Bitcoin Whales Reduce Holdings as Addresses with 1,000+ BTC Drop 2%

Bitcoin (BTC) whales are reducing their holdings ahead of the 2024 US presidential election.

2% Decrease in BTC Held by Whale Addresses

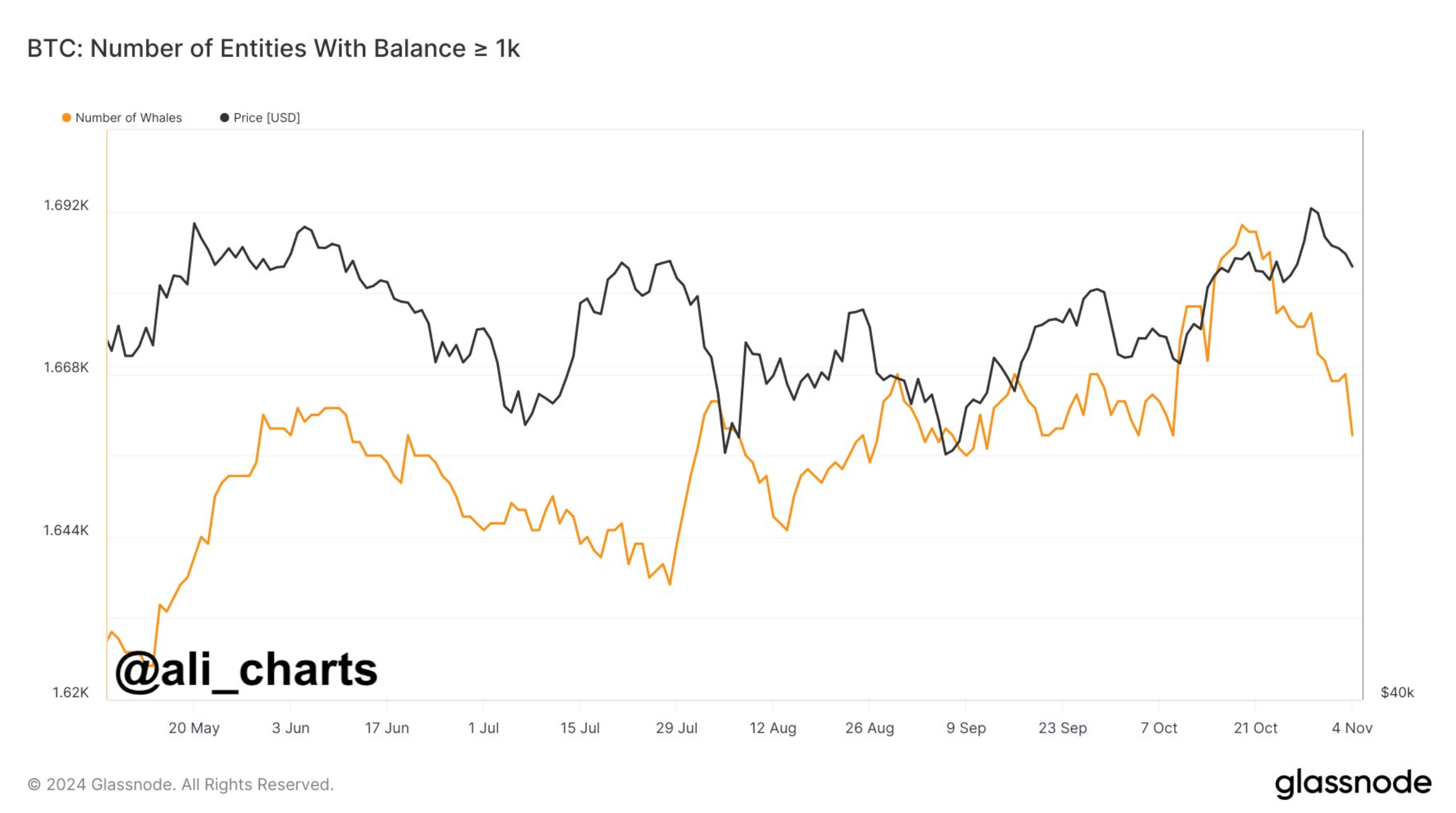

Crypto analyst Ali Martinez reported on X that Bitcoin whales, which are wallet addresses holding significant amounts of BTC, have decreased their exposure, evidenced by a 2% drop in addresses holding 1,000 or more BTC.

The number of Bitcoin whales peaked in mid-October when Donald Trump was favored to win the Republican nomination. Currently, prediction markets indicate Trump has a 62.7% chance of winning, while Kamala Harris has a 37.4% chance.

This selloff by Bitcoin whales may reflect a cautious strategy to avoid potential price volatility associated with the elections.

Anticipation of Price Volatility Among Bitcoin Whales

The selloff could signal that Bitcoin whales expect stricter regulations for digital assets post-election. The Biden administration has faced criticism for its regulatory stance, while Trump has promised to promote the US as the "crypto capital of the world."

In addition to whale activity, long-term holders are also selling BTC, with over 177,000 BTC sold in the past week according to recent analysis.

If whale holdings decline without a price drop, it may suggest increased buying from retail investors. Retail demand for Bitcoin has risen 13% in the last month, indicating a shift in market sentiment.

Martinez highlighted BTC's TD sequential indicator on the 12-hour chart, which is currently signaling a buy opportunity. The TD sequential is used in technical analysis to identify potential price exhaustion and trend reversals.

A potential Trump victory may not guarantee stability for Bitcoin prices; maintaining the $68,000 support level is critical to prevent a drop to $63,000. At press time, BTC is trading at $69,595, reflecting a 1.3% increase in the last 24 hours.