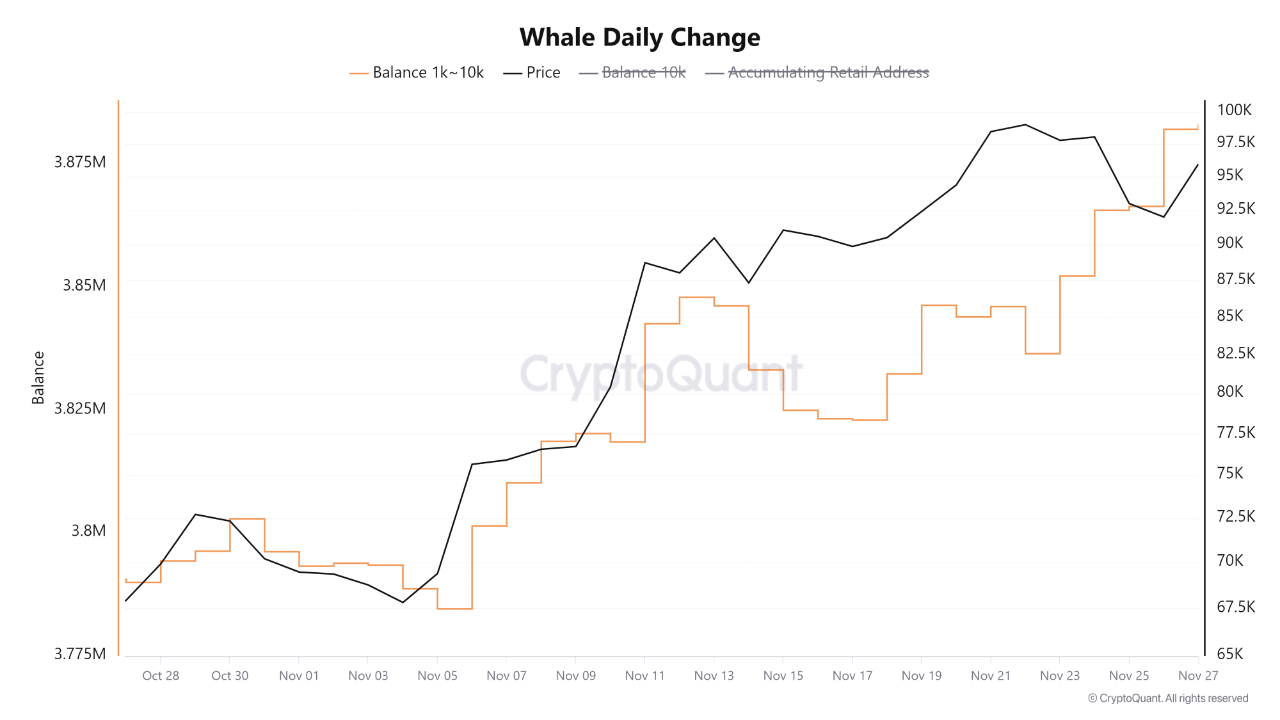

Bitcoin Whales Accumulate $1.5 Billion During Price Dip to $91,000

Bitcoin whales and long-term holders capitalized on the recent BTC price dip to $91,000, accumulating $1.5 billion worth of Bitcoin. According to a report by CryptoQuant, this accumulation occurred as short-term holders experienced significant losses due to panic selling.

On November 26, a total of 16,000 Bitcoins moved into whale reserves, reflecting substantial on-chain accumulation primarily from institutional addresses. Despite an increase in spot Bitcoin buying volume, it remains largely concentrated among institutional investors, with a broader "buy-the-dip" trend not yet observed. A more significant influx of buying activity from both retail and institutional players is necessary for Bitcoin to reach new all-time highs.

-

Courtesy: CryptoQuant

In October, Bitcoin whale holdings reached an all-time high of 670,000 BTC, which preceded a price increase from around $60,000 to nearly $100,000. Continued whale accumulation could further benefit the BTC price, potentially surpassing the $100,000 psychological barrier.

