6 0

Bitcoin Struggles as Volatility and Real Buyers Decline, Says Jeff Park

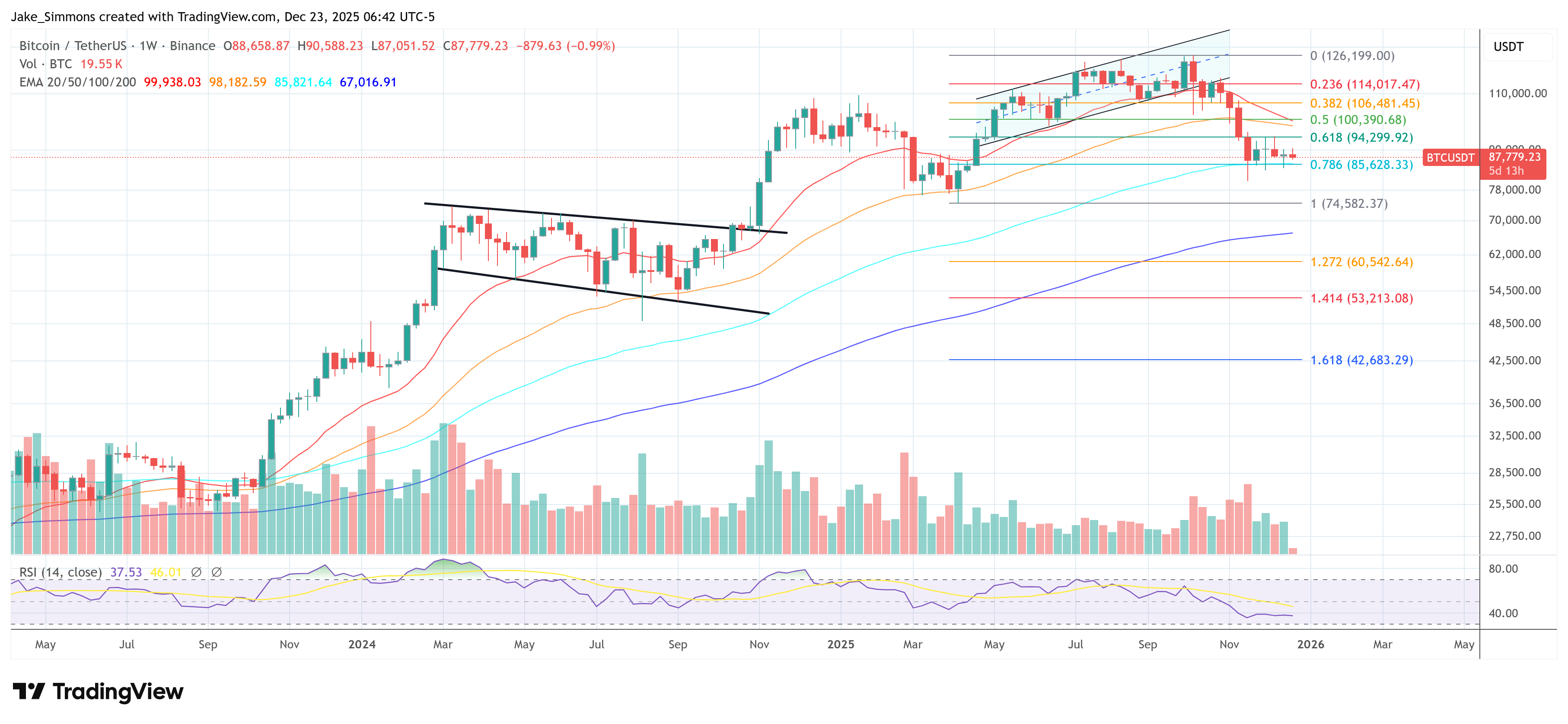

Bitcoin's recent price action has shown reduced volatility, affecting its ability to regain momentum. Despite a strong start to the year and reaching highs above $100,000, Bitcoin has settled into a low-volatility phase.

Key Insights

- Bitcoin's appeal historically relies on high volatility, attracting risk capital that drives prices up.

- Jeff Park from ProCap emphasizes that Bitcoin competes with various assets like equities, gold, and FX in a broad market.

- The lack of real buyers, unlike gold, is seen as a challenge for Bitcoin's growth. Gold benefits from structural bids within the global monetary framework.

- Current Bitcoin flows are dominated by ETFs and corporates, not governments or central banks.

- ETF investors focus on portfolio diversification rather than high-conviction investments.

- Park stresses the importance of retail adoption, warning against over-reliance on institutional participation.

- Concerns about Bitcoin's risks, including "quantum anxiety" and internal disputes, highlight the need for appropriate compensation which low volatility fails to provide.

- Despite challenges, Bitcoin offers advantages in practical ownership compared to physical gold, such as transparent pricing and easier portability.

Bitcoin currently trades at $87,779, reflecting ongoing debates about its future trajectory and market willingness to engage with its inherent risks.