11 1

Bitcoin Holds $85K as Short-Term Holders Drive Recent Pullback

Bitcoin has retraced to the $85,000 level, a critical support zone for bulls. Volatility has compressed, with market sentiment showing signs of fear and apathy.

- The recent decline from ~$88.2K to ~$85K is attributed more to short-term profit-taking than long-term holder distribution.

- Short-term holders (STH) sent about 24.7K BTC to exchanges, with 86.8% realized in profit, exceeding $1.89 billion, suggesting strategic exits rather than panic selling.

- Total STH inflows on December 16 dropped to 3.9K BTC, indicating potential exhaustion rather than significant selling pressure.

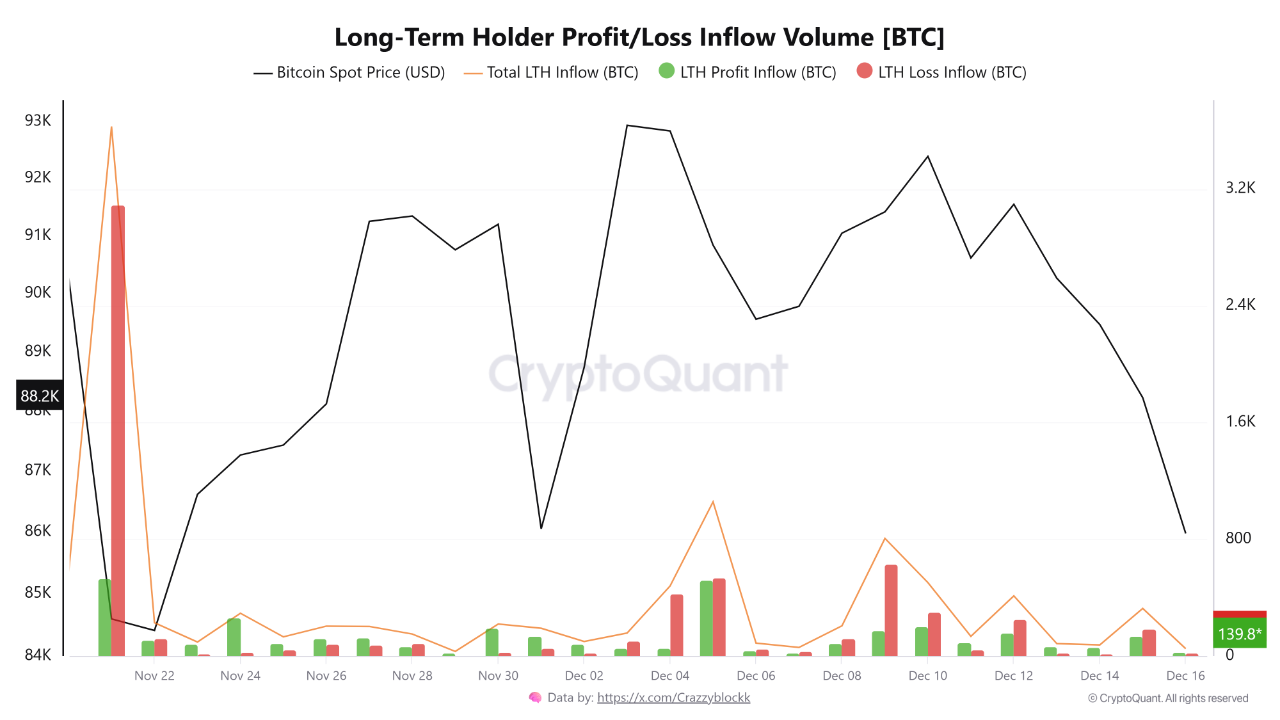

- Long-term holders (LTH) have shown muted activity, with minimal inflows, indicating no major sell-off.

Support Dynamics

- Bitcoin is consolidating between the $85K–$88K range, engaging with the 100-week moving average as dynamic support since 2023.

- Loss of the 50-week moving average marked a shift from expansion to consolidation.

- Volume decline during the retracement suggests corrective movement, not structural sell pressure.

- If Bitcoin fails to hold $85K, it could retrace to the low-$70K range; reclaiming $90K–$92K is needed for bullish momentum.