0 0

Bitcoin Hits $96K, Struggles Against Long-Term Holder Sell Ceiling

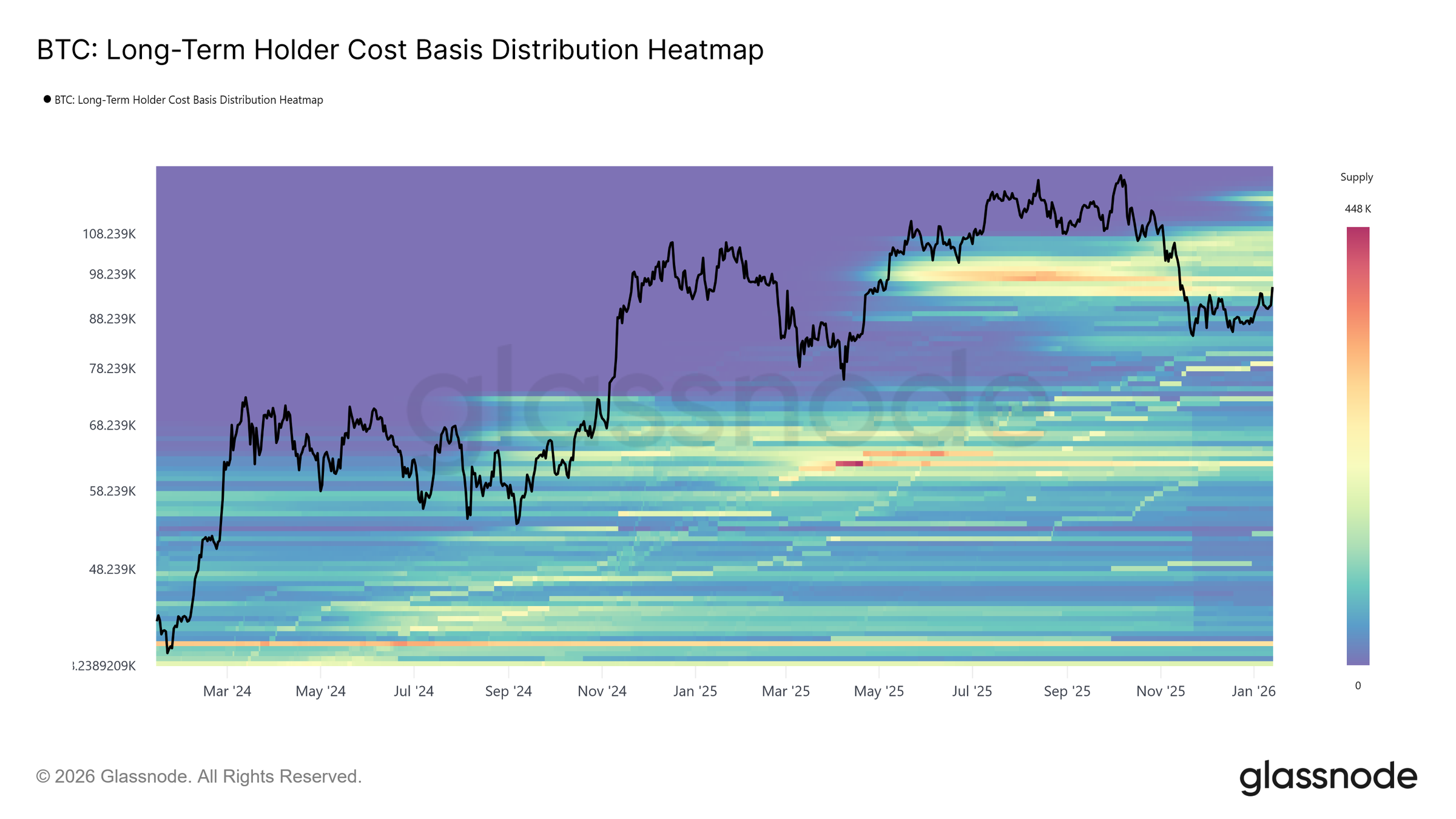

Bitcoin's price has bounced back to a challenging area, with Glassnode reporting it has consistently struggled to break through this overhead supply zone since November. The current move above $96,000 is seen as dependent on derivatives positioning rather than sustained spot buying.

- The $93K - $110K range has been a barrier since April to July 2025 due to long-term holders (LTH) selling near cycle highs.

- Short-term holder (STH) cost basis is at $98.3K; trading above this indicates strong recent demand.

- LTHs are still net sellers, but at a slower rate compared to Q3 and Q4 2025, suggesting less intense profit-taking.

- Failure to maintain above the True Market Mean (~$81K) could lead to deeper market corrections.