BTC Price Recovery Following Whale Activity

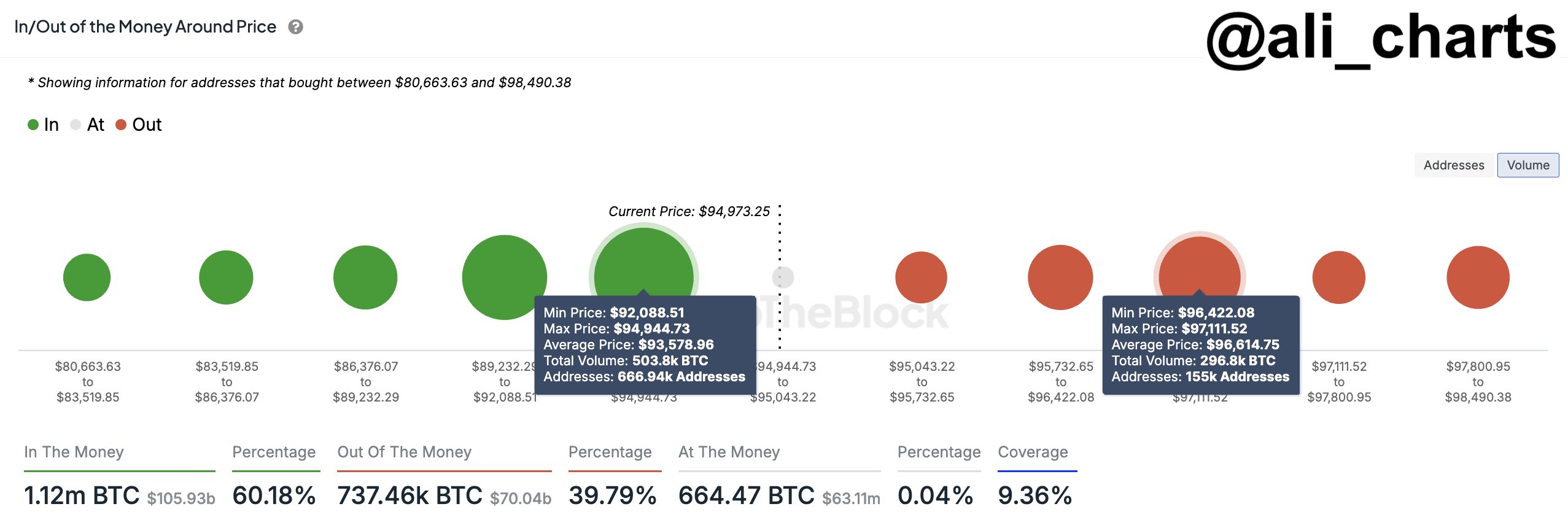

After the recent whale accumulation, BTC price has recovered, trading at $96,575 with a market cap of $1.911 billion. Analyst Ali Martinez predicts a potential Thanksgiving rally that may push Bitcoin towards $99,000, supported by strong technical indicators.

Tonight, coiners are going to tell their families about #Bitcoin $BTC, triggering some sort of Thanksgiving rally. This is why I think #BTC is bound for a rebound to $99,000, and the technicals support it.

I could be wrong, which is why I'm leaving a tight stop-loss. pic.twitter.com/jY5gR1Ka2Y

— Ali (@ali_charts) November 28, 2024

Martinez identifies a critical demand zone for Bitcoin at $93,580, where approximately 667,000 addresses hold nearly 504,000 BTC. He emphasizes the importance of defending this support level to avoid potential sell-offs.

-

Courtesy: Ali Martinez

Following Donald Trump's victory in early November, BTC price surged from $73,000 to $100,000, achieving over 35% gains within a month. Mati Greenspan, founder of Quantum Economics, noted that while Bitcoin has seen minimal pullbacks since Election Day, breaking through the $100,000 mark would signal bullish momentum, albeit possibly after a brief pullback to gather strength for the next attempt.