6 0

Bitcoin Whales Return as Indicators Suggest Rise Toward $130,000

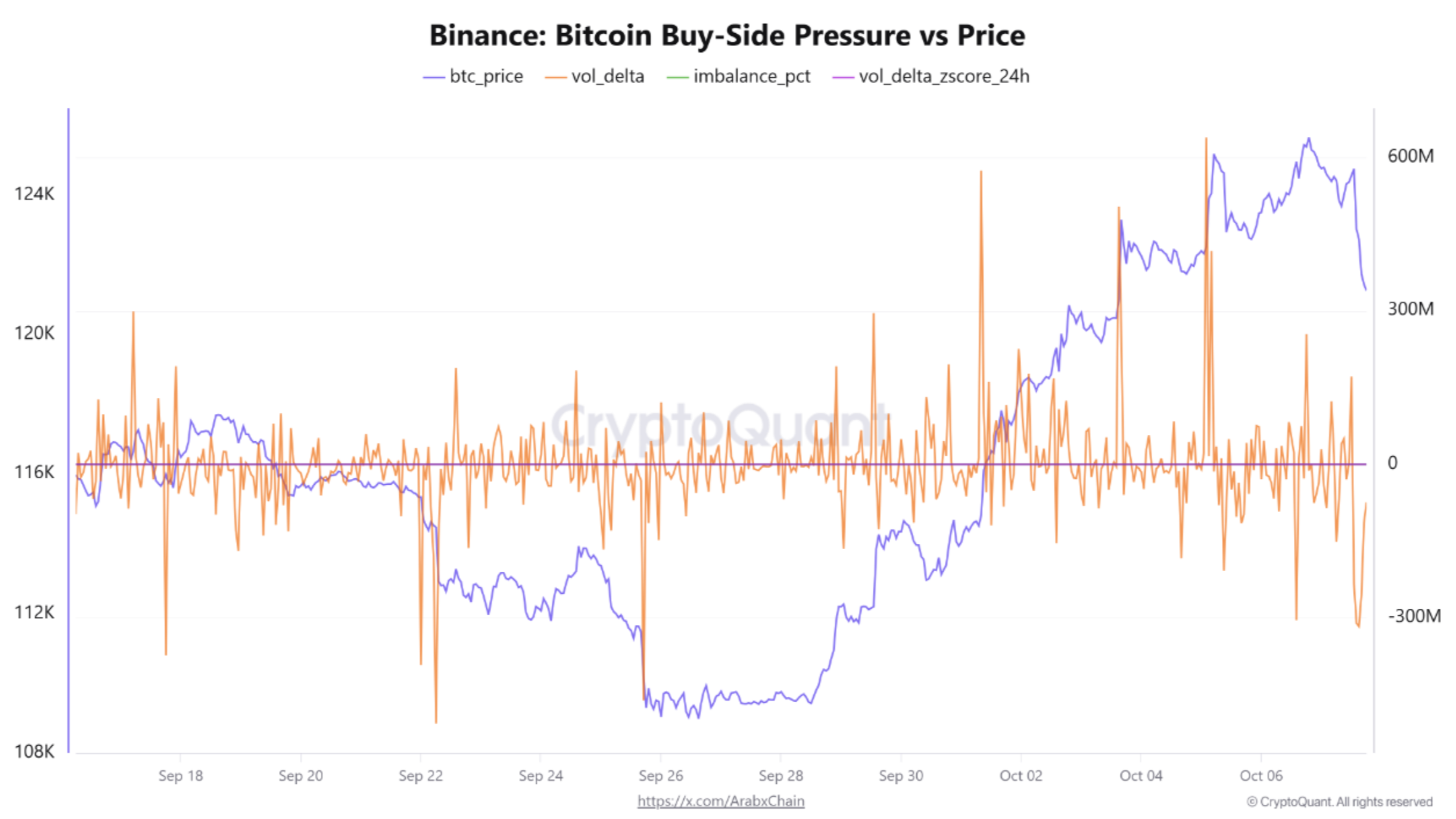

Bitcoin (BTC) recently reached a new all-time high above $125,000. On-chain data identifies three key indicators contributing to this rally:

- Net buying pressure (vol_delta) exceeded $500 million, indicating strong buying interest.

- The imbalance ratio (imbalance_pct) reached 0.23, showing buy orders outnumbered sell orders by 23% on Binance.

- Z-score of 0.79 points to above-average buying activity.

These indicators suggest the return of institutional buyers and whales, with trading volumes at their highest since last July. Despite some recent declines in vol_delta, the overall trend supports further upward movement for BTC.

Market confidence remains strong, reflected in low average daily volatility. Analysts predict potential targets of $125,000–$130,000 in the near term, with a possibility of reaching $140,000 or higher due to decreasing BTC reserves on exchanges. Currently, BTC trades at $122,373, up 0.3% over the past 24 hours.