- Net Realized Profit and Loss shows LTHs realize about 12.8K BTC weekly, down from peaks of 100K BTC.

Bitcoin Demand Insights

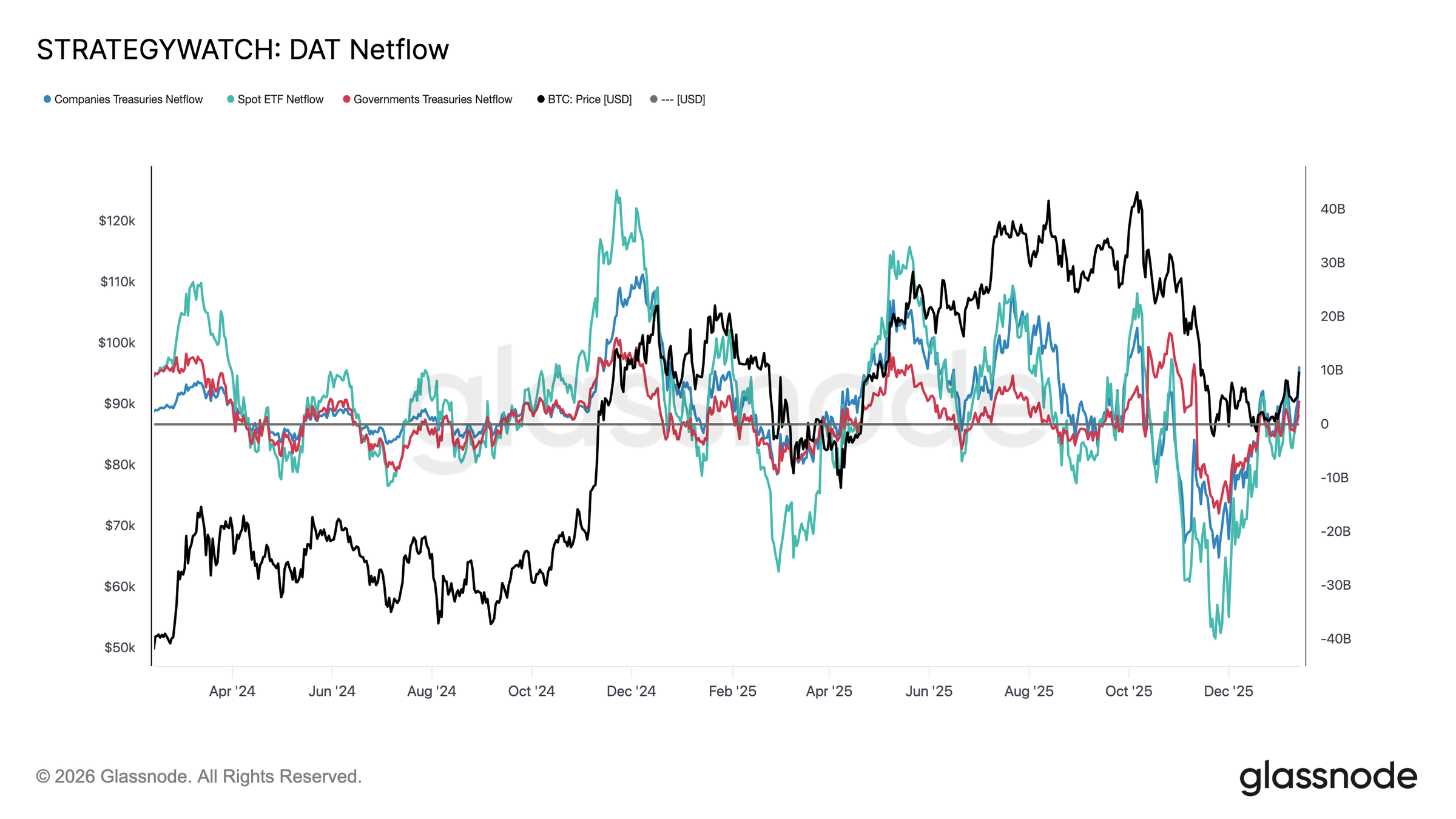

- Institutional balance-sheet flows have stabilized after heavy outflows, with spot ETFs turning positive.

- Corporate and sovereign treasury flows remain sporadic, indicating inconsistent demand.

- Exchange behavior is shifting towards buy-dominance, with reduced sell-side pressure from major platforms like Coinbase.

The recent rise to $96K was driven by short liquidations in a thin liquidity environment, indicating that significant new capital wasn't needed for the price increase. Sustained growth now depends on spot demand and volume replacing forced covering actions.

- Options markets show low implied volatility with downside skew, indicating cautious exposure with a preference for insurance.

- Dealers are short gamma around $94K to $104K, which can amplify market moves.

At present, BTC trades at $96,334.