1 0

BEARISH 📉 : Bitcoin falls below $80K as bear market signals intensify

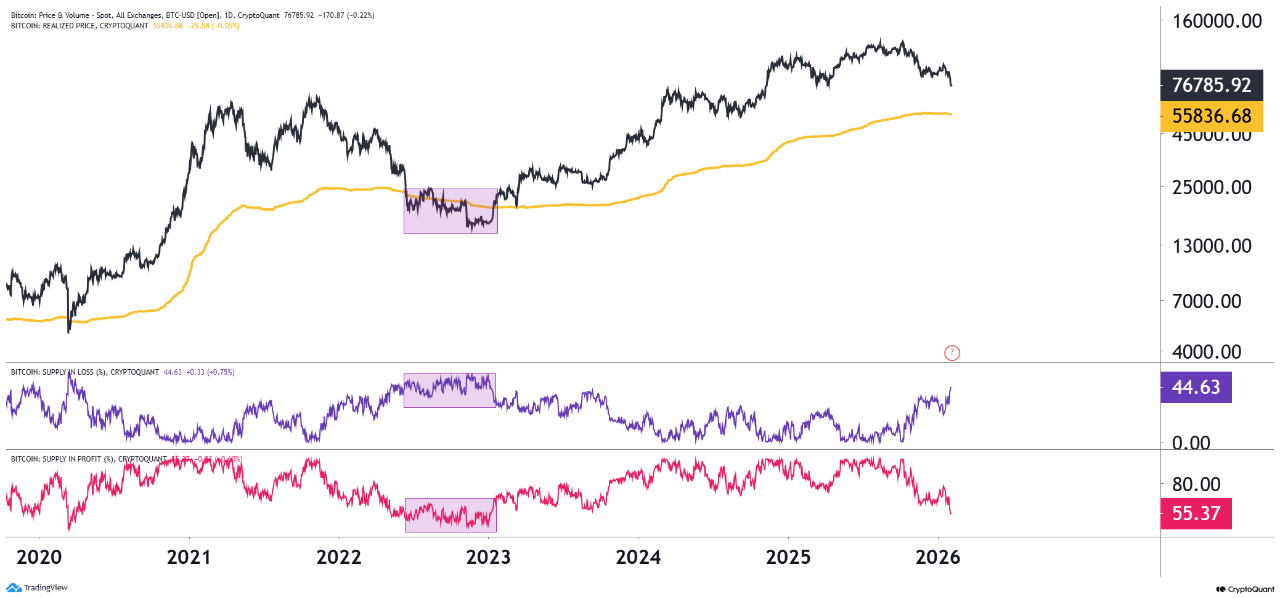

Bitcoin has fallen below $80,000, indicating increased selling pressure across global markets. This reflects broader market volatility and liquidity issues, prompting defensive strategies among investors.

Key Indicators of Market Shift

- On-chain data suggests Bitcoin is showing early bear market signals.

- The Supply in Loss (%) metric has risen to around 44%, indicating more holders at an unrealized loss.

- Despite being above its Realized Price, the combination of losses and weakened price structure points to potential bear market entry.

Bear Market Structural Signals

- Current conditions mirror early stages of past bear markets.

- Supply in Loss exceeding 40% aligns with a decline in Supply in Profit.

- Market health deteriorates slowly, with controlled spread of losses.

This suggests that the market is transitioning rather than correcting mid-cycle. Historical patterns indicate further development of these conditions before a durable bottom forms.

Price Structure Analysis

- Bitcoin's price has dropped below key support levels, closing around $77,500.

- It has broken below the 50-period and 100-period moving averages, with the 200-period average now as resistance.

- The sell-off is characterized by impulsive, high-volume moves, indicating forced exits.

Currently, Bitcoin exhibits a bearish continuation pattern. Without reclaiming the $80K–$85K zone, downside risks prevail, suggesting a prolonged base phase before recovery.