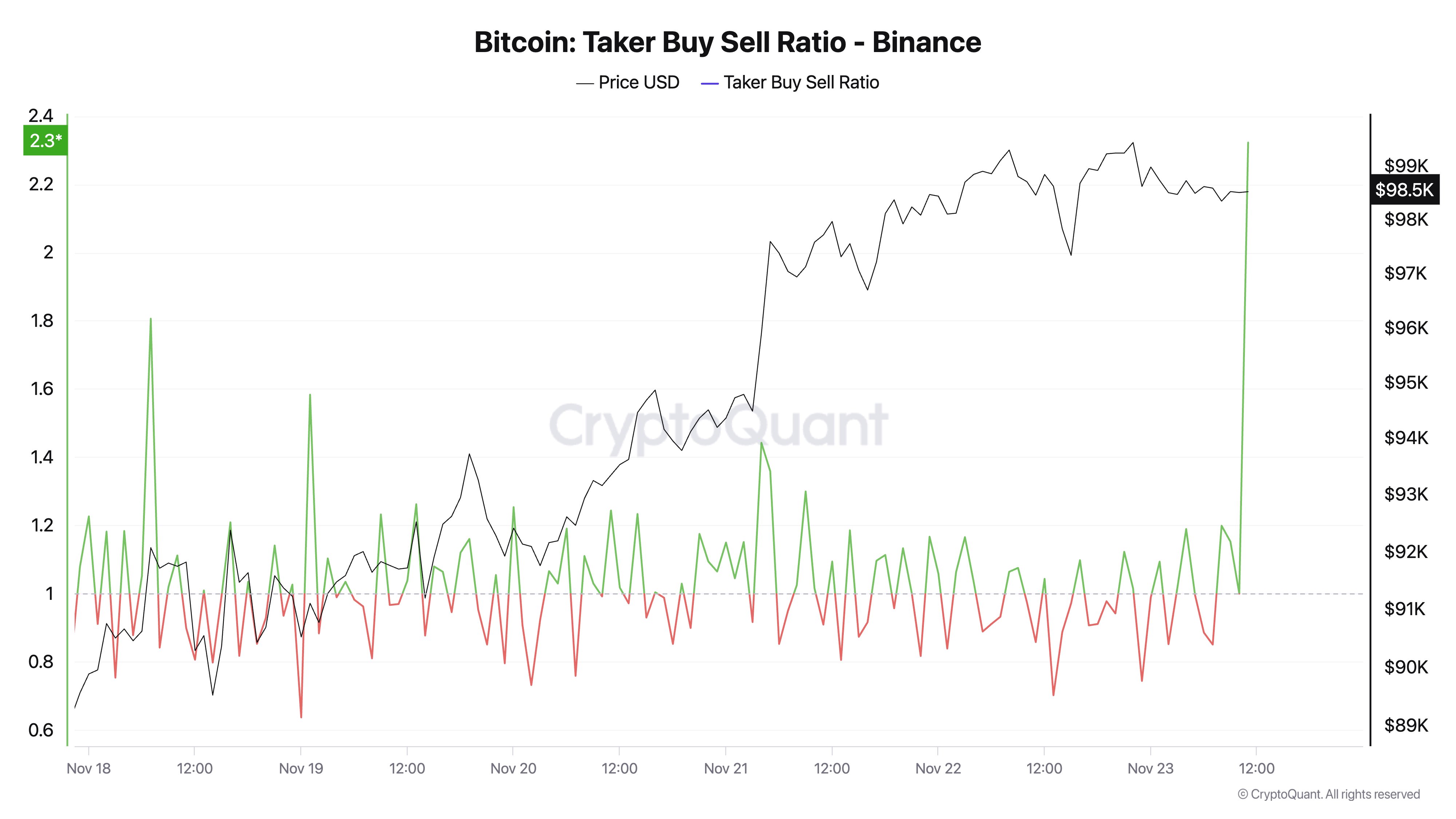

Bitcoin Taker Buy/Sell Ratio Is Rising — Impact On Price

Crypto analyst Ali Martinez reported on November 23 that traders have increased their Bitcoin purchases, as indicated by the rising “taker buy/sell ratio.” This metric measures the volume of taker buys against taker sells for Bitcoin.

A taker buy/sell ratio above 1 indicates higher buying volume, typically interpreted as a bullish signal. Conversely, a ratio below 1 suggests greater selling pressure, indicating bearish sentiment.

Martinez noted that the Bitcoin taker buy/sell ratio on major exchanges like Binance, OKX, HTX, and Bybit has surged, with Binance reporting a spike to over 28. This suggests significant buying momentum, potentially supporting Bitcoin's ascent towards $100,000.

Currently, Bitcoin's price is approximately $97,800, reflecting a 1.1% decline in the past 24 hours. However, BTC has increased nearly 8% over the last week according to CoinGecko data.

Who Is Buying?

Martinez also highlighted that large investors, or whales, holding between 100 and 1,000 coins have been active recently. Data from Santiment shows these whales have acquired over 40,000 BTC, valued at around $3.96 billion, in the last four days. This substantial buying activity may positively influence Bitcoin's market dynamics.