15 1

BlackRock Sells Approximately $500 Million in Bitcoin This Week

BlackRock has sold approximately $500 million in Bitcoin this week, driven by outflows from its iShares Bitcoin ETF. This activity has contributed to broader market sell-offs.

Key Points

- BlackRock's Bitcoin sales primarily involved transfers to Coinbase, indicating a strategy to liquidate holdings.

- The iShares Bitcoin ETF experienced significant net outflows: $68.72 million on August 18, followed by $220 million, $127.49 million, and $198.81 million on subsequent days.

- Since August 15, Bitcoin ETFs have faced total net outflows nearing $1.2 billion, with over $1.1 billion withdrawn this week alone.

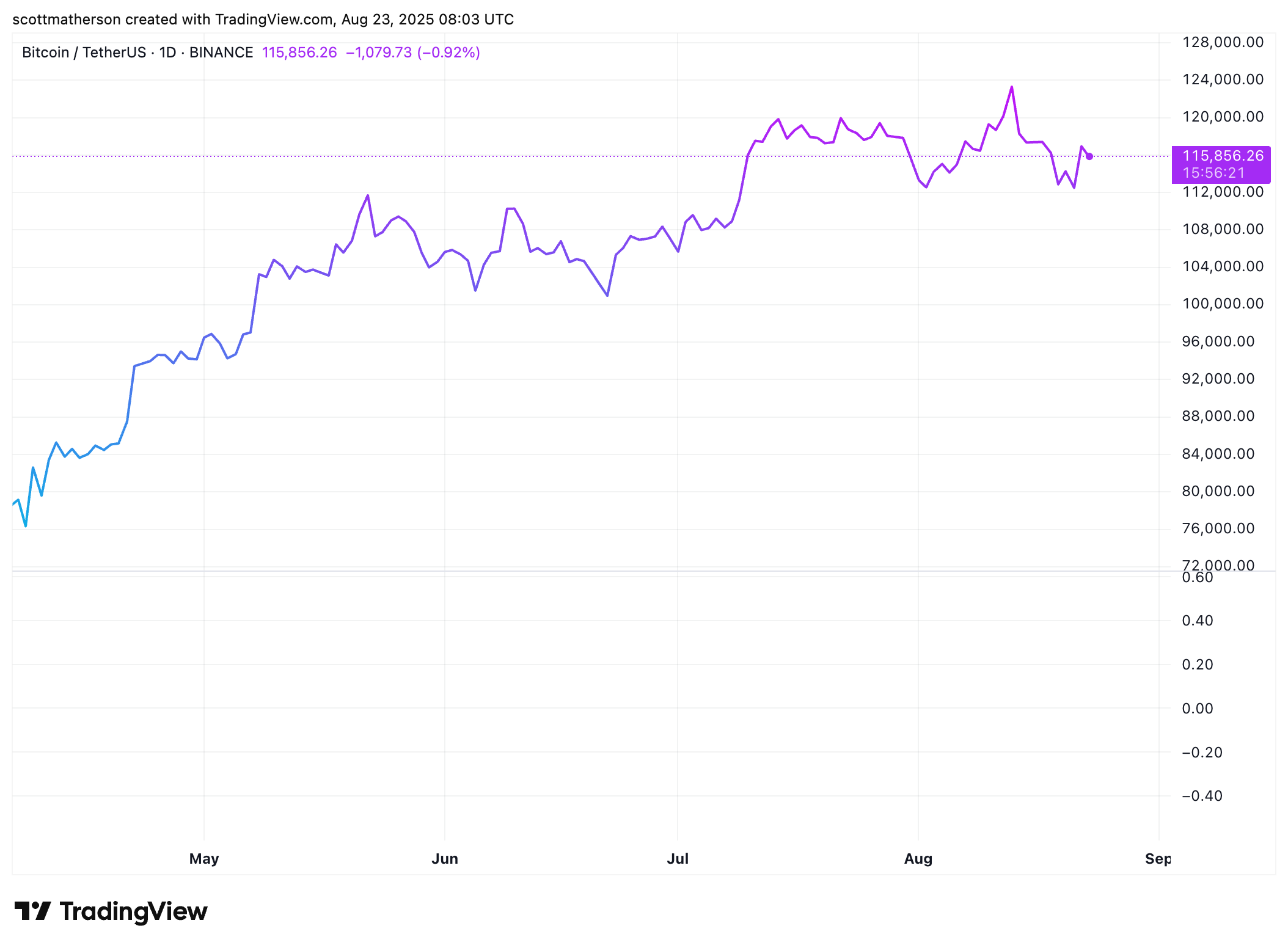

- The Bitcoin price dropped to $112,000 during this period but recovered to around $115,900, influenced by Jerome Powell’s speech suggesting a potential rate cut.

- On August 22, BlackRock was the only fund manager to report a net outflow, while other firms like Ark Invest and Fidelity saw inflows.

Current Bitcoin price is approximately $115,900, reflecting a 2% increase in the last 24 hours.