Bitcoin Whale Activity Increases as Exchange Inflows Rise

Bitcoin has seen increased whale activity since the US election on November 5, marked by higher volumes of Bitcoin transferred to exchanges by active whale addresses. However, there has not been a significant increase in profit-taking among these large holders, as noted by CryptoQuant analyst Onatt.

Whale Activity Suggests Market Stability but Signals Potential Risks

Onatt's report indicates that despite rising Bitcoin inflows into exchanges, there is no immediate selling pressure. Whales seem to be adopting a "wait-and-see strategy," using their Bitcoin for hedging, over-the-counter transactions, or as collateral. While this suggests market stability, Onatt cautions that these movements should be monitored for potential market impacts.

The Adjusted Spent Output Profit Ratio (SOPR) metric does not currently indicate significant profit-taking activities. Typically, large inflows to exchanges correlate with increased selling pressure, but the current situation may reflect strategic positioning by whales in anticipation of market changes. Although immediate sell-off risks are low, rising exchange inflows could indicate future volatility.

Bitcoin Market Performance

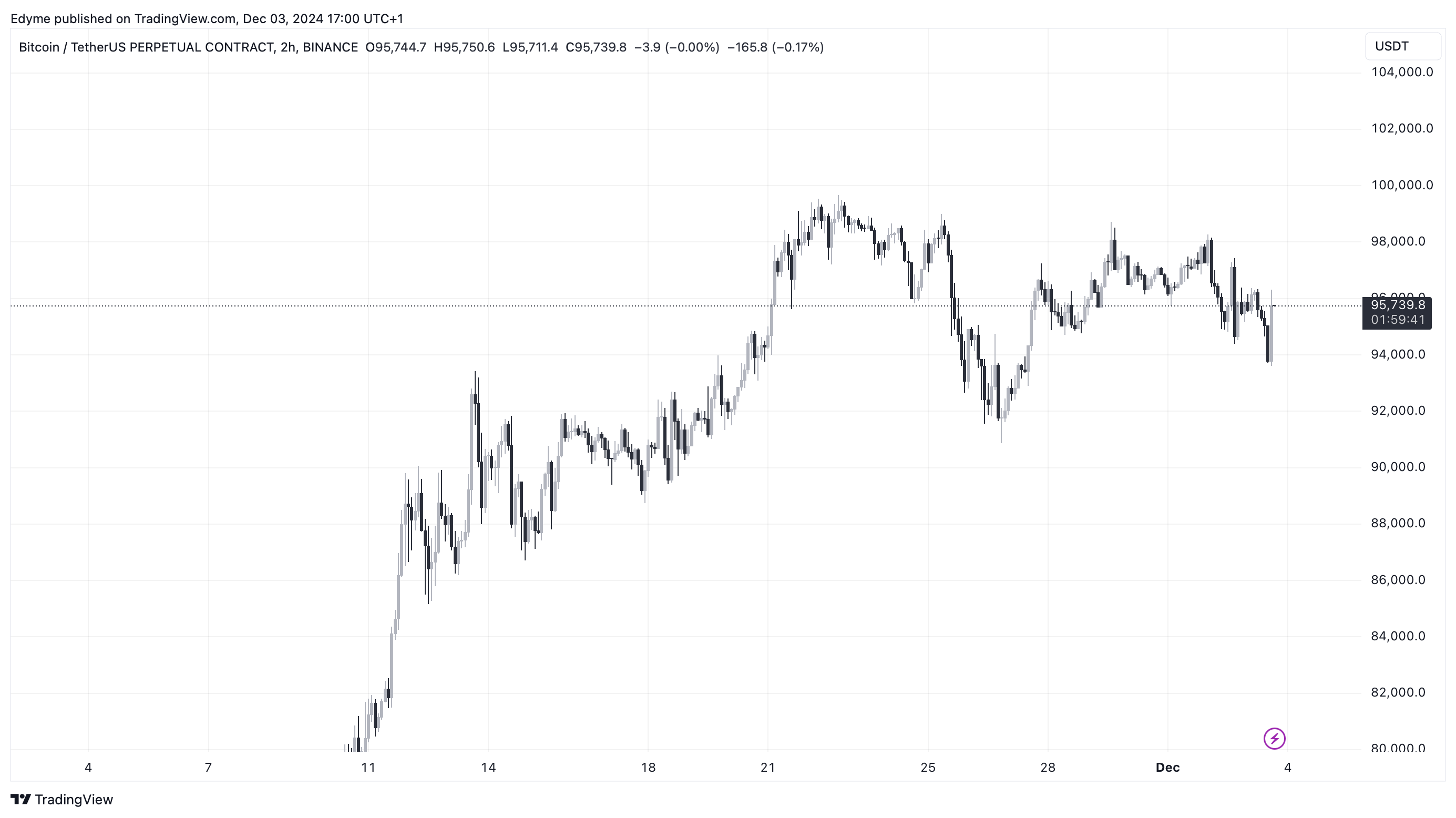

Bitcoin has struggled to maintain momentum after trading above $95,000, unable to move significantly from this price point despite attempts by bears to push it lower. Currently, Bitcoin registers a 2.5% increase over the past week, with a slight decrease of 1.2% in the last 24 hours, trading at approximately $95,837.

Interestingly, Bitcoin's daily trading volume has increased from below $60 billion on November 29 to $94.5 billion now, despite its minor price decline. This rise in trading volume might be linked to sell-offs. Analyst Ali suggests that Bitcoin is forming a head and shoulders pattern on its 1-hour chart, potentially signaling a correction to $90,000 levels.

#Bitcoin $BTC could be forming a head-and-shoulders pattern, which could trigger a price correction to $90,000! pic.twitter.com/mWLDabsYRV

— Ali (@ali_charts) December 3, 2024

Featured image created with DALL-E, Chart from TradingView