BlackRock Surpasses Coinbase as Leading Bitcoin Options Platform

BlackRock's iShares Bitcoin Trust (IBIT) has overtaken Coinbase's Deribit as the largest venue for Bitcoin options, with open interest reaching nearly $38 billion compared to Deribit's $32 billion. IBIT's rapid growth is noteworthy, having amassed over $80 billion in assets under management in just 374 trading days, marking it as the fastest ETF to achieve this milestone.

- IBIT now holds 57.5% of all Bitcoin ETF assets under management, indicating strong institutional confidence in Bitcoin.

- The shift towards regulated US-based venues like IBIT suggests a change in the crypto derivatives landscape.

- Despite IBIT's rise, Deribit remains popular among crypto-native traders for speculative trades in less-regulated contexts.

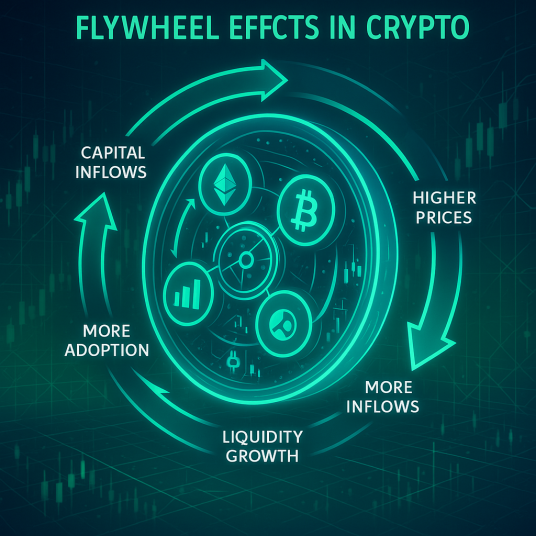

This transition shows increasing institutional capital flow into Bitcoin products, potentially influencing Bitcoin's price stability and volatility.

Macro factors like inflation and geopolitical risks are driving demand for Bitcoin as an alternative store of value. Additionally, Bitcoin-based projects such as layer-2 solutions and DeFi are poised to benefit from increased adoption.