Bitcoin Trading Above $105K After Ceasefire Announcement

Bitcoin is currently trading above $105,000 following a surge triggered by a ceasefire announcement between Israel and Iran. This geopolitical relief has revitalized risk assets, allowing BTC to regain a critical psychological level previously seen as resistance. Key highlights include:

- BTC experienced a dip to $98,200 amid Middle East tensions before recovering.

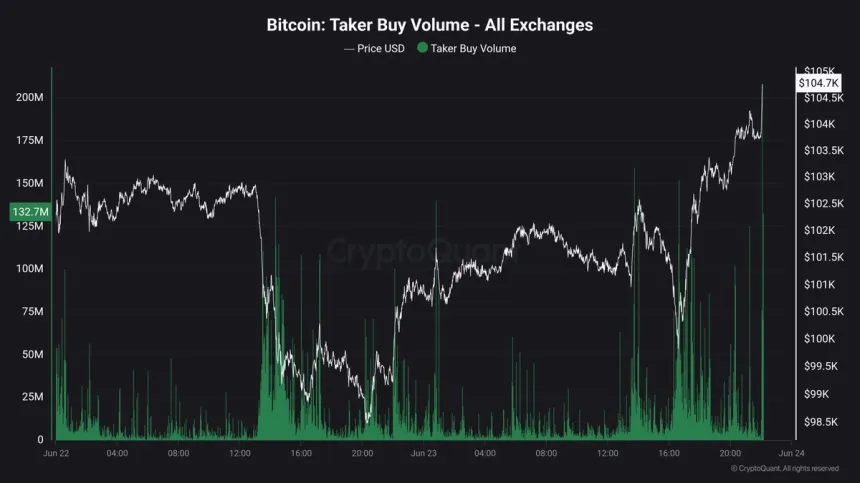

- Taker Buy Volume has surged, indicating increased buying interest from institutional traders.

- A breakout above $110,000 could signal the start of a new bullish phase.

Market Dynamics

Despite current strength, Bitcoin faces a crucial test within a tight trading range after failing to break its all-time high. Notable points are:

- Price is approximately 6% below the $112,000 peak.

- Geopolitical instability and macroeconomic factors, such as the Fed's interest rate policy, create uncertainty.

- Heavy Taker Buy Volume suggests aggressive buying at current levels.

Holding above $105,000 is pivotal. A drop below $103,600 or the psychological $100,000 level could lead to significant sell-offs. Conversely, sustained trading above these levels could pave the way for further gains.

Recent Price Action

The 12-hour chart shows a strong recovery after a brief dip below the $103,600 support. Current observations include:

- Bitcoin is now trading around $105,357, confirming $103,600 as a high-demand area.

- Volume increased significantly during the bounce, indicating strong buying activity from larger investors.

- Approaching resistance at $109,300 may confirm a consolidation range or open paths to retest all-time highs if breached.

Short-term momentum looks positive as long as Bitcoin stays above key moving averages. The next few days will be critical in determining the asset’s trajectory.