4 0

Bitcoin Trades Below $110,000 as Whales Rebalance Portfolios

Bitcoin is trading below $110,000 at $108,071, up 2% in the last 24 hours. Despite nearing its all-time high, Bitcoin remains in a holding pattern due to institutional rebalancing and on-chain dynamics.

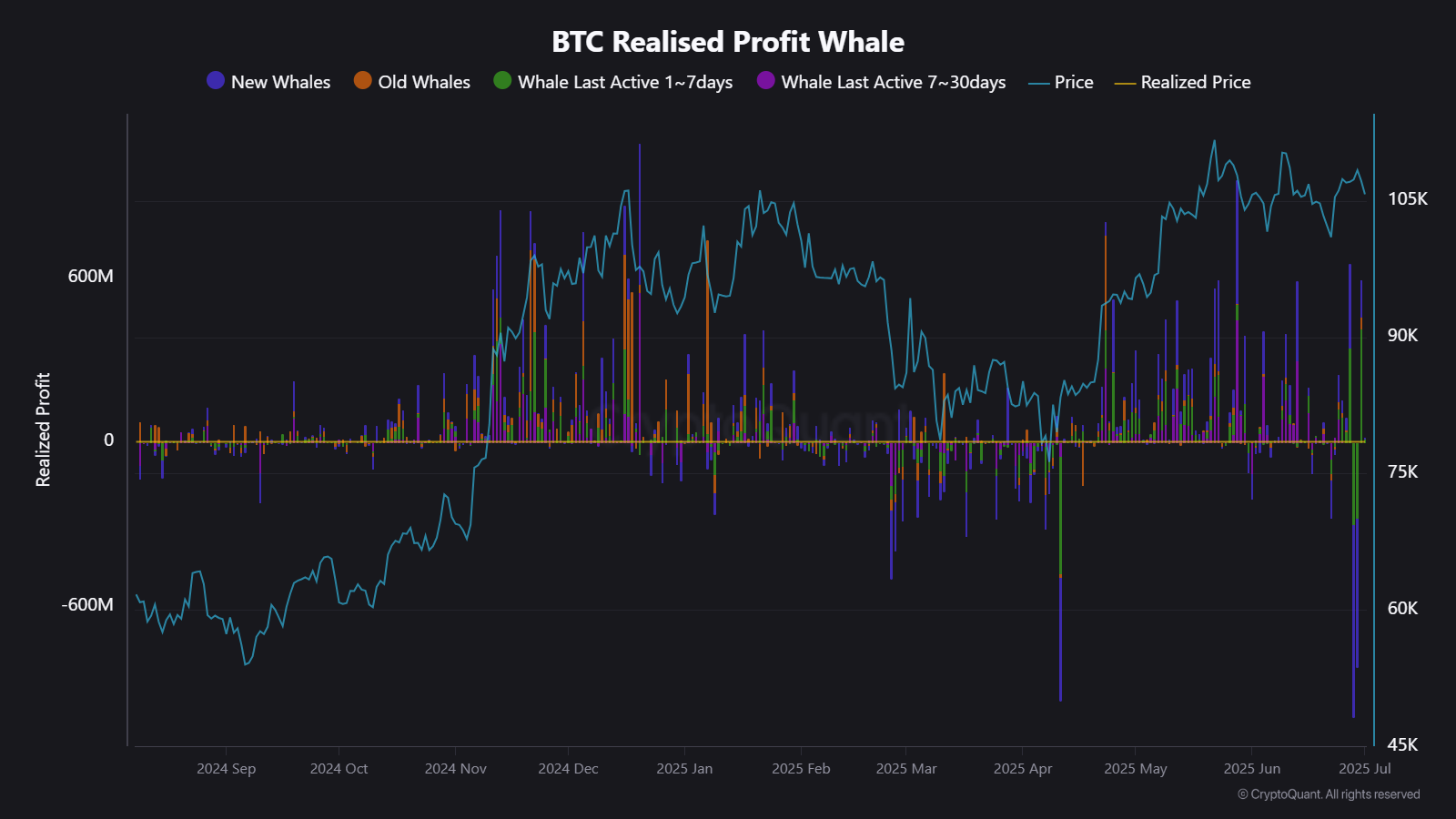

Institutional Rebalancing and Market Sentiment

- A total of $641 million in realized profits and over $1.24 billion in losses were recorded, indicating a potential market sentiment shift.

