9 0

BEARISH 📉 : BlackRock’s Bitcoin ETF may decrease market volatility premiums

BlackRock has filed an S-1 for an "iShares Bitcoin Premium Income ETF" aimed at tracking Bitcoin's price while generating income by selling call options linked to its spot Bitcoin ETF, IBIT. The filing is seen as a potential source of increased volatility in BTC-linked derivatives markets.

- Key details such as the fee and ticker are not yet disclosed.

- The ETF aims to monetize implied volatility by selling call options, similar to covered-call equity ETFs.

- This strategy may lead to an oversupply of short-dated upside exposure, compressing premiums for sellers over time.

According to Jake Ostrovskis from Wintermute, the ETF adds to an already crowded volatility-selling landscape, potentially leading to lower yields from market-implied premiums.

- The existence of such ETFs might not directly affect Bitcoin's price but could impact the sustainability of attractive income levels from options.

- Investors may face increased challenges in capturing premium during quiet market regimes and risk being underexposed to sharp upward moves in BTC.

Optimal returns will increasingly rely on bespoke structuring, strike selection, tenor management, and liquidity access, rather than merely being short vol.

- If demand for BlackRock’s ETF materializes, traders will need to assess its impact relative to existing IBIT options activity and how it affects specific expiries or strikes.

- This development indicates a trend towards more ETF-native BTC exposure, with volatility pricing shifting towards systematic flows.

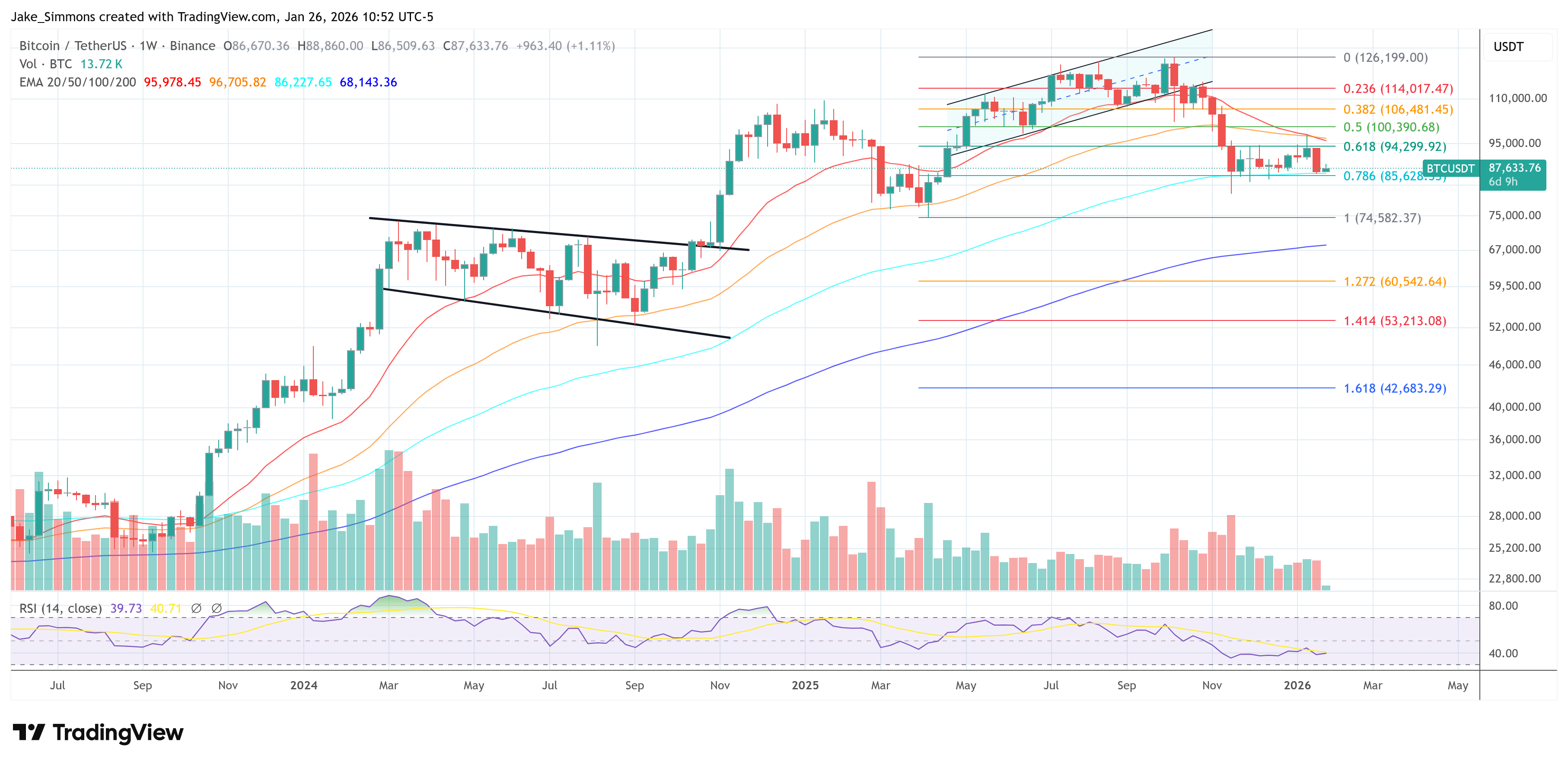

Currently, Bitcoin is trading at $87,633.