Analysts Discuss Bitcoin’s Future After Price Reaches $75,358

Bitcoin reached an all-time high of $75,358 after the announcement of Donald Trump's reelection, marking a nearly 10% price increase within a day. The asset currently trades at $74,037, reflecting a decline of approximately 1.1% from its peak.

Is The Top In For Bitcoin?

Market analyst CryptoBullet discussed Bitcoin's dominance index (BTC.D) and the TD Sequential indicator, suggesting that BTC dominance may be nearing a peak. He noted historical patterns from 2018, 2019, and 2021 where similar TD-9 signals preceded significant reversals.

Is #BTC #Dominance finally topping out?

$BTC.D is printing the second TD-9 Sell on the 2W timeframe this cycle

IMO this is something worth paying close attention to.

We can see the same pattern repeating itself over and over again: no matter which direction #BTC… pic.twitter.com/j7Y3kGaQXJ

— CryptoBullet (@CryptoBullet1) November 6, 2024

More Room For Rally?

Analyst Ali warned of a potential pullback to $72,000 following a sell signal on Bitcoin’s four-hour chart. However, he indicated that a sustained close above $75,400 could lead to a new high of $78,000.

If you’re late to the bull party, take caution: the TD Sequential just flashed a sell signal on the #Bitcoin $BTC 4-hour chart, hinting at a possible pullback to $72,000.

However, a sustained close above $75,400 would invalidate this bearish setup and trigger an upswing to… pic.twitter.com/Ljd8lyPsM4

— Ali (@ali_charts) November 6, 2024

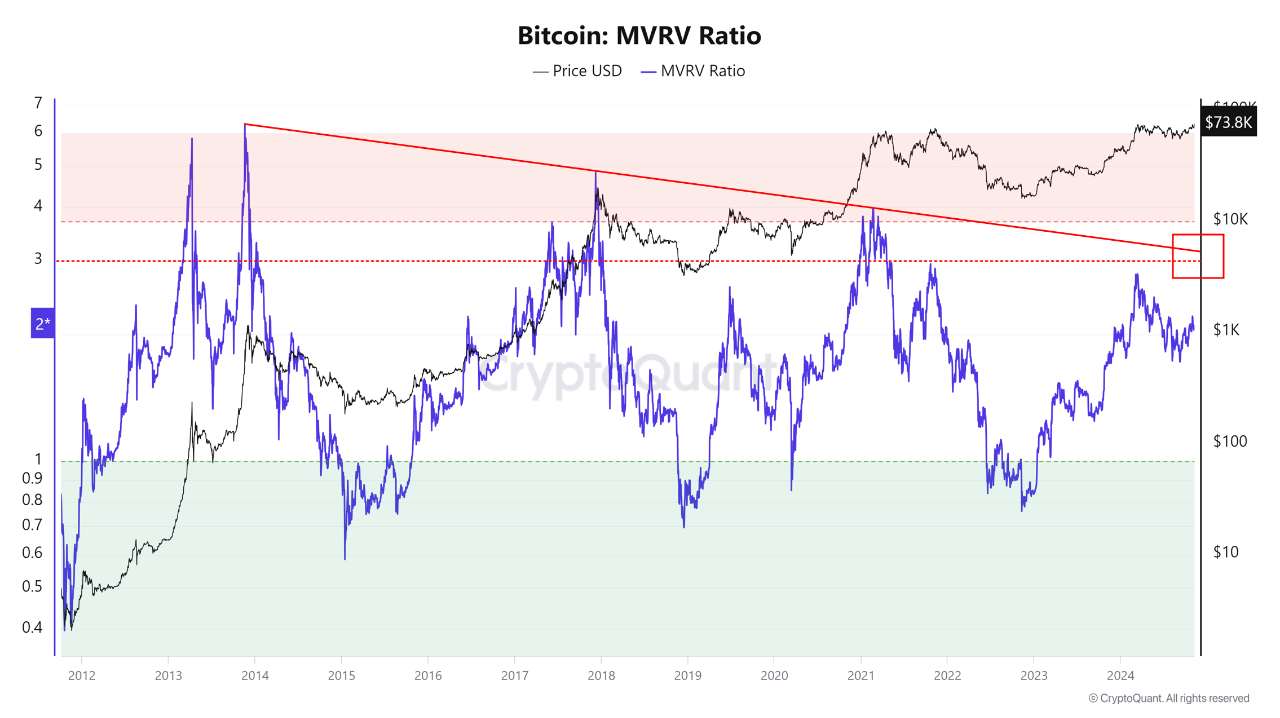

Additionally, CryptoQuant analyst MAC.D provided insights using the MVRV (Market Value to Realized Value) ratio, indicating Bitcoin has not yet reached an overheating stage, allowing for further upside potential. He noted that as market capitalization increases, the rate of price growth typically slows, predicting overheating when the MVRV value reaches around 3.

Featured image created with DALL-E, Chart from TradingView.