9 0

Bitcoin Shows Triple Bearish Divergence, Analyst Warns of Trend Exhaustion

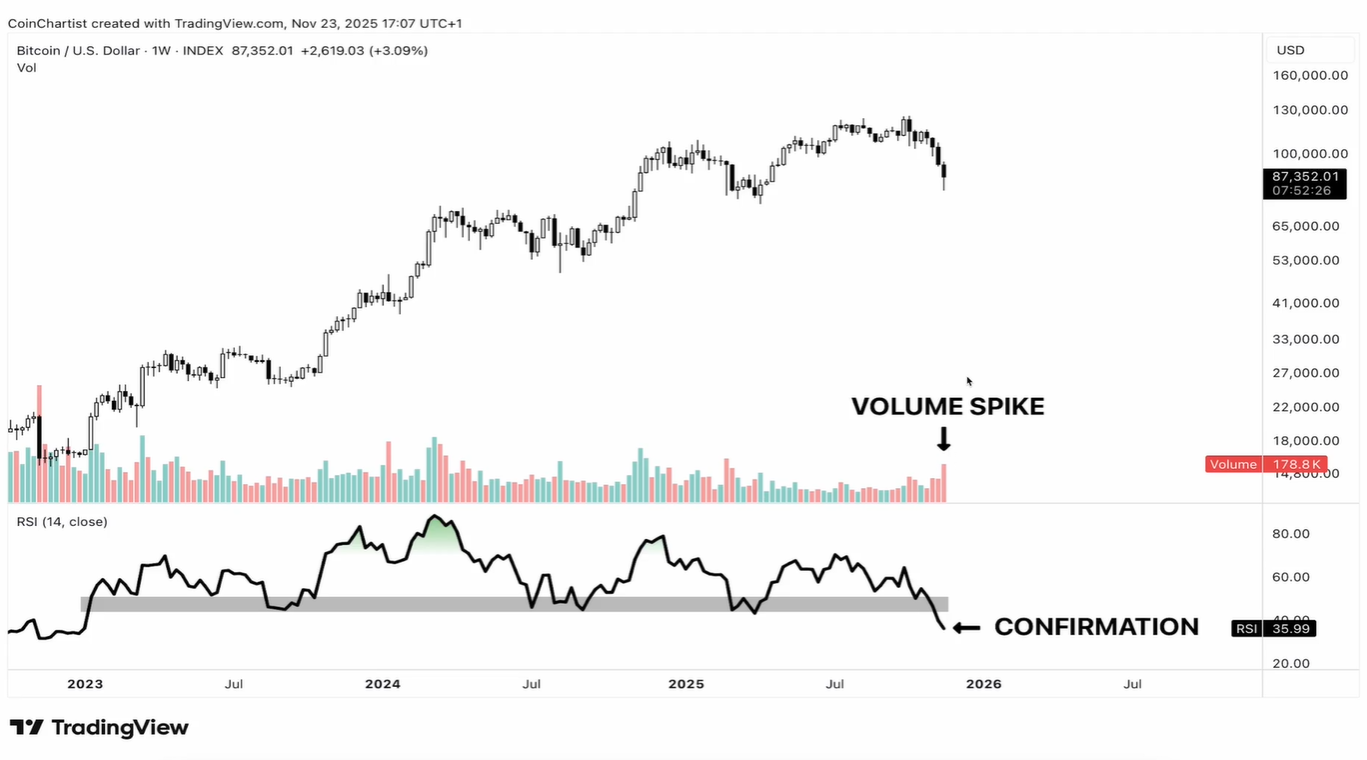

Bitcoin's recent activity suggests a potential downturn, according to analyst Tony Severino. He identifies a "triple bearish divergence" in higher timeframes, indicating that the upward trend may be waning despite new price highs.

Key Insights

- A triple bearish divergence occurs when price makes three successive higher highs while technical indicators show lower highs, suggesting weakening momentum.

- The first high correlated with strong market excitement around an ETF launch, marking a peak in momentum.

- The second and third highs saw weaker internals, with fewer aggressive buyers and profit-taking, indicating market exhaustion.

- Severino emphasizes that this pattern is a setup requiring confirmation from breaking trendlines and moving averages, not a standalone action trigger.

- A significant break past key moving averages (20 and 50 EMA) and changes in RSI patterns signal potential trend shifts.

Potential Downside

- Severino uses Fibonacci levels to suggest a retracement target between $44,100 and $34,409, estimating a possible 60-70% drop from recent highs.

- He cautions about a larger bearish pattern on even higher timeframes that could influence Bitcoin's longer-term outlook.

- At press time, Bitcoin's price stood at $87,658.

Severino underscores the importance of risk management, noting that these signals do not guarantee outcomes and are not financial advice.