Bitcoin 30-Day Trader Profits Return to ‘Healthy’ Range

On-chain data indicates that the unrealized gains of 30-day Bitcoin investors have returned to a historically 'healthy' zone, which could signal bullish trends for BTC.

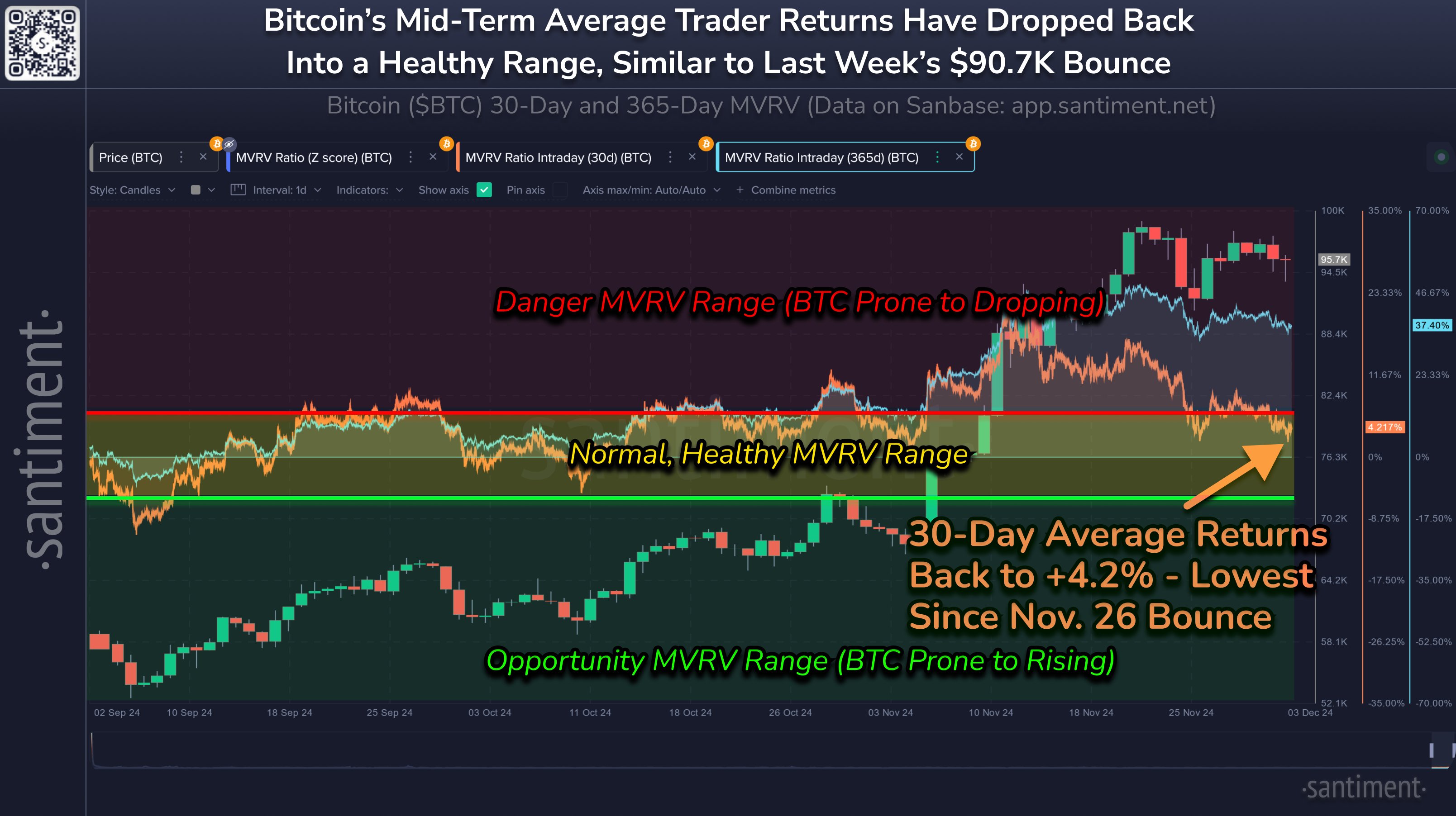

Bitcoin MVRV Ratio for 30-Day Traders

Santiment, an on-chain analytics firm, recently analyzed the trend in Bitcoin's Market Value to Realized Value (MVRV) Ratio. This metric compares the market cap of Bitcoin held by investors against its realized cap, reflecting initial investment amounts.

An MVRV Ratio above 1 indicates net unrealized profit among investors, while a value below 1 signifies a prevalence of losses. The focus here is on the MVRV Ratios for 30-day and 365-day holding ranges, providing insight into short-term and long-term investor profit-loss dynamics.

The following chart illustrates the trends in the Bitcoin MVRV Ratio for both 30-day and 365-day traders over recent months:

The chart shows that the MVRV Ratio for 30-day investors peaked last month during Bitcoin's all-time high exploration. However, as the cryptocurrency entered a consolidation phase, the metric has since cooled down. Santiment identified three zones based on historical trends, indicating that while the metric previously reached the 'danger' region, it has now returned to the 'healthy' range.

Currently, the MVRV Ratio stands at 4.2%, within the +5% to -5% 'healthy' zone. This level was last observed on November 26, just before a rebound in BTC prices.

Higher MVRV Ratios typically lead to increased selling pressure among investors, making values above 5% indicative of potential price declines. With the 30-day traders' MVRV Ratio back in the healthy range, Bitcoin may either resume its rally or avoid further drops.

For those who purchased Bitcoin within the past year, the MVRV Ratio exceeds 37%. Long-term holders generally exhibit lower selling tendencies, suggesting that these profits may not pose an immediate threat to BTC.

BTC Price

Currently, Bitcoin trades around $94,900, reflecting a 1% decline over the past week.