41 7

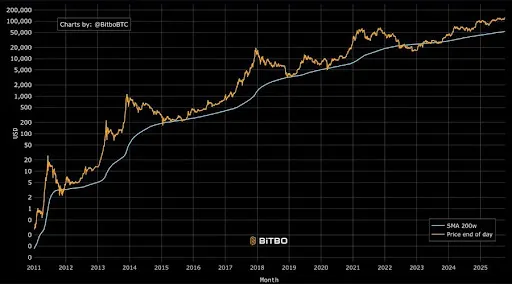

Bitcoin’s 200-Week Moving Average Signals Strong Buy Opportunities

The 200-week moving average (WMA) is a critical indicator for Bitcoin, marking the boundary between bear market capitulation and long-term accumulation. Historically, when Bitcoin approaches the 200 WMA, it signals a buying opportunity. However, this window can be fleeting as BTC's price movement is volatile.

Key Observations

- Bitcoin has hit the 200 WMA five times, each signaling a potential buy opportunity.

- Three of these instances lasted only days, highlighting the challenge of timing entries.

- In April 2023, Bitcoin was $31,000, with the 200 WMA at $25,000. A brief dip below the 200 WMA offered limited chances to buy before prices rose again.

- The 200 WMA is now above $50,000, potentially rising further if Bitcoin's uptrend continues.

Long-Term Bullish Outlook

- An analyst highlights that Bitcoin remains strong on higher timeframes, with a consolidation zone above $108,000.

- This area could transform into support, paving the way for significant price expansion.

- Recent movements suggest a continuation pattern, with hidden bullish divergences potentially confirming this outlook.

- A major price move is anticipated in the upcoming week.