4 0

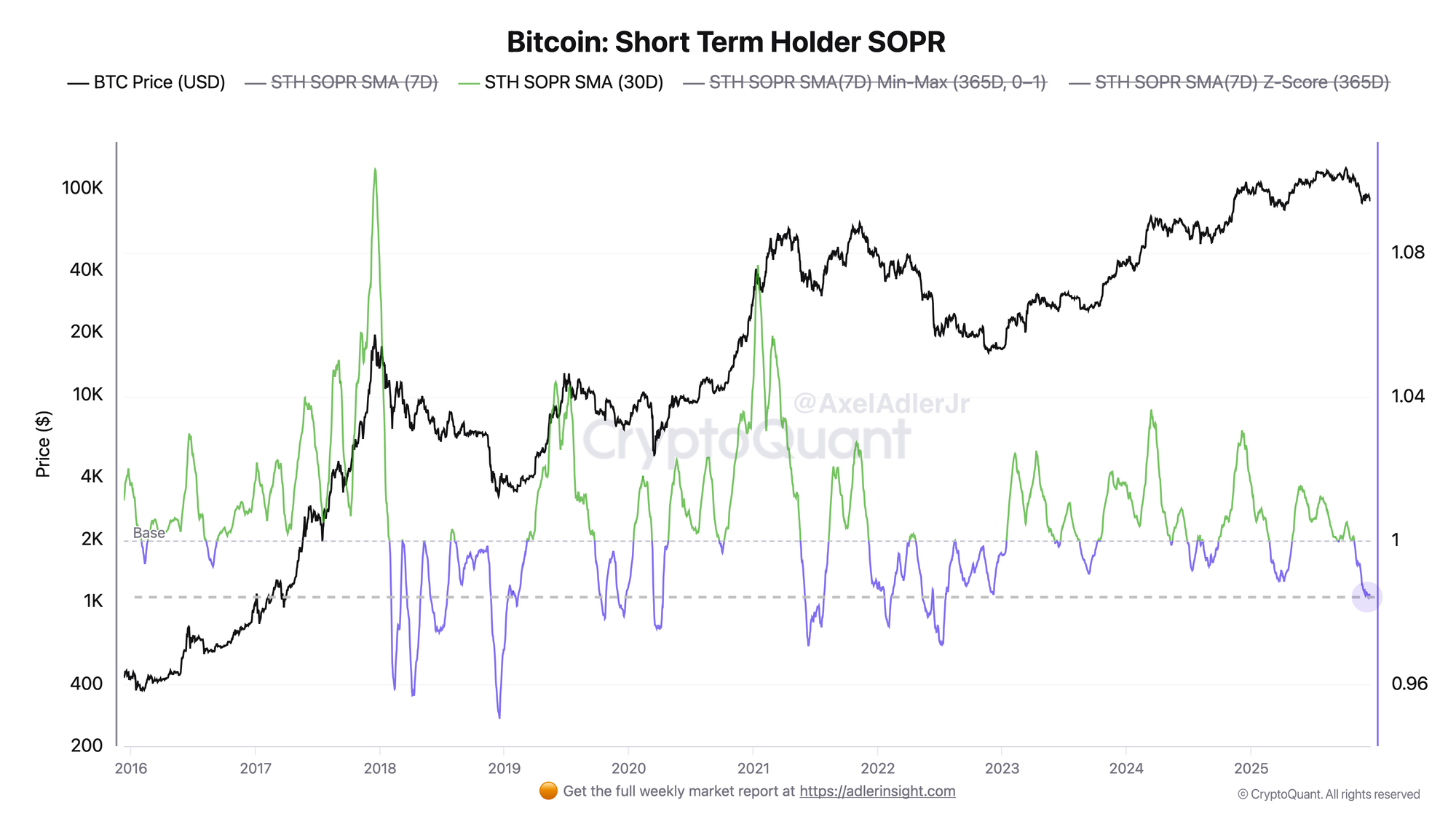

Bitcoin Under Pressure as Short-Term Holders Realize Losses

Bitcoin is experiencing significant selling pressure, affecting short-term market sentiment. Recently, BTC surged from $86,000 to $90,000 but quickly retreated back to $86,000, confirming sellers' dominance.

- Short-term holders are under stress as Bitcoin's price falls below their average purchase price.

- The Short-Term Holder Spent Output Profit Ratio (STH-SOPR) has declined to 0.98, indicating losses for short-term holders.

- This environment often leads to decreased confidence and increased sensitivity to further declines.

The market remains fragile, with potential for either deeper capitulation or stabilization. A meaningful recovery requires the STH-SOPR to exceed one, indicating absorbed selling pressure.

Bitcoin Faces Critical Support Challenges

BTC consolidates around $87,000 after dropping from October highs of $125,000. The 50-day and 100-day moving averages have been lost, reinforcing a bearish bias.

- Price hovers above the 200-day moving average near $86,000–$88,000, a critical support zone.

- Volume suggests selling pressure dominates, with recent rebounds showing muted volume.

- For recovery, BTC must reclaim $95,000–$100,000 and hold above declining moving averages.

Overall, the chart indicates continued consolidation or further downside risks until clear signs of recovery appear.