- Late June saw conflicting behaviors among Bitcoin whales, with portfolio adjustments typical at the end of the second quarter.

- Large profit and loss movements did not continue into early July, suggesting possible stabilization or a new market phase.

- Newer whales showed capitulation signs, while older whales secured $91 million in profits.

- This trend may indicate a shift in market control, hinting at a local exhaustion phase rather than ongoing growth.

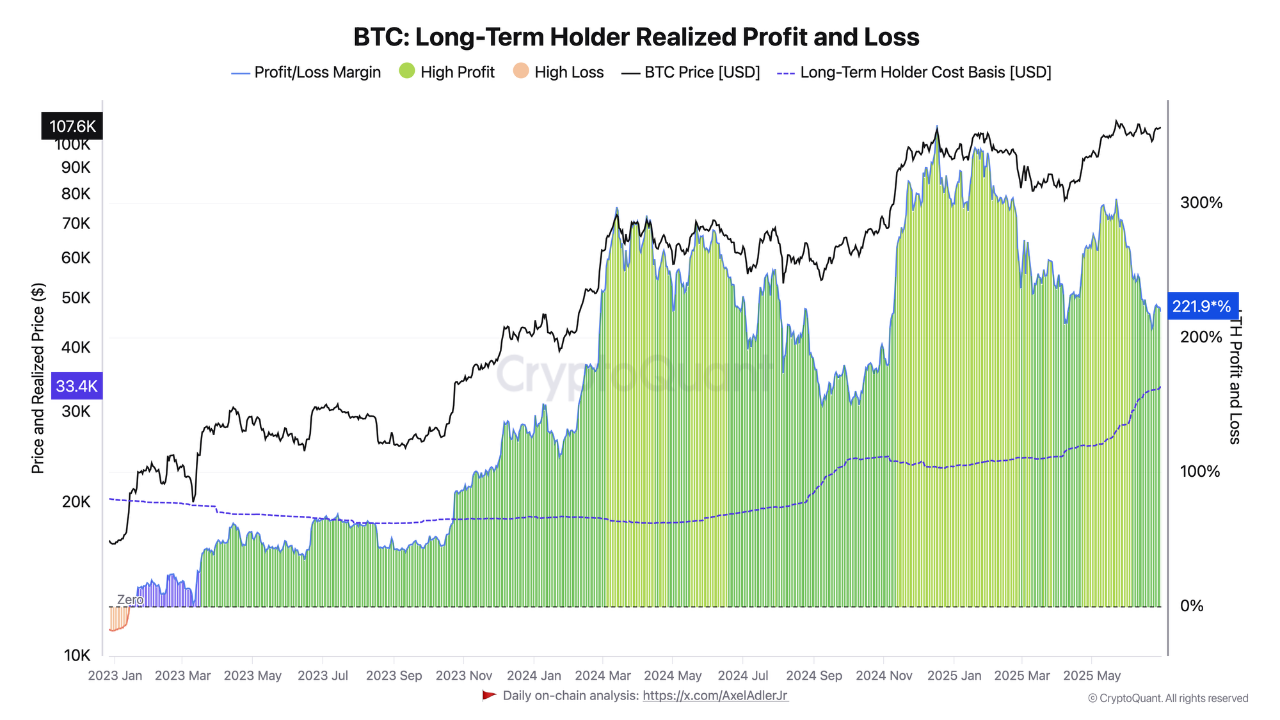

Long-Term Holder (LTH) Unrealized Profits

- Long-term holders’ unrealized profits have decreased despite Bitcoin's proximity to record highs, currently averaging around 220%.

- The Market Value to Realized Value (MVRV) ratio shows that levels are significantly lower than peaks of 300% and 350% observed during previous market tops.

- The realized price for LTHs is approximately $39,000, indicating a cushion but lack of speculative excess.

- A return to top-cycle unrealized profit levels would require Bitcoin to reach about $140,000, aligning with some bullish forecasts.