11 1

Bitcoin’s Apparent Demand Rebounds as Price Approaches $100,000

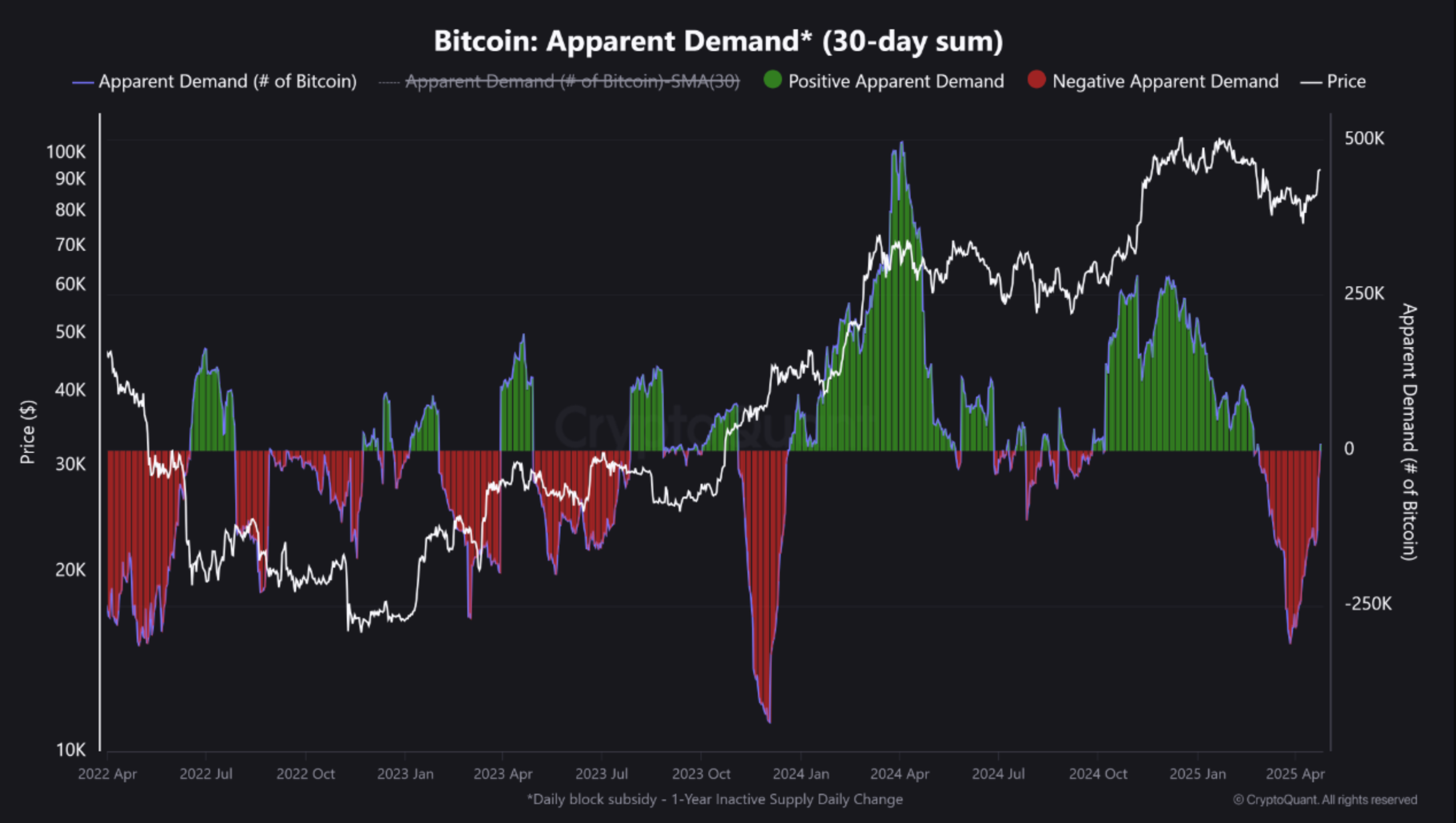

Bitcoin (BTC) approaches the $100,000 milestone, with indicators suggesting a potential breakout. Key metrics indicate increased demand following a period of decline.

Bitcoin's Apparent Demand Rises

- Bitcoin's Apparent Demand has rebounded into positive territory after weeks in the red.

- This metric measures cumulative demand by tracking wallet accumulation and exchange outflows over 30 days.

- The rebound indicates strong buying pressure and bullish sentiment.

- A chart shows this increase aligns with a price rebound above $87,000.

Recent data highlights:

- Apparent Demand is at its first positive reading since February.

- US-based spot BTC ETFs saw net inflows of over $2.5 billion in five consecutive days.

- Cumulative net inflows into spot BTC ETFs total $38.05 billion.

Potential for a BTC Rally

- Historically, reversals in Apparent Demand have preceded significant rallies or strong price support.

- BTC must maintain support around $91,500 to sustain upward momentum.

- Analysts suggest a weekly close above $93,500 is needed to target $100,000.

- As of now, BTC trades at $94,492, reflecting a 2% increase in the last 24 hours.