8 1

Bitcoin Traders Increasingly Sell Put Options to Accumulate BTC

Traders in the Deribit BTC options market are increasingly writing BTC put options, indicating bullish expectations. This strategy allows them to collect premiums while holding stablecoins to cover potential purchases of BTC if prices drop.

- The strategy reflects long-term bullish sentiment among traders.

- BTC price has risen to over $92,000 from a low of $75,000 earlier this month, driven by haven demand and institutional interest.

- Options data shows significant buying of call options at strikes of $95,000, $100,000, and $135,000, with the $100,000 strike being particularly popular.

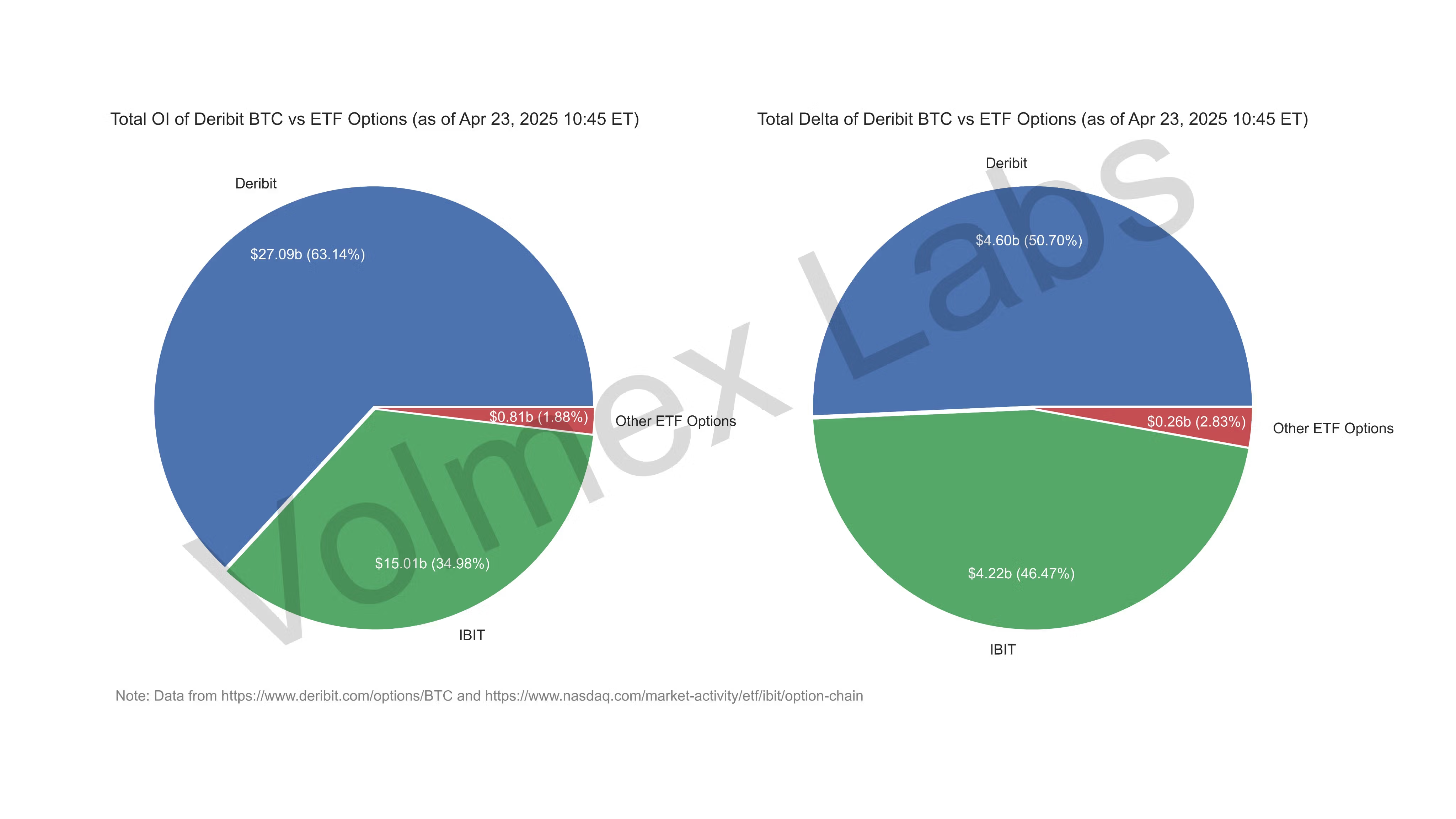

- Cumulative delta in BTC options reached $9 billion, indicating high sensitivity to BTC price changes.

- Total notional value of outstanding options contracts is $43 billion.

- Market makers are hedging against volatility due to increased open interest and shifts in strike pricing.

Traders on Deribit show a more bullish positioning than those trading options tied to U.S.-listed bitcoin ETFs.