10 0

Bitcoin Drops Below $112K Amid $19B Futures Liquidation

Bitcoin has fallen below the $112,000 level due to macroeconomic concerns and a significant $19 billion futures liquidation.

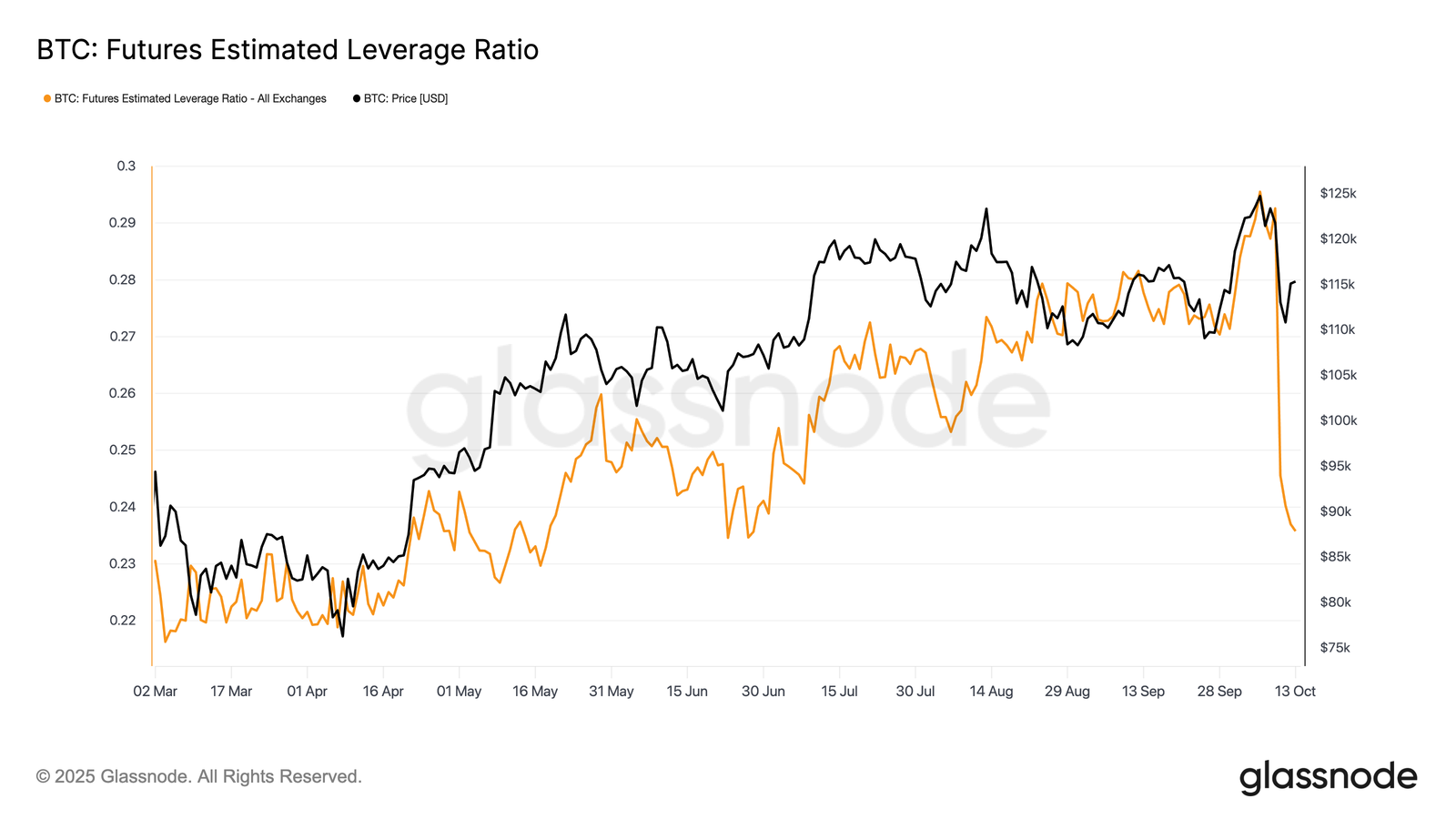

- Glassnode reports the market is entering a "reset phase" with leverage flushes and increased volatility.

- Bitcoin is trading around $111,000, down 9% in the last week.

- Selling by long-term holders continues, and Bitcoin ETFs see a 2,300 BTC outflow this week.

- The Estimated Leverage Ratio has dropped to multi-month lows, indicating intense liquidation.

Market Analysis

- Options market shows stabilization signs with rebounding open interest despite high volatility.

- Some traders consider this a final reset stage before potential price recovery.

- Ted suggests Bitcoin may reach new highs by 2026 if the $102,000 level holds.

- Jason Pizzino warns that dropping below $108,000 could threaten the bull market but notes other assets like gold and stocks are near record highs.