0 0

Bitcoin Nears $92K Resistance Pivotal for Short-Term Holder Profits

Bitcoin has shown resilience, rebounding toward the $92,000 level after late-2025 weakness. Despite this improvement, it remains within a consolidation range since November.

- Analysts are split on whether Bitcoin's recent gains signal a trend reversal or if more time is needed for market stabilization.

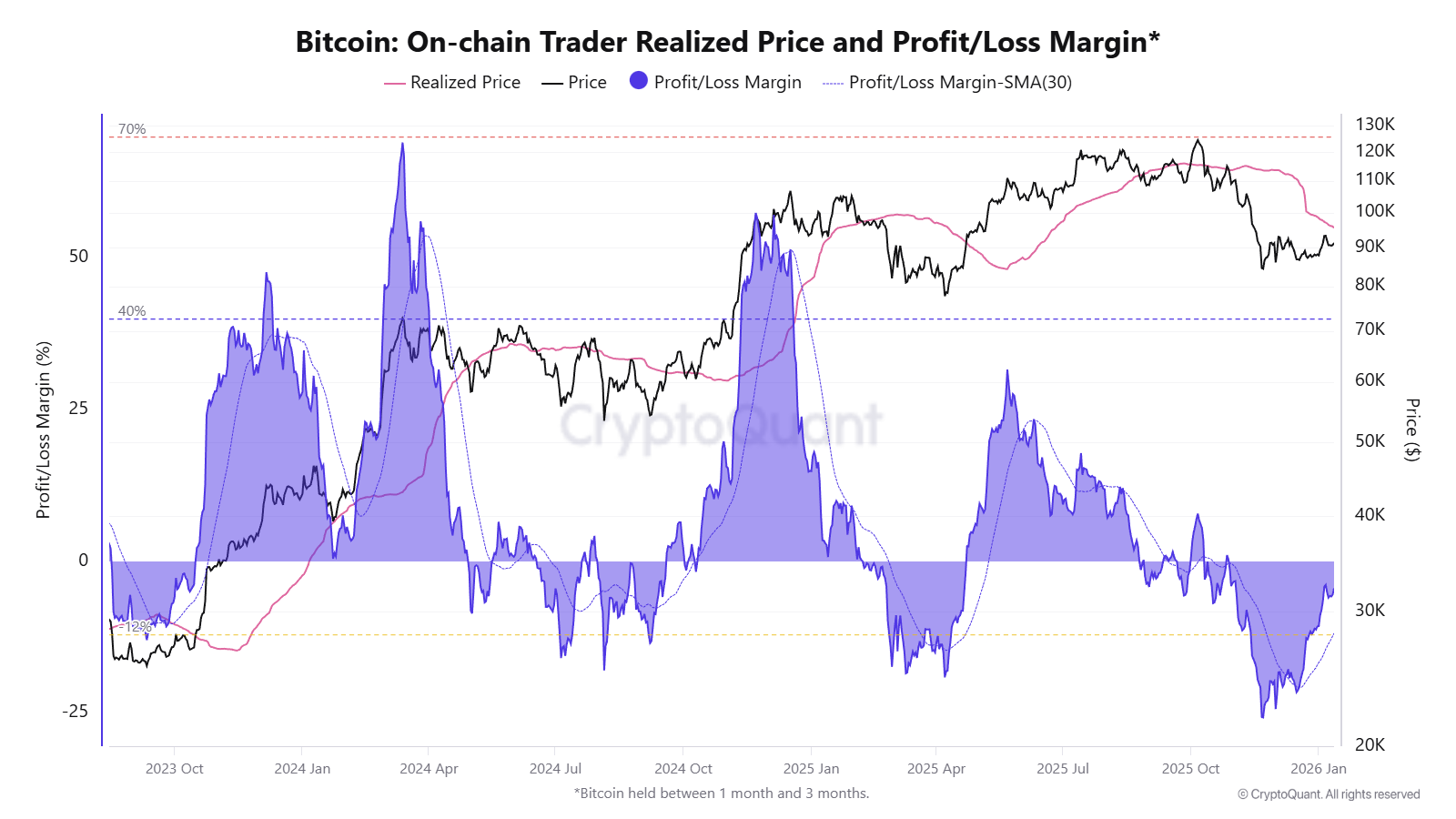

- A CryptoQuant report indicates short-term holders may soon reach profitability, easing selling pressure and potentially supporting further gains.

- The critical zone is around $92,200. A break above this level could reduce the incentive for short-term holders to sell during minor rallies.

Psychological Inflection Point for Short-Term Holders

- $92,000–$92,200 is a psychological threshold for short-term holders (STHs). Crossing this could reduce stress among recent buyers.

- If STHs return to profit, selling pressure typically diminishes, potentially leading to increased holding or buying behavior.

- Past data shows crossing the STH realized price often improves market structure.

- Reclaiming and holding above $92K signals absorbed supply and strengthening demand, which could extend the trend.

However, failure to maintain this level risks renewed selling pressure, keeping Bitcoin in a consolidation phase.

Bitcoin Price Consolidation

- After a correction from October highs near $125,000, Bitcoin found strong demand at $85,000–$88,000, forming higher lows.

- Currently trading above the 200-day moving average, indicating a continued macro upward trend despite recent challenges.

- BTC is below the 100-day and 50-day moving averages, creating resistance around $92,000–$94,000.

- Reduced trading volume suggests consolidation rather than impulsive trends.

- For bullish momentum, Bitcoin needs a decisive close above $92,000–$94,000. Failure to do so may lead to another test of $88,000 support.