7 0

Bitcoin’s Summer Lull Presents Inexpensive Trading Opportunities

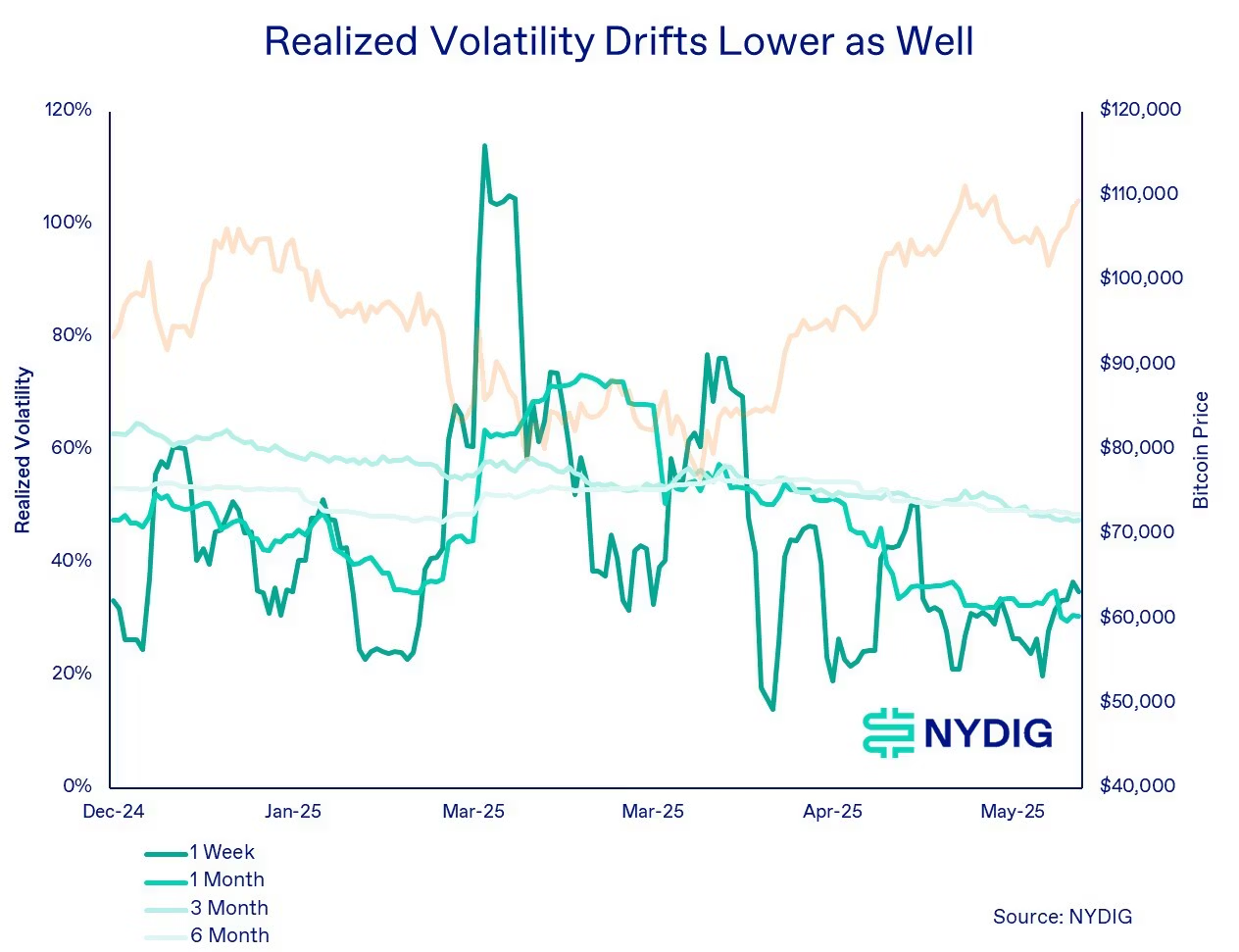

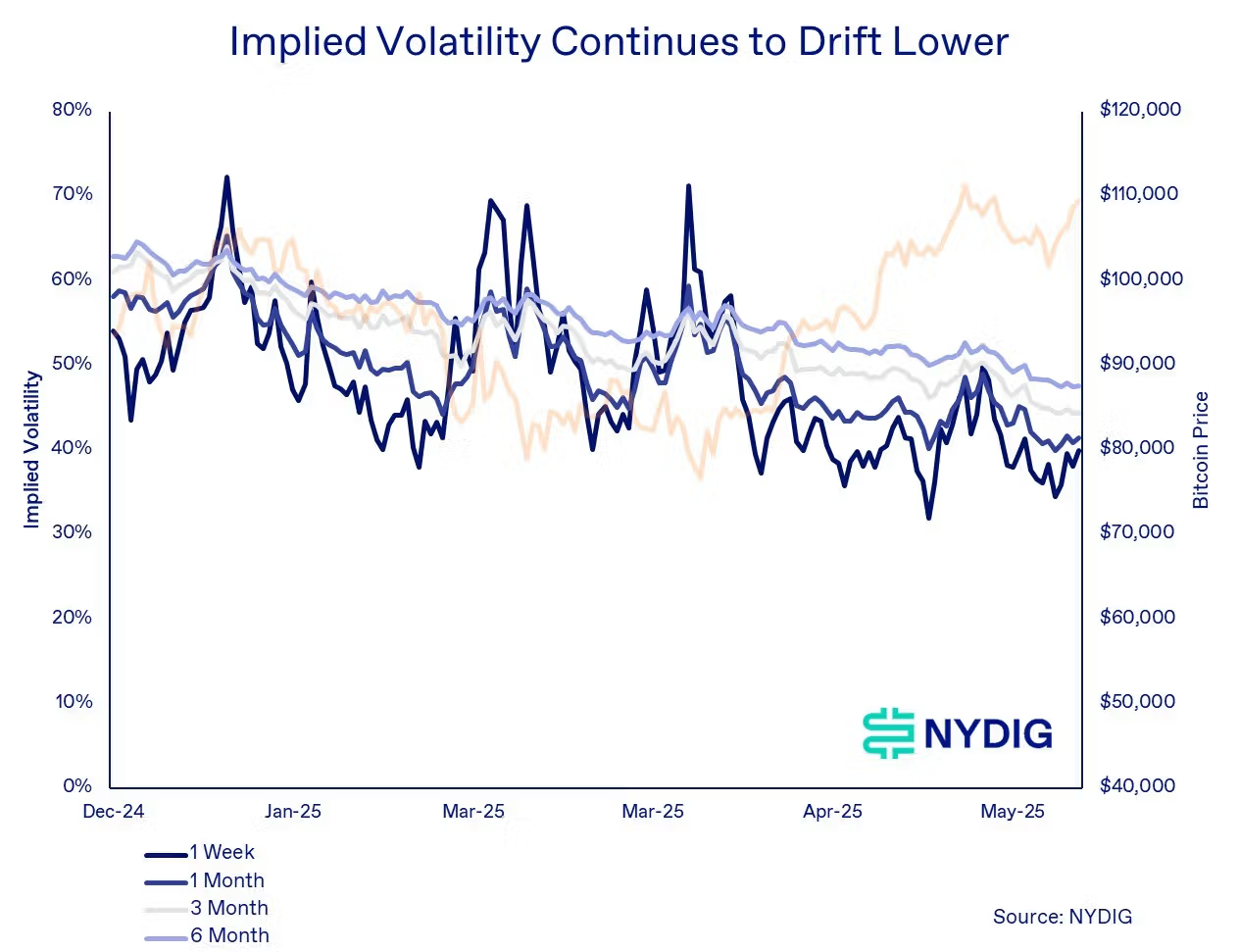

Bitcoin (BTC) recently reached new highs above $100,000, yet volatility is decreasing. NYDIG Research noted that both realized and implied volatility are trending lower despite the price surge.

Key points include:

- Volatility decline is notable amid high prices

- Market entering a quieter summer phase may sustain this trend

- Increased demand from treasury companies and sophisticated trading strategies contributing to stability

- Short-term traders face challenges in capitalizing on price movements

Despite the calm, opportunities exist for traders. NYDIG suggests hedging through options as costs are currently low. Key upcoming events include:

- SEC decision on GDLC conversion (July 2)

- Conclusion of tariff suspension (July 8)

- Crypto Working Group findings deadline (July 22)

This period could present strategic positioning for market-moving catalysts, making it a potential setup for patient traders.