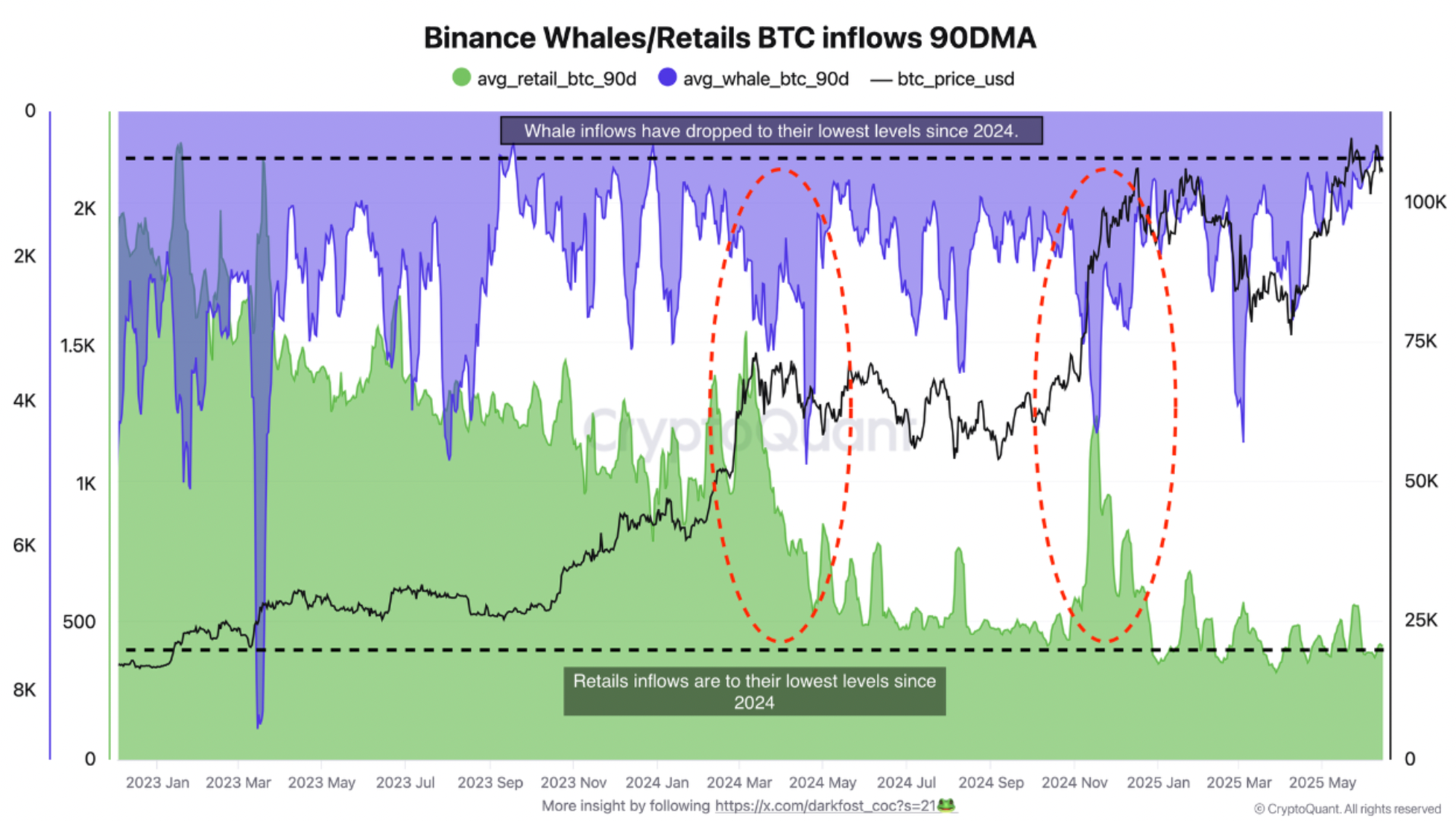

Bitcoin Whale and Retail Inflows to Binance Hit Cycle Lows

Bitcoin (BTC) has decreased from $110,530 on June 9 to approximately $106,900 amid rising geopolitical tensions between Israel and Iran. Despite this decline, on-chain data indicates that Bitcoin whales and retail investors expect further price increases.

Bitcoin Whale And Retail Inflows To Binance Tumble

Recent data from CryptoQuant shows:

- Bitcoin inflows to Binance from whales and retail investors have reached their lowest levels of the current market cycle.

- This behavior reflects a preference to hold Bitcoin rather than sell.

- Previous instances of synchronized behavior between these groups often correlated with market tops.

Analyst Darkfost noted that this alignment may indicate broader market confidence and expectations for future profits. Additionally, a Bitcoin whale has opened a $200 million long position with 20x leverage, supporting positive sentiment.

Should BTC Holders Be Worried?

Despite the low inflow levels, some analysts warn of potential corrections:

- MIRZA predicts BTC could drop to $85,000.

- Peter Brandt suggests a possible decrease to $23,600 if current trends mirror the 2021-22 cycle.

Conversely, BTC outflows from exchanges are increasing, which may lead to a supply shock. Currently, BTC is trading at $106,920, reflecting a 1.8% increase in the past 24 hours.