9 0

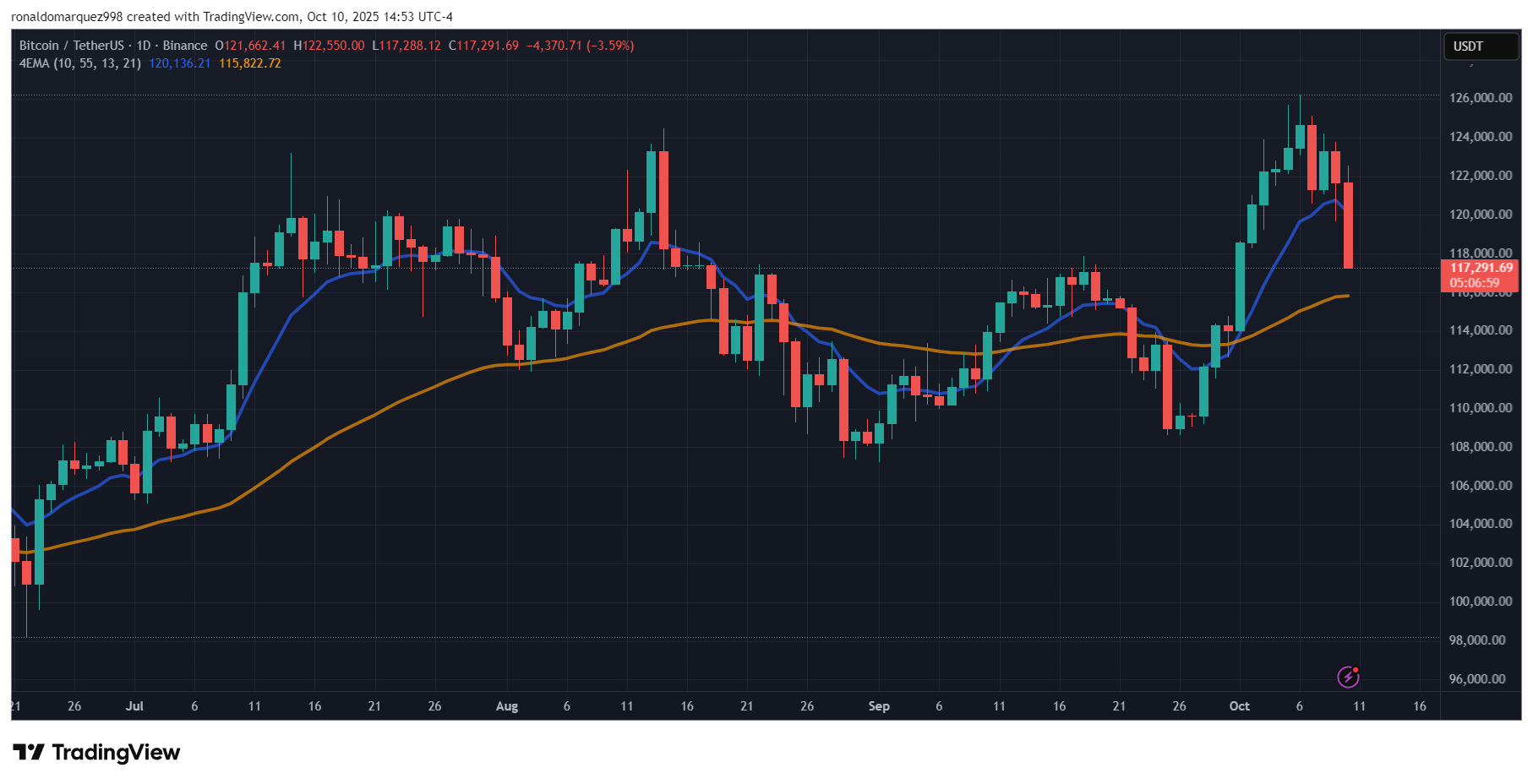

Bitcoin Falls 6% Amid $200M Liquidations and Tariff Concerns

The Bitcoin price has dropped by 6% from its all-time highs, leading to liquidation events nearing $200 million. Analysts link the decline to geopolitical issues, notably President Trump's tariffs on Chinese goods.

Impact of Tariffs on Bitcoin

- Tariffs introduce risks like disrupted supply chains, inflation, and slowed global trade.

- Investors are rotating towards safer assets like cash and gold.

- Tariff risks could delay anticipated rate cuts.

- Unwinding short positions affects alternative cryptocurrencies and leveraged Bitcoin holdings.

- Uncertainty in trade policies creates an "uncertainty premium," demanding market discounts.

Analysts draw parallels to past market behavior, noting similar tariff threats previously led to significant crypto market crashes.

Future Outlook for Bitcoin

- Key support zone around $116,000 is crucial for potential buyer return.

- Federal Reserve's monetary policy easing could trigger a rebound.

- Continued downside volatility expected in the short term.

- Medium-term investors may start accumulating Bitcoin.

- Long-term prospects remain positive with potential rate cuts and strong fourth-quarter performance.

Market expert Timothy Peterson notes AI simulations predicting a 50% chance of Bitcoin exceeding $140,000 by month-end. The recent drop adjusts expectations to around $130,000, indicating an 11% increase from the current price.

Despite uncertainties, there remains an 18% chance for "Uptober" to end negatively.