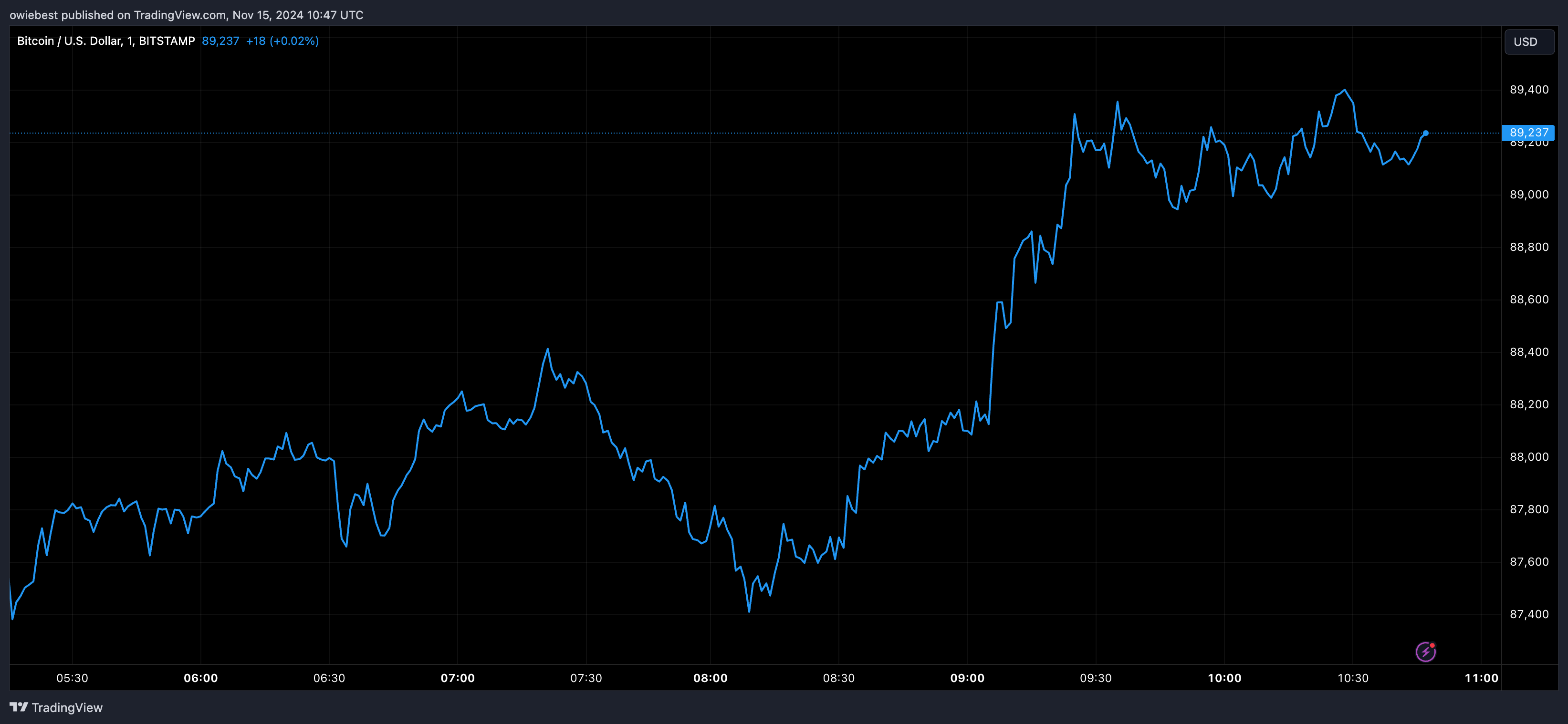

Bitcoin Volume Crashes 27% as Price Declines to $87,848

The Bitcoin trading volume has decreased significantly, dropping by approximately 27% and leading to a decline in its price. This reduction has prompted discussions among market analysts regarding the implications of this trend, specifically whether it signifies a Distribution or Accumulation phase.

Bitcoin Price Falls As Volume Plummets 27%

According to CoinMarketCap, Bitcoin's daily trading volume has fallen by 26.46%, with current volume at $85.89 billion. This decrease aligns with a broader correction in Bitcoin's price.

As of the latest data, BTC's price has retreated to $87,848 after previously trading above $90,000, reflecting a decline of 2.87%. A drop in volume can indicate reduced market interest; however, recent high activity may be influenced by the US Presidential elections and Donald Trump's victory.

The decline in volume might suggest a phase of market consolidation, where Bitcoin's price stabilizes before a potential breakout. Analyst 'Personal Trader' noted that the market is entering a decline phase, hinting at a possible correction period before approaching the $100,000 target.

BTC Price Decline May Indicate A Distribution Or Accumulation Phase

In light of the recent price and volume decline, analyst ‘IonicXBT’ has examined the significance of these trends within the context of Bitcoin market cycles: Accumulation and Distribution phases.

The Accumulation phase occurs when institutions begin purchasing Bitcoin, typically during low price periods following a decline. During this phase, trading volume increases as buyers enter the market, driving prices higher. Strong upward price movements are generally accompanied by significant volume, indicating robust buying pressure.

Conversely, the Distribution phase arises when institutions sell their Bitcoin. Prices may peak or be perceived as overvalued during this stage. In this scenario, BTC volume rises while prices fall, signaling strong selling pressure. Price spikes with low trading volume indicate weak buying interest, suggesting that institutions are exiting the market.

IonicXBT indicated that he will soon identify the Bitcoin market top and bottom. He posits that Bitcoin is not currently in a distribution phase, which suggests it remains a “buyer’s market” with potential for future price increases.