Bitcoin Expected to Surpass Gold and US Dollar in Coming Months

An original Bitcoin advocate forecasts a rapid increase in demand for Bitcoin, supporting estimates that BTC could reach six figures soon.

“OG” refers to someone exceptional or “old-school.”

This supporter suggests Bitcoin is positioned to outperform gold, the US dollar, and other major assets shortly.

Rising Over Gold, Greenback

ShapeShift CEO Erik Voorhees anticipates Bitcoin will surpass major assets in the coming months, stating it has high potential to eclipse gold, the US dollar, and oil.

When demand for gold rises, more gold is produced. When demand for oil rises, more oil is produced. When demand for USD rises, more USD are produced. When demand for Bitcoin rises...

— Erik Voorhees (@ErikVoorhees) October 29, 2024

Voorhees noted that unlike gold, oil, and the US dollar, which can be produced in response to rising demand, Bitcoin's supply is capped at 21 million coins as designed by Satoshi Nakamoto.

Bitcoin-Gold Relationship

Max Keiser, another Bitcoin proponent, believes there is a correlation between gold and Bitcoin prices, suggesting that an increase in gold prices may lead to a corresponding rise in BTC prices. He stated that for every $1 rise in gold, BTC typically rises by $20.

Expecting A Bitcoin Surge

Voorhees advises the cryptocurrency community to monitor Bitcoin closely, predicting upward movement across all aspects of the coin, including its price. Many crypto experts project imminent growth, anticipating Bitcoin will exceed six figures.

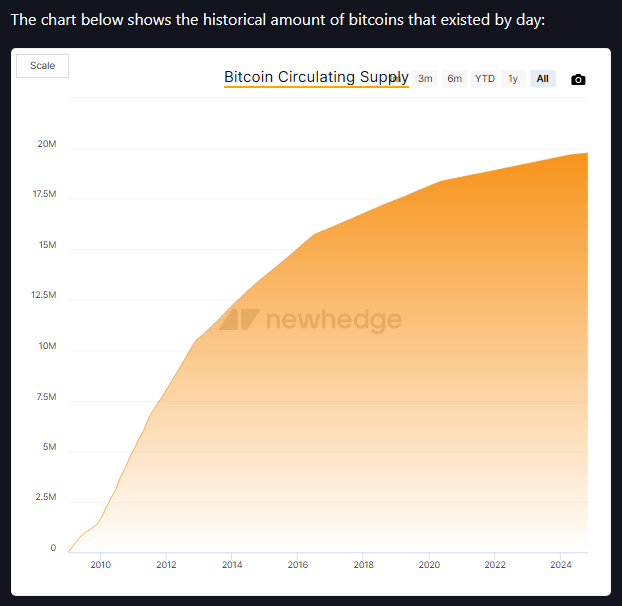

19 Million BTC Mined

Reports indicate over 19 million BTC are currently circulating in the market, the highest amount recorded. Analysts note many of these coins are stored in “cold wallets,” with some held by Bitcoin ETFs.

A Chinese journalist estimated that over 5% of all Bitcoins are owned by Bitcoin ETFs, valued at approximately $72.545 billion.

Featured image from Pexels, chart from TradingView