4 0

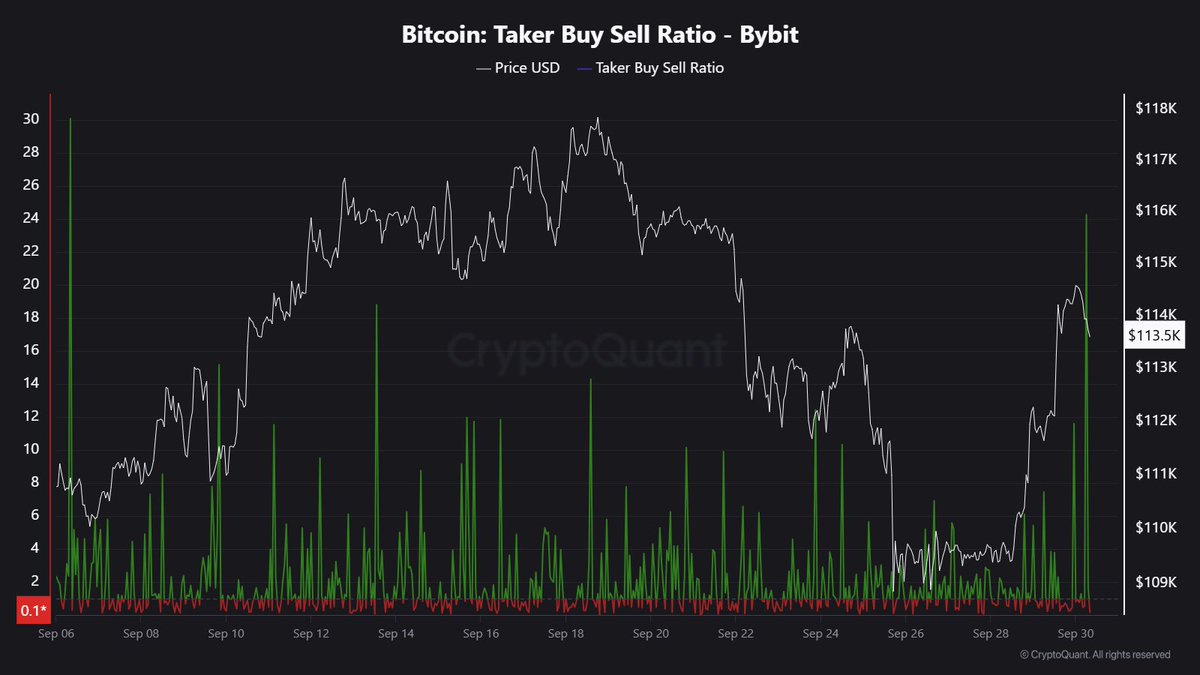

Bitcoin Traders Open Aggressive Longs as Taker Ratio Hits 24.26

Bitcoin has shown resilience, bouncing from a low near $108,000 to above $113,000. Bulls aim for $115,000, but momentum weakens as sellers resist. Uncertainty rises due to macro risks like the potential US government shutdown, impacting risk assets including Bitcoin.

Bybit Data Shows Surge in Long Positions

- Analyst Maartunn noted an increase in the Taker Buy/Sell Ratio on Bybit, reaching 24.26, the highest since September.

- This signals aggressive long positions, indicating strong bullish sentiment.

- However, such imbalances can lead to instability if these positions unwind.

The market is watching Bitcoin's ability to break the $115,000 resistance. A breakout could lead to $117,500, while failure might trigger profit-taking or liquidations, pulling it towards $110,000.

Bitcoin Holds Key Support But Faces Strong Barrier

- Bitcoin trades near $113,100, between support from the 50-period moving average and resistance at $117,500.

- The broader structure shows lower highs since July’s peak of $125,000, indicating medium-term waning momentum.

- Long-term trends remain upward with strong support around $100,000 and $80,000.

A break above $117,500 could challenge $120,000, while falling below $110,000 might test the $105,000 region.