13 1

Bitcoin Traders Brace for Major Tariffs and Whale Activity This Week

Bitcoin traders are preparing for a volatile week influenced by key factors:

#1 US Tariffs Set to Rise on April 2

- The US administration plans “reciprocal tariffs” effective April 2, escalating international trade tensions.

- Tariffs include 25% levies on auto imports and oil purchases from Venezuela.

- Retaliatory measures from Canada, China, the EU, and Mexico may follow, increasing market uncertainty.

- Inflation pressure could rise due to higher consumer costs on imports.

- Policy uncertainty is significantly elevated compared to past crises, leading to anticipated market volatility.

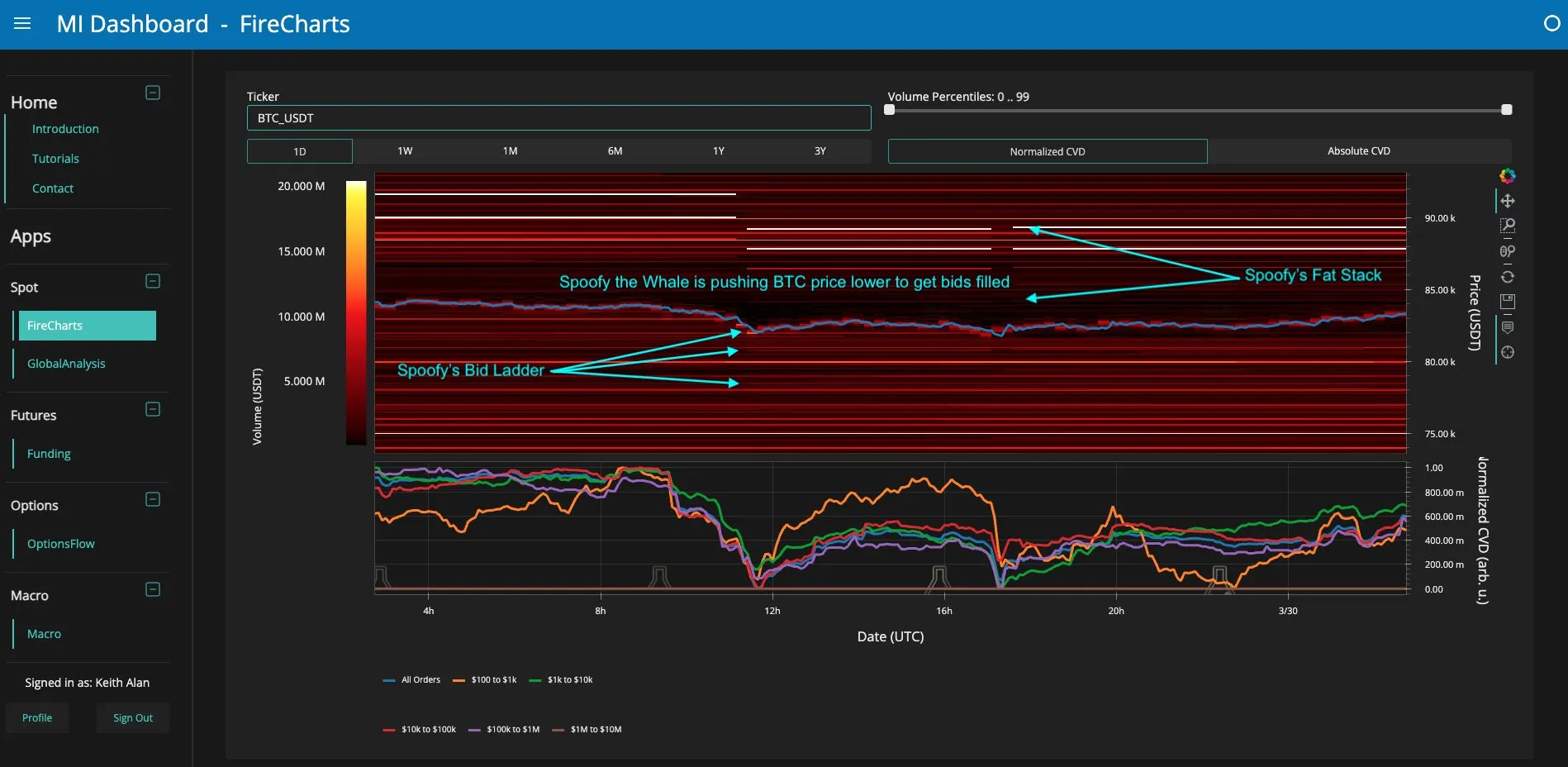

#2 Bitcoin Whale Activity

- Large liquidity movements in Bitcoin hint at a potential whale strategy linked to an entity known as “Spoofy the Whale.”

- This whale appears to be buying dips and has bids positioned down to $78k.

- Upcoming events may catalyze price swings, with implications for BTC's near-term prospects.

