11 0

Bitcoin Falls Under $110K; ETFs See $241 Million Inflows

The Bitcoin price dropped below $110,000, marking a 5% loss amid intensified downturns in global risk-assets markets. Despite this, corporate demand remains steady with US firms continuing to buy.

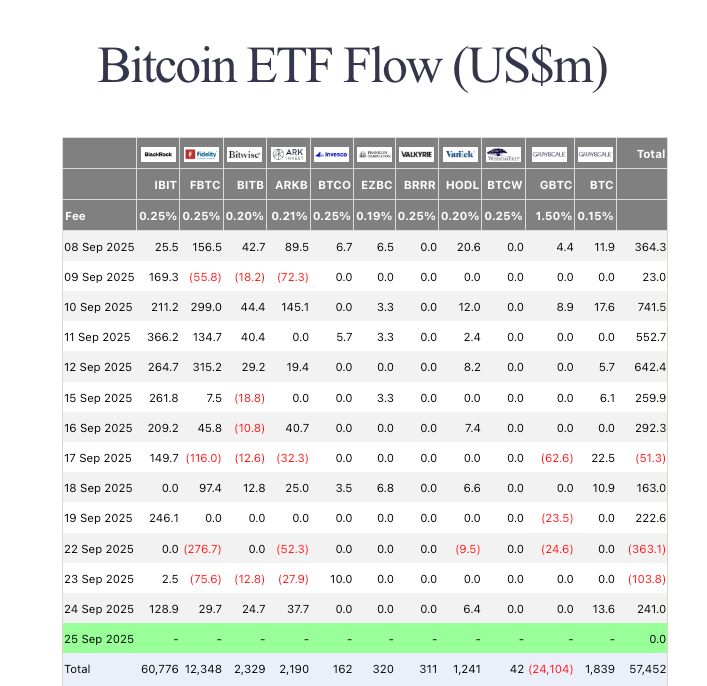

- US spot Bitcoin ETFs recorded $241 million in inflows on September 24, partially offsetting earlier outflows of $466 million.

- BlackRock's IBIT ETF led with $128.9 million in inflows, followed by Ark Invest's ARKB ($37.7 million) and Fidelity's FBTC ($29.7 million).

- DCC Enterprises increased its holdings by purchasing an additional 50 BTC, now holding 1,058 BTC.

- DCC aims to acquire 10,000 BTC by the end of 2025, having achieved a +1,556% yield since May.

Price Forecast:

- BTC is consolidating near $109,600 after breaking support at $110,000.

- Technical indicators suggest further downside risks; RSI is at 37.17, signaling bearish momentum.

- Elliott Wave analysis indicates potential correction towards $100,000, with significant support at $101,500.

- A failure to hold $101,500 may lead to further decline to $91,352.

- To counteract bearish risks, Bitcoin needs to reclaim $114,100 and potentially break above $118,600.

Despite macro headwinds, institutional inflows are providing some short-term support.