4 0

BULLISH 📈 : Brazil’s Bill Bans Algorithmic Stablecoins, Bitcoin Hyper Raises $31M

Key Points:

- Brazil's new legislation requires stablecoins to have 1:1 backing with fiat or high-quality liquid assets, banning algorithmic models. This move aims to protect consumers and facilitate the introduction of the Drex digital currency.

- The legislative focus is shifting capital towards fundamental infrastructure projects that address scalability and utility issues in the crypto space.

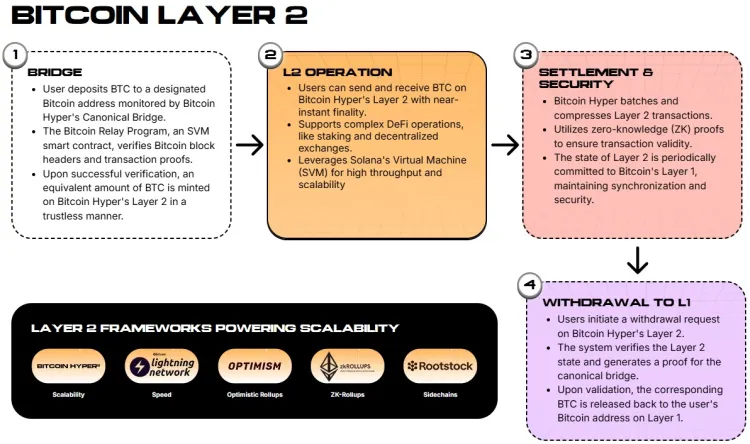

- Bitcoin Hyper utilizes the Solana Virtual Machine (SVM) to enhance Bitcoin's capability with high-speed smart contracts, raising over $31 million through its presale.

- Significant whale activity indicates institutional interest in Layer 2 solutions, with major on-chain purchases noted in early 2026.

Implications:

- Bill 4.308/2024 in Brazil mandates issuers of stablecoins to maintain separate client funds from proprietary capital, a response to past liquidity issues.

- The ban on algorithmic stablecoins like Terra’s UST is strategic, intending to clear the path for 'Drex' and other compliant alternatives.

- Investors are reallocating from risky yield products to infrastructure layers offering real utility, boosting interest in projects like Bitcoin Hyper.

Technical Insights:

- Bitcoin Hyper integrates SVM as a Layer 2 solution on Bitcoin, achieving rapid execution speeds akin to Solana while leveraging Bitcoin's security.

- This architecture allows developers to create smart contracts in Rust that interact efficiently with native Bitcoin liquidity.

Market Trends:

- The presale success of Bitcoin Hyper, raising over $31.2M, highlights investor confidence in sustainable infrastructure projects amidst regulatory changes.

- Whale investments emphasize a shift towards quality, long-term infrastructure bets amidst tightened regulations.

Image Context:

Note: Cryptocurrency investments carry risks including regulatory changes and market volatility. Conduct thorough due diligence before investing.