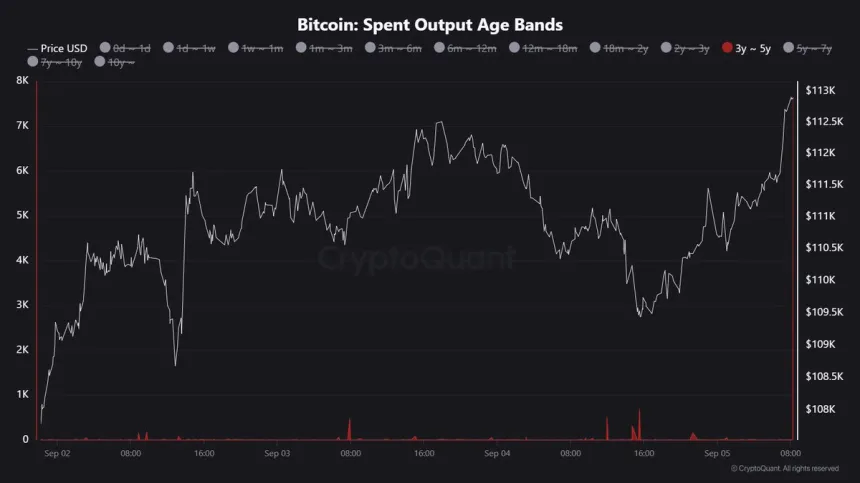

7,626 BTC Aged 3–5 Years Recently Released Back Into Circulation

Bitcoin is trading over 9% below its all-time high of $124,500, facing selling pressure but maintaining support around $105,000. Analysts are divided on future price movements—some predict a deeper correction, while others foresee a return to previous highs.

Key insights from analyst Maartunn indicate:

- Old coins are flowing into ETF wallets, with significant movements expected in summer 2024, fall 2024, and summer 2025.

- This cycle shows repeated supply rotation, unlike previous singular events.

- Long-term holders are decreasing exposure, while ETFs absorb supply.

A recent movement of 7,626 BTC aged three to five years suggests long-term holders are releasing dormant coins. This activity often signals market uncertainty and influences investor behavior.

Despite profit-taking, Bitcoin remains above $110,000, indicating buyer absorption of supply. ETF inflows are seen as mitigating sharper corrections. However, if demand does not increase, newly unlocked coins may create volatility.

Currently priced at $112,409, Bitcoin has rebounded from the $109K–$110K demand zone. It faces resistance at the 50-day moving average ($111,661) and the 100-day moving average ($114,382).

Resistance levels could limit upward movement, particularly the red 200-day moving average at $114,746. A close above $114K would signal bullish continuation; failure to hold above $110K could lead to revisiting lower supports around $106K–$108K.