10 2

Bitcoin Experiences Volatility Following False Tariff Pause Rumors

Speculation regarding a White House plan to pause tariffs for 90 days on all countries except China led to significant volatility in markets, particularly affecting Bitcoin and equities. Key events include:

- At 10:10 AM ET, rumors surfaced about a potential tariff pause.

- By 10:18 AM ET, the S&P 500 gained over $3 trillion in market cap.

- Reports at 10:25 AM ET stated the White House was unaware of any such plans.

- At 10:26 AM ET, CNBC declared the rumors incorrect, and by 10:34 AM ET, the White House labeled them "fake news."

- The S&P 500 later lost $2.5 trillion in market cap within minutes.

- Bitcoin rose around 7.2% to over $81,200 shortly after the rumor but fell back to approximately $77,560 after confirmation of no pause.

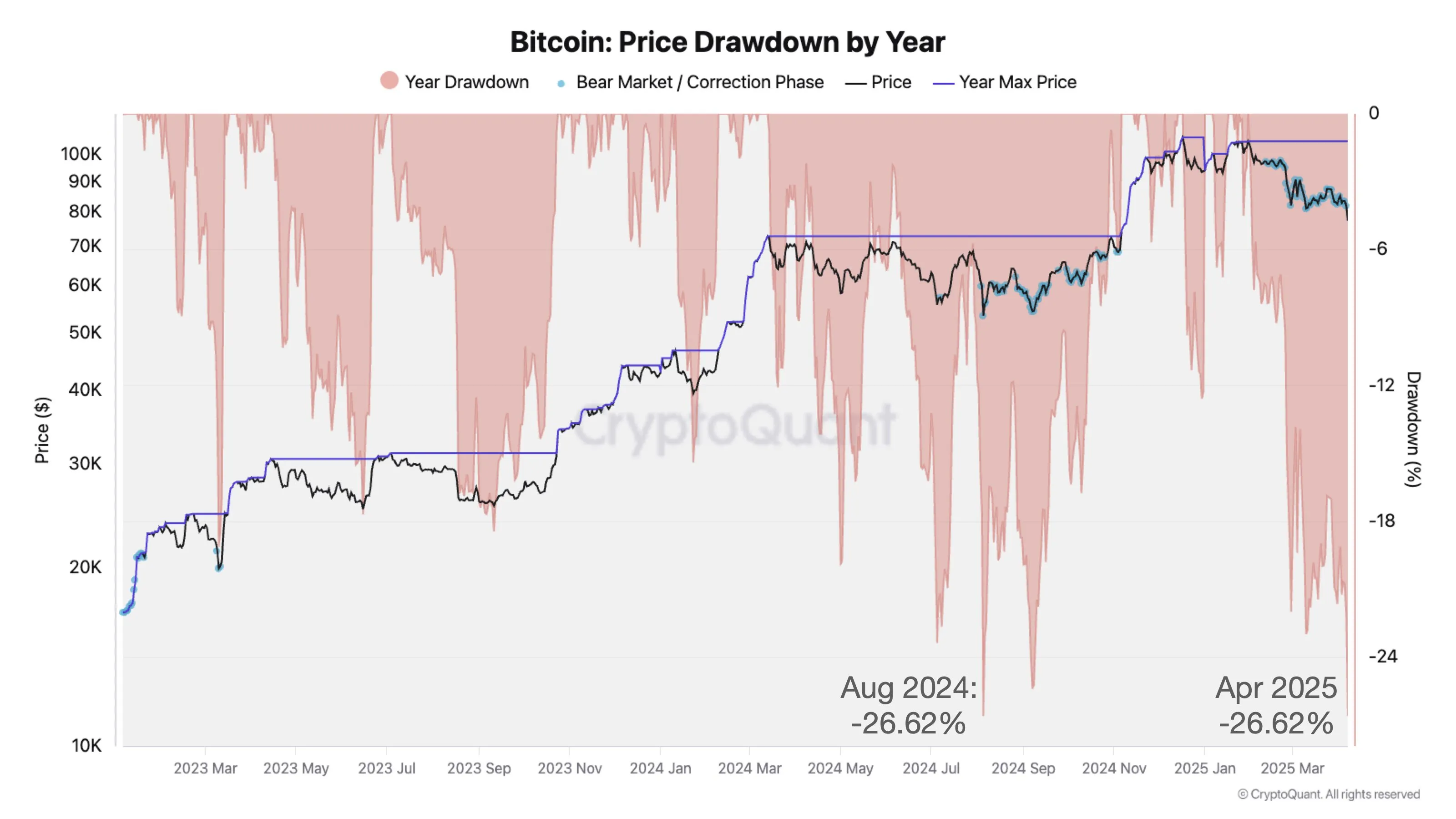

Analysts commented on the rapid shifts. Pentoshi noted sidelined capital could lead to upside risk. Will Clemente III highlighted that Bitcoin's drawdown could reach -26.62%, matching previous corrections. Macro analyst Alex Krüger warned of potential further drops in the market, emphasizing heightened volatility.

European Union Commissioner Ursula von der Leyen expressed readiness to negotiate with the US on tariffs. At press time, Bitcoin was trading at $78,824.