7 0

Bitcoin Trades at $112,000 Following 7.5% Decline from Record High

Bitcoin (BTC) is currently trading at $112,047, down 7.5% over the past two weeks after failing to maintain momentum following its peak above $124,000. Analysts are evaluating on-chain metrics to determine if this decline is a temporary pause or a sign of an overarching correction.

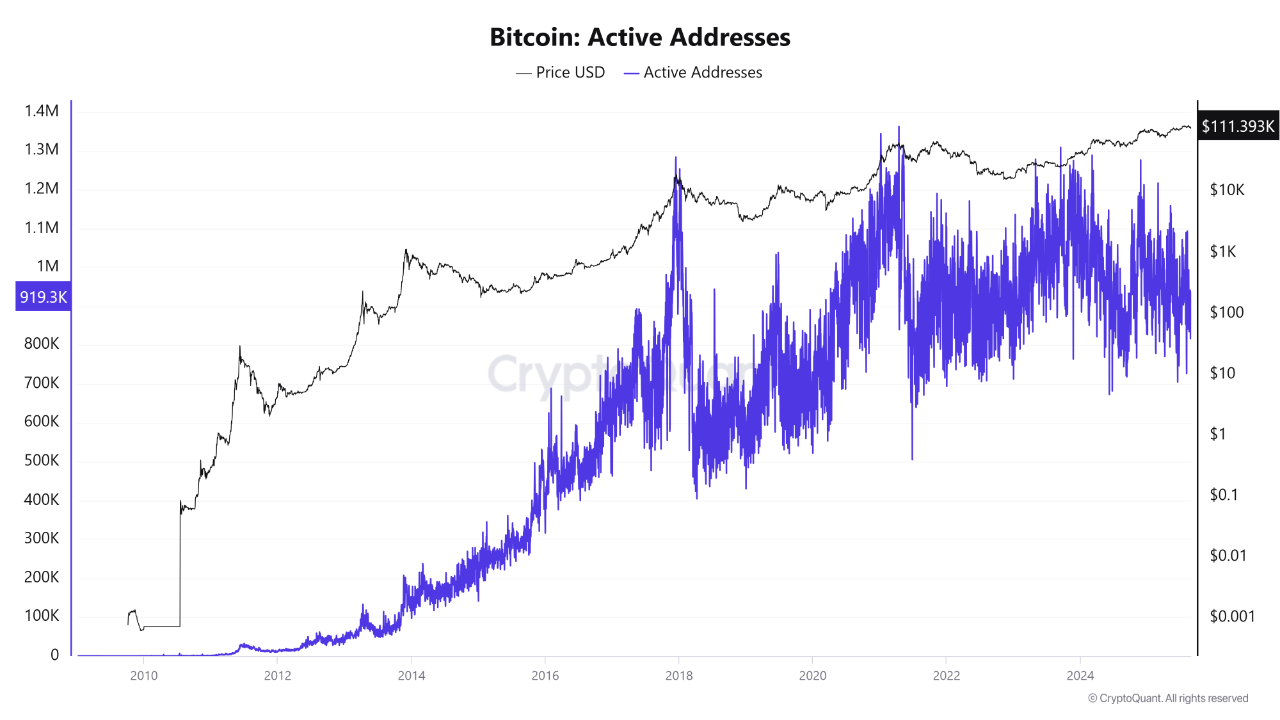

Active Address Growth Signals Resilient User Base

- High active addresses suggest stable network usage despite price drop.

- Historically, active addresses correlate with market cycles; spikes align with price peaks.

- Daily active addresses have stabilized between 900,000 and 1 million, currently at approximately 919,000.

- Sustained activity may support Bitcoin’s value, with potential targets of $150,000–$200,000 if maintained above 1 million addresses.

- A decline in address activity could lead to a price drop towards $80,000–$90,000.

Bitcoin Exchange Inflows Reach Multi-Year Lows

- Bitcoin's 30-day moving average of exchange inflows has hit its lowest since May 2023.

- Low inflows indicate reduced selling pressure as fewer coins are transferred to exchanges.

- Decreased inflows on Coinbase and Binance suggest diminished selling from large holders.

- Lower inflows combined with rising prices may signal a constrained supply environment, potentially supporting higher valuations.