5 0

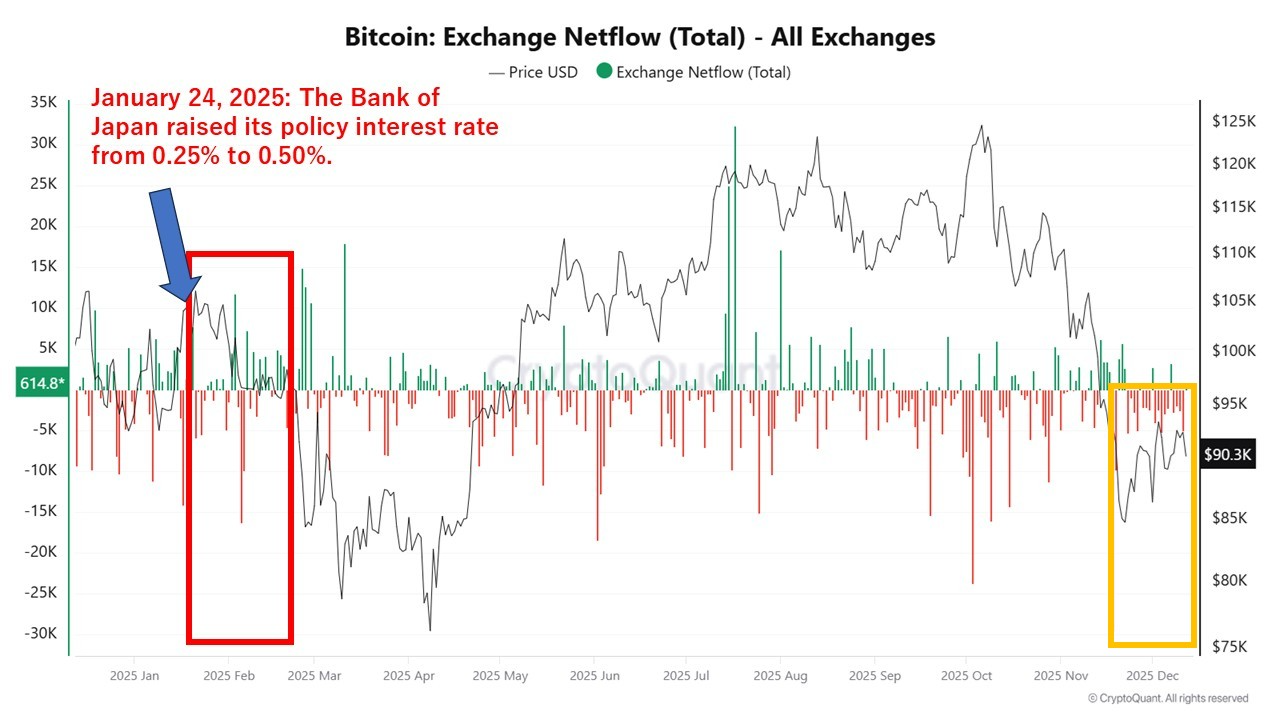

Bitcoin Investors Brace for BOJ Rate Hike Amid Rising Exchange Outflows

The Bitcoin market remains stable within the $90,000 range, experiencing a slight 0.04% increase recently. The cryptocurrency has shown a steady rise, entering an ascending channel phase. Despite this, investors are cautious due to an anticipated negative economic catalyst.

Bitcoin Inflows and Funding Rates Amid Anticipated Rate Hike

- Japan's economic developments may affect Bitcoin, with analysts predicting a 25 bps rate hike by the Bank of Japan in December.

- Interest rate hikes typically cause capital shifts away from risky assets like Bitcoin, potentially leading to price declines.

- Investors are attempting to mitigate price pressure by adjusting their positions before the potential rate hike.

Exchange netflows indicate rising inflows as investors reduce spot exposure, similar to previous BOJ rate hikes. Funding rates are also declining, showing preemptive caution among investors.

Future Prospects for Bitcoin

- Bitcoin is currently valued at $90,190, showing a weekly gain of 0.77%.

- The focus is shifting from the rate hike to the yen's post-announcement dynamics.

- Bitcoin's near-term movement may depend on the yen's strength or a "sell the rumor, buy the fact" scenario.

- Bitcoin maintains its status as the largest cryptocurrency with a market cap of $1.67 trillion and a dominance of 58.2%.