Bitcoin Reaches Weekly High Above $112,000 as Cycle Nears Peak

Bitcoin (BTC) Update: Bitcoin has reached a weekly high above $112,000, indicating a potential new uptrend. Analyst CryptoBirb suggests this uptrend may last around 50 days, with Bitcoin nearing the end of its cycle, which has lasted 1,017 days since November 2022.

Projected Cycle Peak

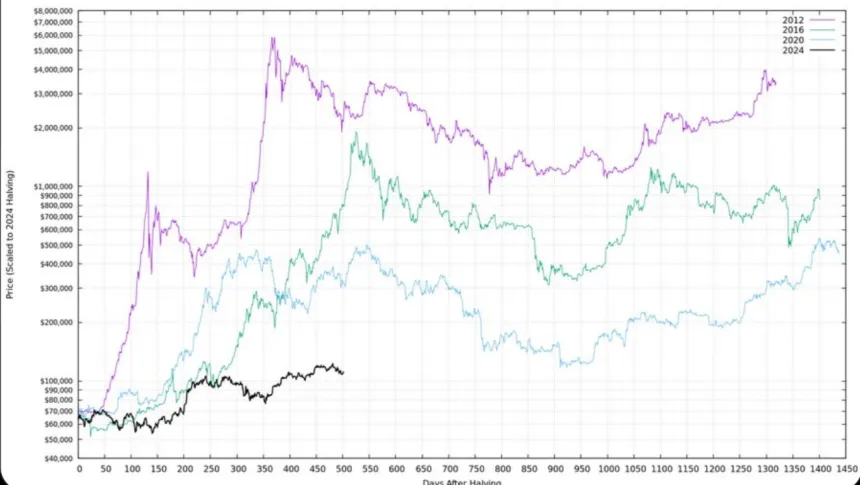

- Historically, Bitcoin bull markets peak between 1,060 and 1,100 days after significant lows.

- This cycle's peak is expected between late October and mid-November 2025.

- 503 days have passed since the last Halving in April 2024; peaks typically occur 518 to 580 days post-Halving.

- Bitcoin is currently in a "hot zone" for increased volatility and price movements.

CryptoBirb warns that following a peak, Bitcoin often declines by 70% to 80% over 370 to 410 days. A bearish phase is anticipated in early 2026, with a historical probability of 100% for a bear market that year.

September Performance: September historically sees an average decline of 6.17% for Bitcoin, but stronger performance is expected in October and November. September 17 is noted as a key date to monitor.

Support and Resistance Levels

- Key support levels: 50-week SMA at $95,900 and 200-week SMA at $52,300.

- 200-day breakout point at $111,000; 200-day SMA at $101,000.

- Local support identified between $107,700 and $108,700; resistance at $113,000 to $114,100.

Short-term trading sentiment is currently bearish. If Bitcoin falls below $107,000 to $108,000, further corrections of 20% to 30% may occur. Mining remains strong, with costs at $95,400, suggesting low capitulation risk.

Analysts also caution about a possible market peak leading into an altcoin season in October and November. October 22 is marked as significant for Bitcoin's cycle.

Currently, Bitcoin trades at $112,886, down nearly 11% from its all-time highs.