Bitcoin Trades Above $82,000 as Market Sentiment Remains Weak

Bitcoin shows signs of recovery after a drop to $74,000 earlier this month, currently trading above $82,000 and approaching $85,000. Its market capitalization exceeds $1.6 trillion.

A report from CryptoQuant attributes this rebound to:

- High crypto price volatility driven by trade tensions and macroeconomic changes.

- Recovery following China's and the EU's tariff suspension on April 9, reducing tariffs to 10% for most countries.

Technical Support and Market Sentiment

CryptoQuant highlights Bitcoin's 365-day moving average at $76,100 as key support, previously significant in past market cycles. Current price movements are monitored for potential uptrend signals. A breach below this level could signal a bearish phase.

Investor sentiment remains weak, with CryptoQuant’s Bull Score Index at 10, indicating low chances of a sustained rally unless it rises above 40. Resistance levels noted at $84,000 and $96,000 which have historically affected price movement.

Altcoin Accumulation Signal

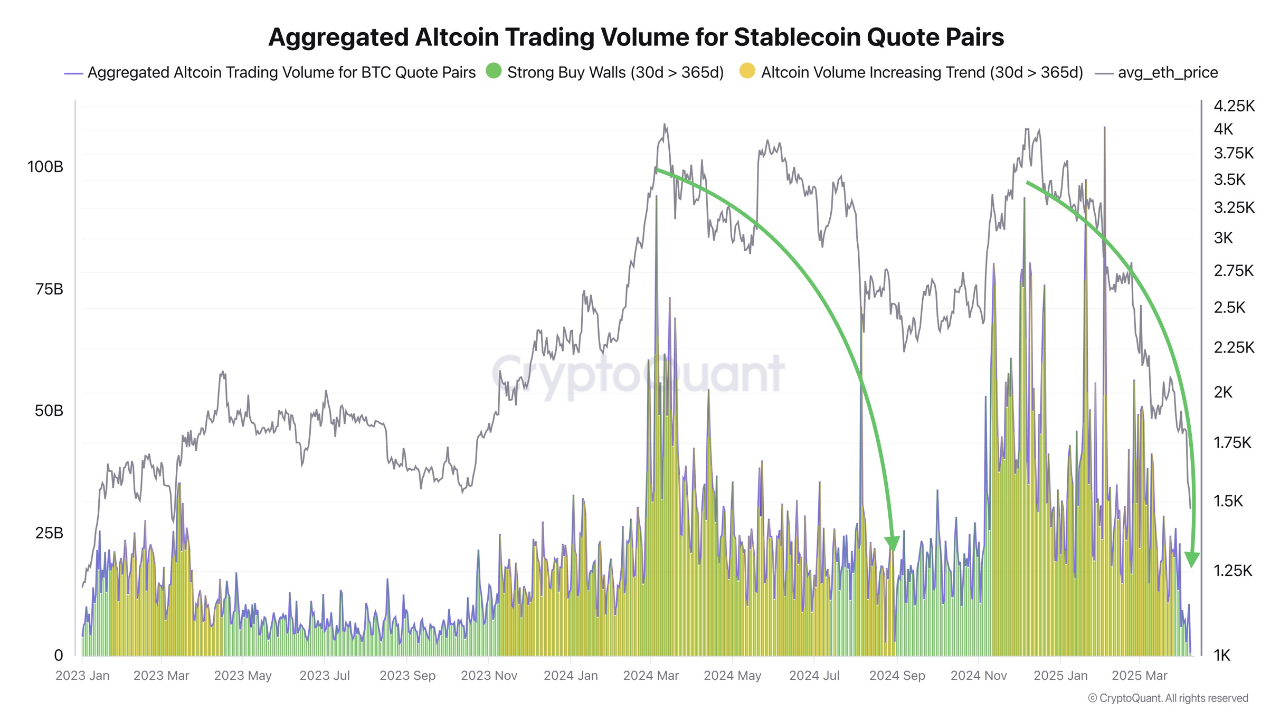

CryptoQuant analyst Darkfost indicates favorable conditions for altcoin accumulation, noting that the 30-day moving average of trading volume for altcoins paired with stablecoins has dropped below its annual average.

This behavior suggests potential buying zones, similar to trends observed in September 2023. While Bitcoin’s outlook is uncertain, altcoins may be entering a favorable phase for dollar-cost averaging strategies.

Darkfost warns these windows can last for extended periods but have historically preceded altcoin recoveries if the macroeconomic environment stabilizes.