11 1

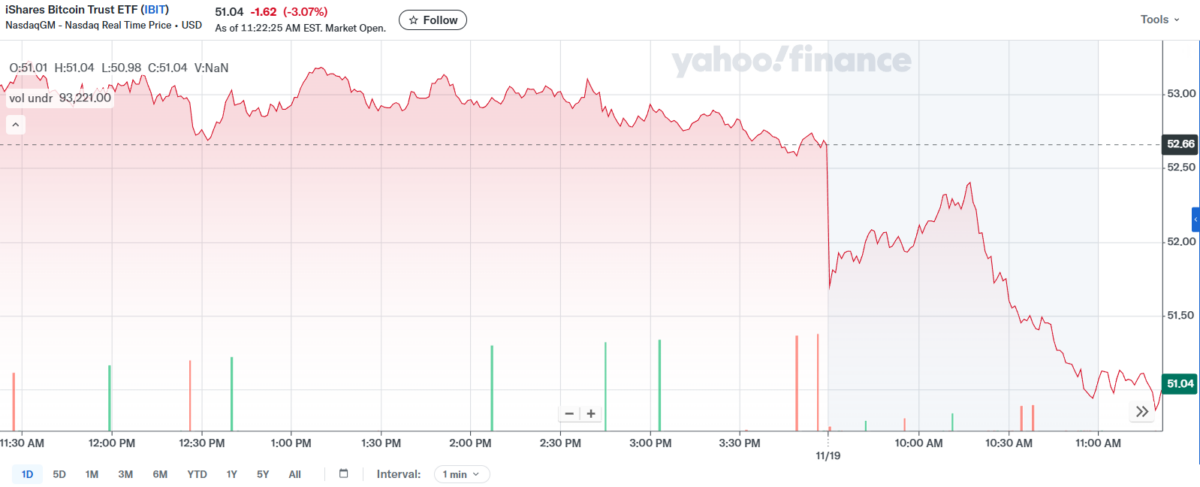

BlackRock Bitcoin ETF Experiences Record $523 Million Outflow Amid BTC Decline

Investors withdrew approximately $523 million from BlackRock's iShares Bitcoin Trust (IBIT) on Nov. 18, marking the largest outflow since its inception in January 2024. This move aligns with a broader decline in Bitcoin prices, which have hit a seven-month low.

- The ETF experienced five consecutive days of net redemptions, totaling $1.425 billion in capital outflows.

- November records the highest monthly outflows for Bitcoin ETFs.

- While IBIT saw significant outflows, other ETFs like Grayscale and Franklin Templeton recorded inflows of $139.6 million and $10.8 million, respectively.

- This trend indicates a shift towards alternative Bitcoin investment vehicles despite ongoing risk aversion.

Bitcoin Price Impact

- Bitcoin's price dropped below $90,000, approximately 30% down from October highs exceeding $126,000.

- On Nov. 19, Bitcoin traded at $89,620, a 4.30% daily decrease.

- The average purchase price for Bitcoin ETF investors is around $90,146, leading to potential losses and redemptions.

Despite recent outflows, BlackRock's iShares Bitcoin Trust remains the leading Bitcoin ETF by assets under management at $87.63 billion as of Nov. 19, having accumulated nearly $25 billion from March through October 2025.