Bitcoin Faces Volatility as Short-Term Holders Take Profits

Bitcoin experienced significant volatility, with prices fluctuating between $92,300 and $96,420. Currently, it hovers around $93,000, struggling to find a clear direction. Market participants are uncertain whether Bitcoin will maintain its bullish trend or undergo a deeper correction.

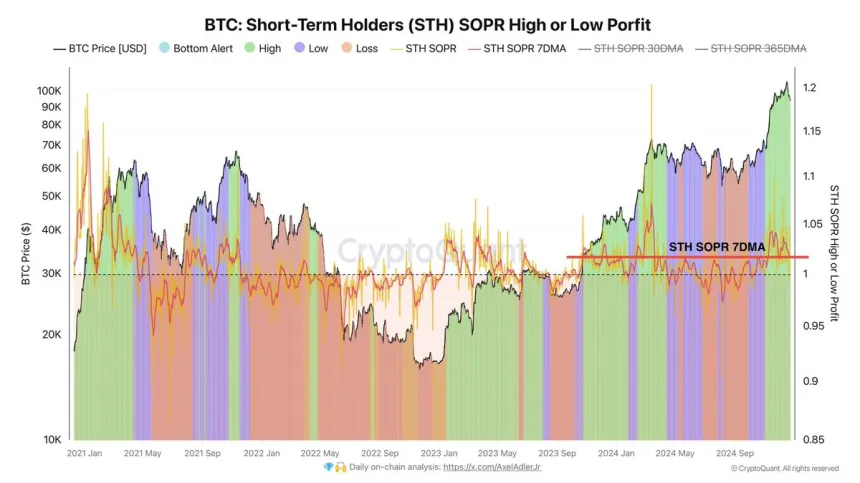

CryptoQuant analyst Axel Adler noted that short-term holders (STH) continue selling at high-profit margins, which may impact Bitcoin's price stability due to insufficient demand to absorb the selling pressure. If demand does not keep pace with profit-taking, a local correction could occur, affecting Bitcoin’s price trajectory. The upcoming days are crucial for determining if buyers will support the price or if selling pressure will lead to further declines.

Bitcoin Demand Levels Responding

Bitcoin has experienced intense volatility while attempting to surpass the psychological barrier of $100,000, maintaining support above $92,000. Investors are closely observing Bitcoin’s movements amidst this uncertainty, as the asset showcases resilience against competing bullish and bearish forces.

Adler provided additional insights on STH behavior, indicating active selling at high profit margins, which could result in a local correction without consistent demand. However, STHs are less likely to sell at a loss during a bull market, potentially allowing Bitcoin to stabilize around key support near $90,000.

If Bitcoin maintains levels above $90,000, consolidation could set the stage for future rallies, possibly leading to new all-time highs. The next few days will be critical in assessing Bitcoin's path forward.

BTC Holding Above $90K

Currently trading at $93,800 after recent selling pressure, Bitcoin remains above the essential support level of $92,000. However, losing both the 4-hour 200 moving average (MA) and exponential moving average (EMA) presents a short-term bearish signal, indicating that additional demand is needed for upward momentum.

For bulls to regain control, Bitcoin must recover the 4-hour 200 MA at $96,500 and the 200 EMA at $98,500. A decisive close above these levels would indicate renewed bullish momentum. Conversely, failure to reclaim these indicators may lead to prolonged consolidation or a retest of lower support levels.

Featured image from Dall-E, chart from TradingView