#3 Technical Analysis: Bearish Flag Breakdown

- A bearish flag pattern breakdown raises concerns about support levels around $81K.

- If BTC falls below this level, a target range of $70K–$73K may be reached.

- Contrarian sentiment suggests a possible market reversal despite negative outlooks surrounding April 2.

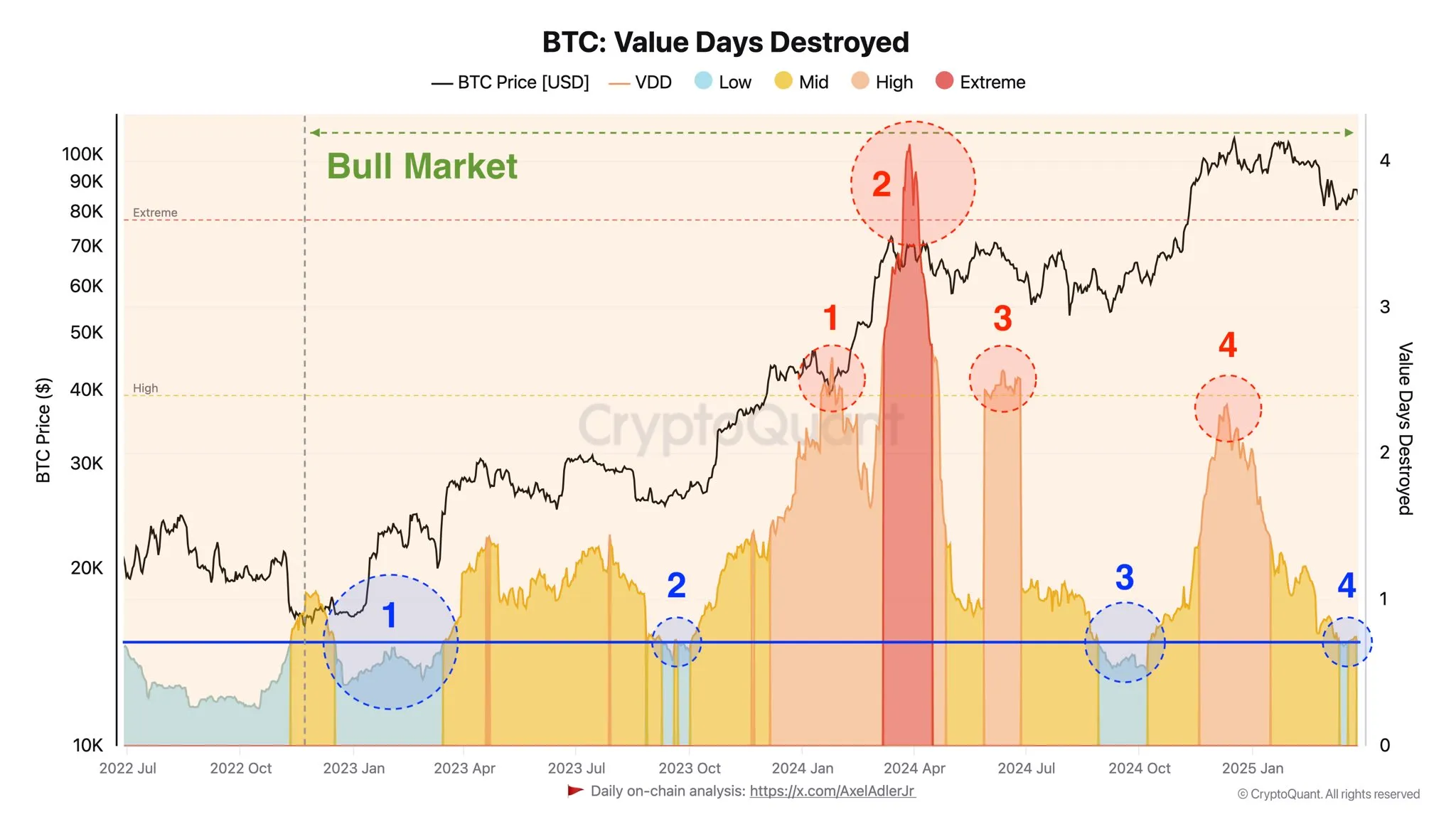

#4 Accumulation by Seasoned Investors

- Experienced players are entering a new accumulation phase, as indicated by low selling activity.

- Historical data correlates low Value Days Destroyed (VDD) periods with potential price increases.

- Current market conditions suggest confidence among long-term investors, despite macroeconomic uncertainties.

#5 CME Gap Considerations

- The recent filling of a CME gap between $82,000 and $85,000 is noteworthy.

- A new CME gap formation over the weekend may lead to a price move towards $84k next week.

- CME gaps often influence Bitcoin's price action, depending on broader market trends.

Currently, BTC is trading at $82,010.