0 0

BULLISH 📈 : Bitcoin approaches potential undervaluation signaling accumulation opportunity

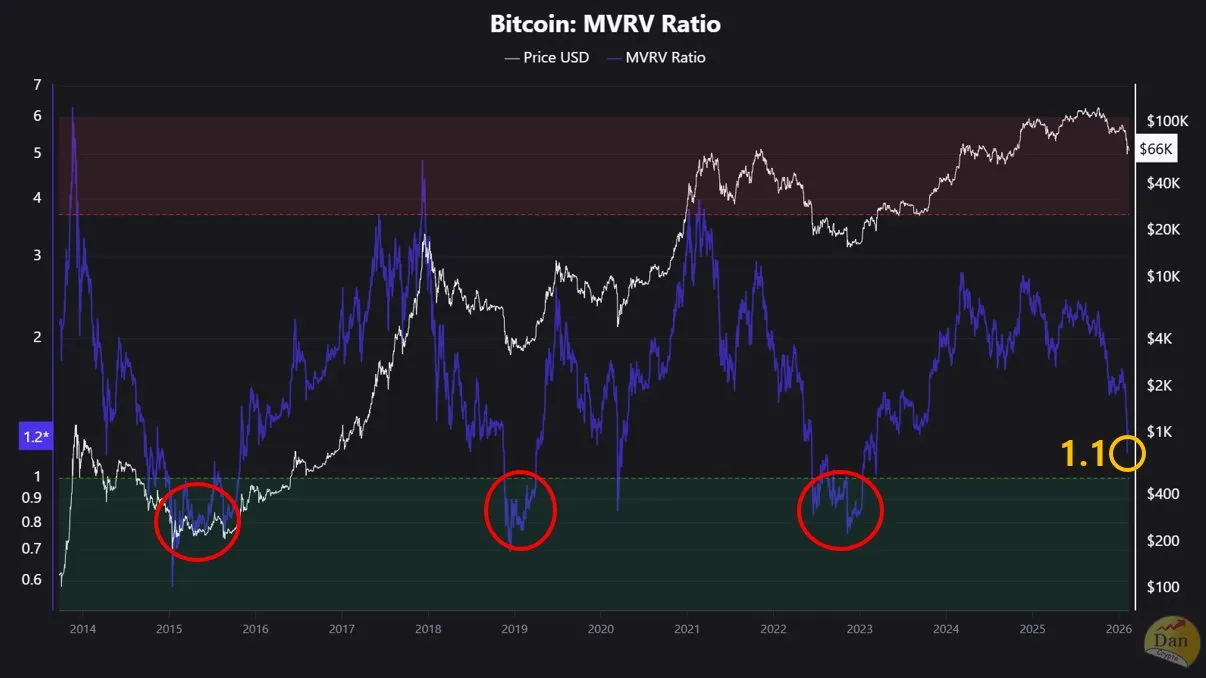

Bitcoin's current market position is approaching a level on the MVRV ratio that traditionally suggests "undervaluation," according to CryptoQuant contributor Crypto Dan. This indicates a potential shift from a four-month decline since October 2025’s all-time high into an accumulation phase.

Key Insights

- Bitcoin is nearing the "undervalued zone" with the MVRV ratio at approximately 1.1. Historically, a ratio below 1 indicates undervaluation.

- The MVRV ratio tends to compress around prior cycle lows, with past sub-1.0 dips marking bottoming phases.

- Crypto Dan notes differences in this cycle compared to previous ones, particularly the absence of a sharp rise into the overvalued zone, suggesting the decline pattern may differ.

Mayer Multiple and 200-Week MA

- Analyst Will Clemente highlights two key indicators: the Mayer Multiple and the 200-week moving average, both indicating long-term accumulation territory.

- The Mayer Multiple is around 0.60, close to historical market bottom signals.

- Bitcoin's 200-week moving average is near $57,926, with the current price about 15% above it, yet not having touched it during the current decline.

As of the latest update, Bitcoin is trading at $67,277.