Bitcoin Trading Near $115,000 Amid Short-Term Holder Pressure

Bitcoin is currently trading around $115,000 after a decline from its recent all-time high of nearly $124,000. Market volatility has returned, leading to debates about whether BTC will undergo further corrections or prepare for another upward movement. Key points include:

- Indecision among buyers and sellers at critical price levels.

- Analysts caution stronger selling pressure may arise if momentum isn't regained.

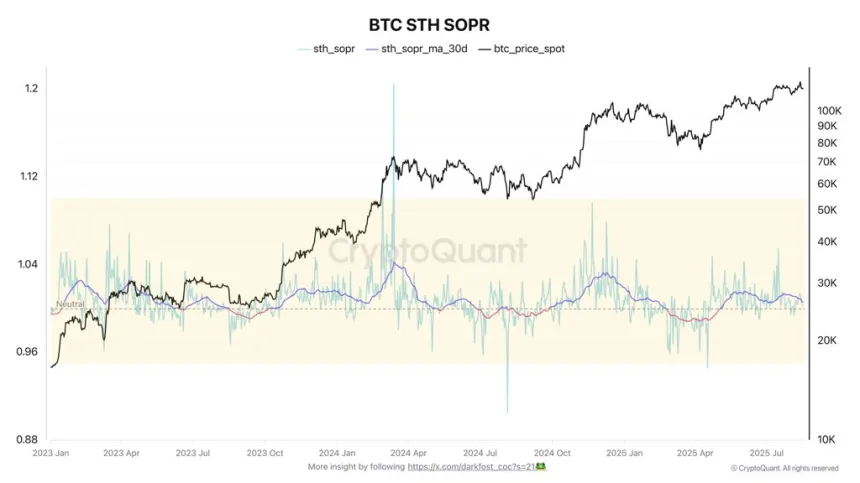

- Short-term holders (STHs) have faced profit realizations below 5% since late 2024, indicating difficulty in securing gains.

- The Spent Output Profit Ratio (SOPR) for STHs remains neutral at 1, suggesting many recent entrants are breaking even.

Bitcoin Short-Term Holders Under Pressure

Analyst Darkfost highlights that STHs are waiting for price appreciation after entering the market late during BTC's rise above $100,000. In bull markets, when STHs are shaken out, SOPR often dips below 1, indicating selling at a loss and creating potential dollar-cost averaging opportunities.

Bitcoin Price Analysis: Key Levels in Focus

Bitcoin is testing support near the 50-day moving average ($115,712). A breakdown could lead to further declines toward the 100-day moving average ($110,833). Despite recent declines, the overall structure remains positive, with strong support established above $100,000. Key resistance is noted near $123,217, which must be overcome for BTC to approach the $130,000–$135,000 range. The ultimate support level is the 200-day moving average at $100,339, maintaining the broader bullish trend.