2 0

Bitfinex Whales Reduce BTC Longs, Potential Volatility Ahead

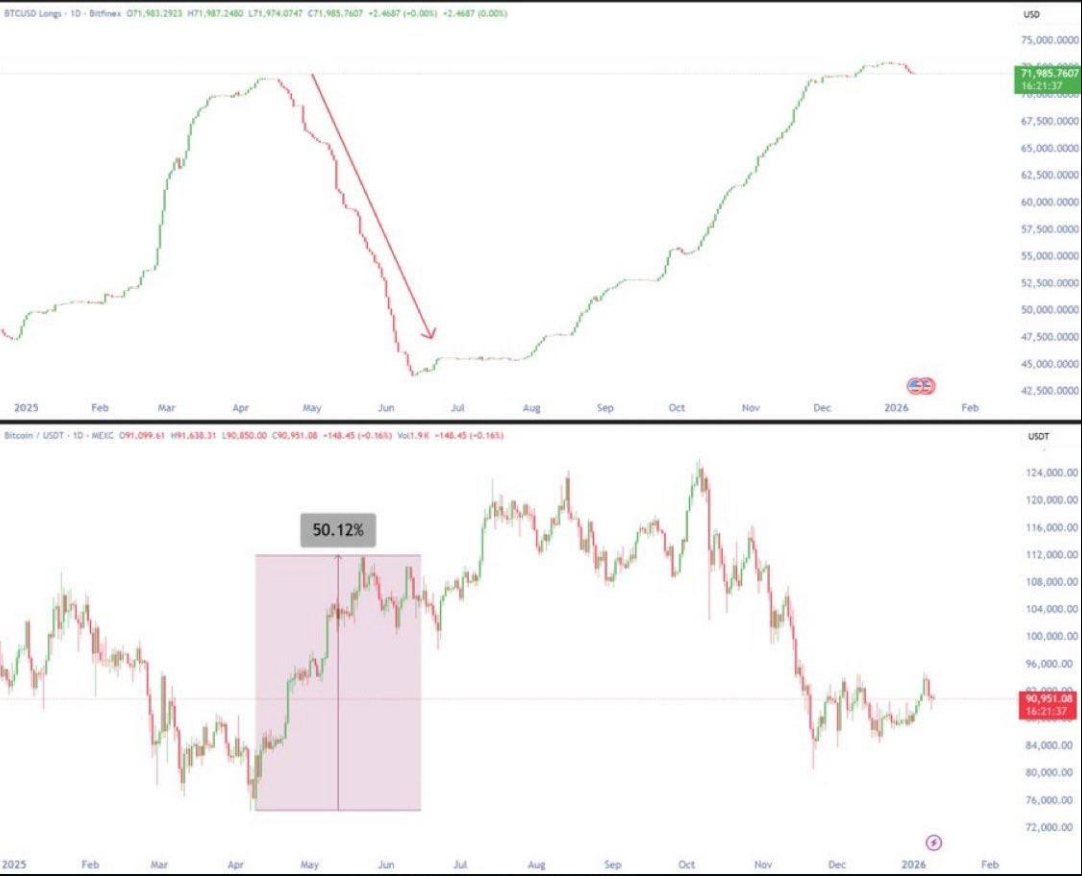

Recent data from TradingView indicates that large holders on Bitfinex have reduced their long positions in Bitcoin following a peak of 73,000 BTC in late December. This is part of a larger trend seen in 2025, where whale holdings dropped by approximately 220,000 BTC.

Whale Activity and Historical Analysis

- Traders suggest that the reduction in long positions could signal upcoming price gains, similar to patterns seen in early 2025 when Bitcoin fell below $74k but later rebounded to $112k within 43 days.

- MartyParty highlights this pattern, suggesting current whale behavior might lead to significant volatility.

Market Dynamics

- According to CryptoQuant, while whale holdings decreased by over 200,000 BTC throughout the year, smaller investors have increased their exposure, potentially broadening market ownership.

- This diversification could stabilize prices, though it doesn't ensure price increases.

Price Range and Resistance

- Bitcoin has been trading between $88,000 and $92,000, with a key resistance level at $94,000.

- A break above $94,000 with volume could affirm a bullish outlook, whereas failure to rise may expand the downside range.

Outlook and Considerations

- Analysts are considering historical patterns for potential targets, like $135k if past trends repeat.

- The outcome depends on market conditions, including volume, funding rates, and net positioning on derivatives platforms.

- Sustained demand or increased selling pressure at resistance levels will influence Bitcoin's direction.