3 0

BEARISH 📉 : Bitcoin drops below $80,000 triggering $1.3 billion in losses

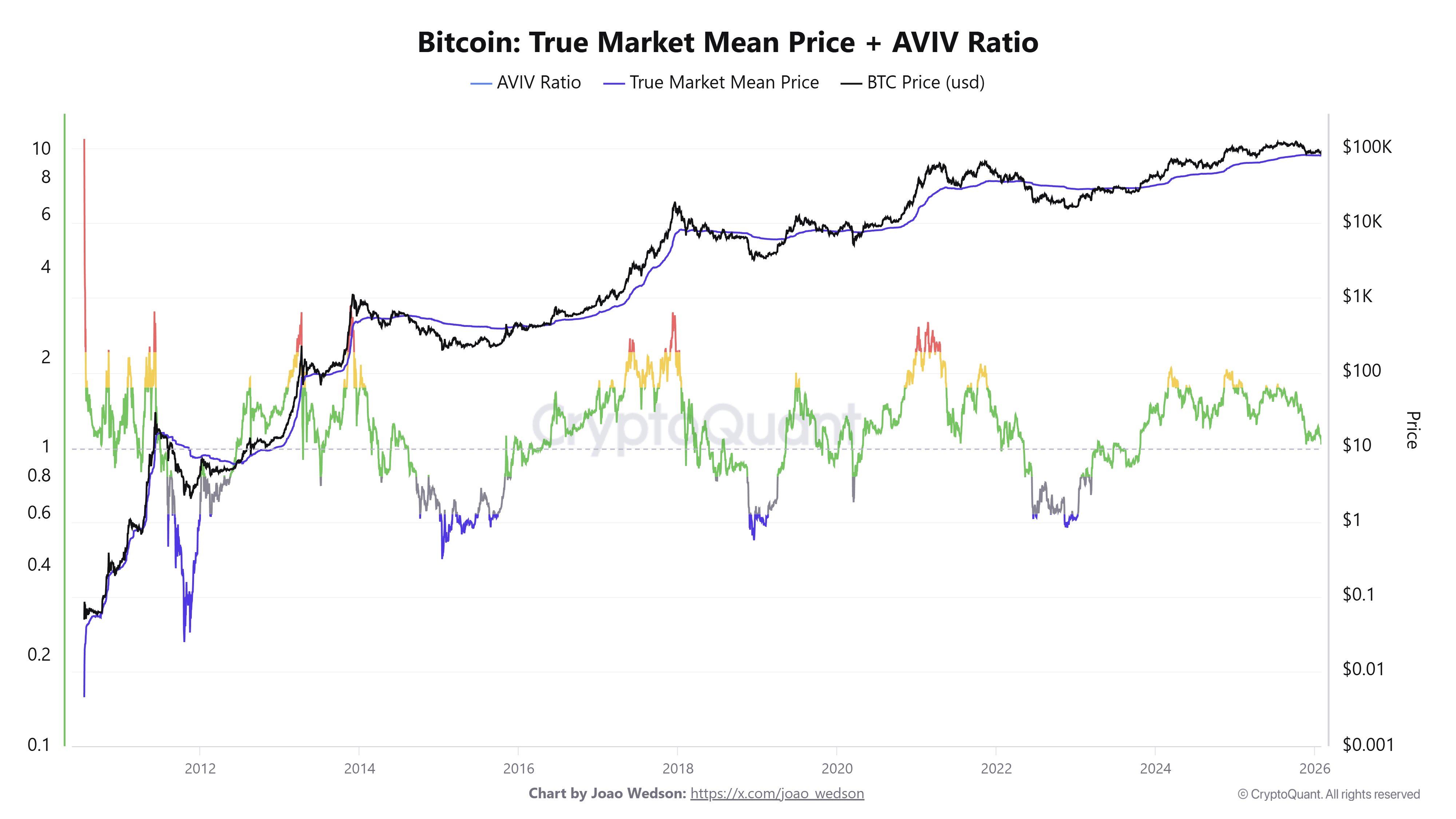

Bitcoin has dropped below $80,000, experiencing significant liquidations with a total loss of $1.3 billion in the last 12 hours. This price drop marks a key point as it aligns with the cost basis for Bitcoin Spot ETFs, affecting institutional investors.

Bitcoin Slips Under ETF Realized Price

The $80,000 level is crucial both technically and on-chain, having previously acted as support during market corrections since October 2025. Its breach could lead to increased redemptions from Bitcoin ETFs, which already saw $1.61 billion outflow in January 2026 alone.

Future Scenarios for Bitcoin

- Bearish Scenario: A weekly close below $80,000 may push Bitcoin to $72,000, $68,000, and $62,000, aligning with volume profile clusters where liquidity might stabilize.

- Bullish Scenario: A rebound could target $90,000 initially, then $95,000 (SMA111), with a breakthrough above $100,000 signaling a potential uptrend resumption.

Currently, Bitcoin trades at $77,832, down 7.1% from the previous day.