10 0

Bitcoin Whale Accumulation Claims Exaggerated, Exchange Consolidation Impacts Data

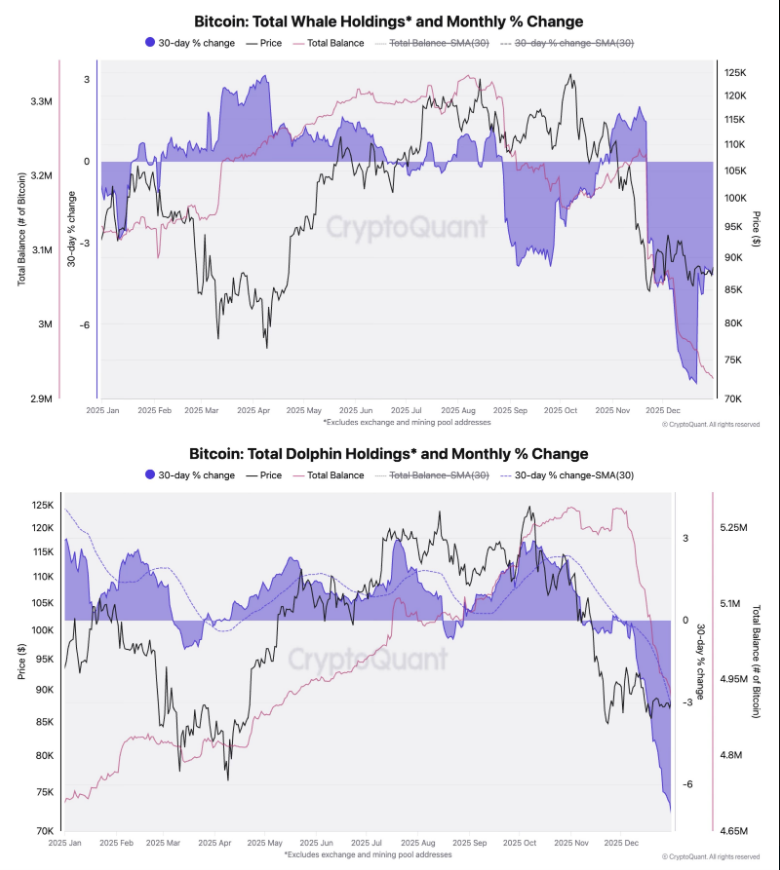

Recent data from CryptoQuant indicates that claims of large Bitcoin holders (whales) reaccumulating are overstated. This perception is often due to exchanges consolidating their holdings into fewer, larger wallets, which onchain trackers may misinterpret as whale activity.

Exchange Consolidation Misleads Whale Data

- Exchanges merge funds for operational reasons, artificially inflating the number of large holders.

- True large holder balances are decreasing, particularly in wallets holding 100 to 1,000 BTC, aligning with outflows from spot ETFs.

Long-Term Holders Shift Behavior

- Long-term holders have been net buyers over the last 30 days after significant selling since 2019.

- This shift reduces a major source of selling pressure without guaranteeing a price rally.

Price and Market Dynamics

- Bitcoin prices hover around $89,750, slightly below a recent high of $90,250.

- The market cap is about $1.75 trillion with volume near $52 billion, indicating weak support for significant moves.

ETF Flows Impact

- U.S. Bitcoin ETFs have altered ownership dynamics, influencing onchain flows and storage locations.

- ETF outflows correlate with reduced balances in mid-sized wallets while long-term holders quietly buy.

Investment Implications

- Current trends suggest consolidation rather than a bull run or crash.

- Future price movements depend on ETF flow activity and increased trading volume to confirm trends.