9 0

Bitcoin Hyper Positioned as Top Crypto Amid Potential Short Squeeze and Inflation Data

Key Points:

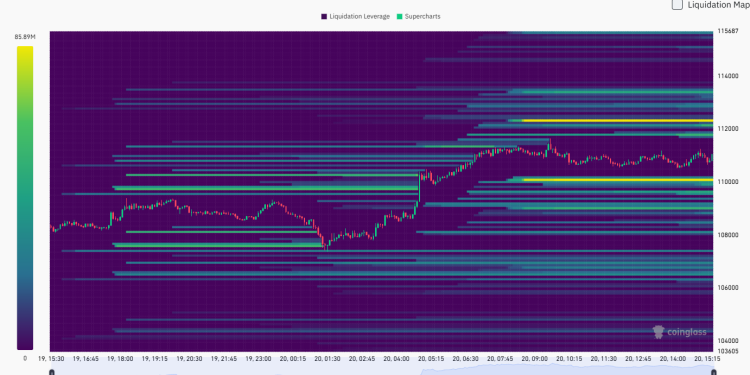

- Bitcoin (BTC) is facing potential upward pressure due to concentrated liquidity above its current price, hinting at a possible short squeeze.

- The "Coinbase premium" for Bitcoin is increasing, indicating heightened U.S. institutional and retail demand.

- Bitcoin's price is around $110K, with technical signals and macro factors suggesting a potential breakout.

- A short squeeze occurs when numerous market participants betting on a price decline are forced to buy back as the price rises, which could trigger further upward movement.

- Fresh data shows significant liquidity above Bitcoin’s current price, setting the stage for a possible upward move.

- Institutional interest is growing, evidenced by the rising Coinbase premium, signaling steady accumulation by large investors.

- Michael Saylor's Strategy has increased its Bitcoin holdings, maintaining demand from significant players.

- The upcoming U.S. CPI release amid a government shutdown could impact market dynamics, potentially influencing Bitcoin's movement.

- A favorable CPI result might support expectations for Fed rate cuts, potentially benefiting risk assets like Bitcoin.

- Bitcoin Hyper ($HYPER), a Layer 2 solution, aims to enhance Bitcoin transactions with fast speeds and low costs, leveraging Solana Virtual Machine for scalability.

- If a short squeeze occurs alongside institutional demand and favorable macroeconomic conditions, it could significantly boost Bitcoin and Bitcoin Hyper.