3 0

BEARISH 📉 : Bitcoin falls below $87K amid political instability and liquidations

Bitcoin is facing a critical demand zone after falling below the $87,000 level. The price action remains delicate as buyers struggle to regain control amidst increasing sell-side pressure and broader market risks.

- The recent drop is influenced by macroeconomic factors, including political instability in the US, with an estimated 78% chance of a government shutdown as of January 30, 2026.

- A rapid liquidation event occurred, wiping out around $170 million in leveraged long positions within 60 minutes, totaling approximately $320 million over four hours.

- Nearly $40 billion in total crypto market value was lost, driven primarily by derivatives rather than spot market capitulation.

Deleveraging-Led Drop

- XWIN Research Japan attributes the drop to forced liquidations in the derivatives market, focusing on leveraged long positions.

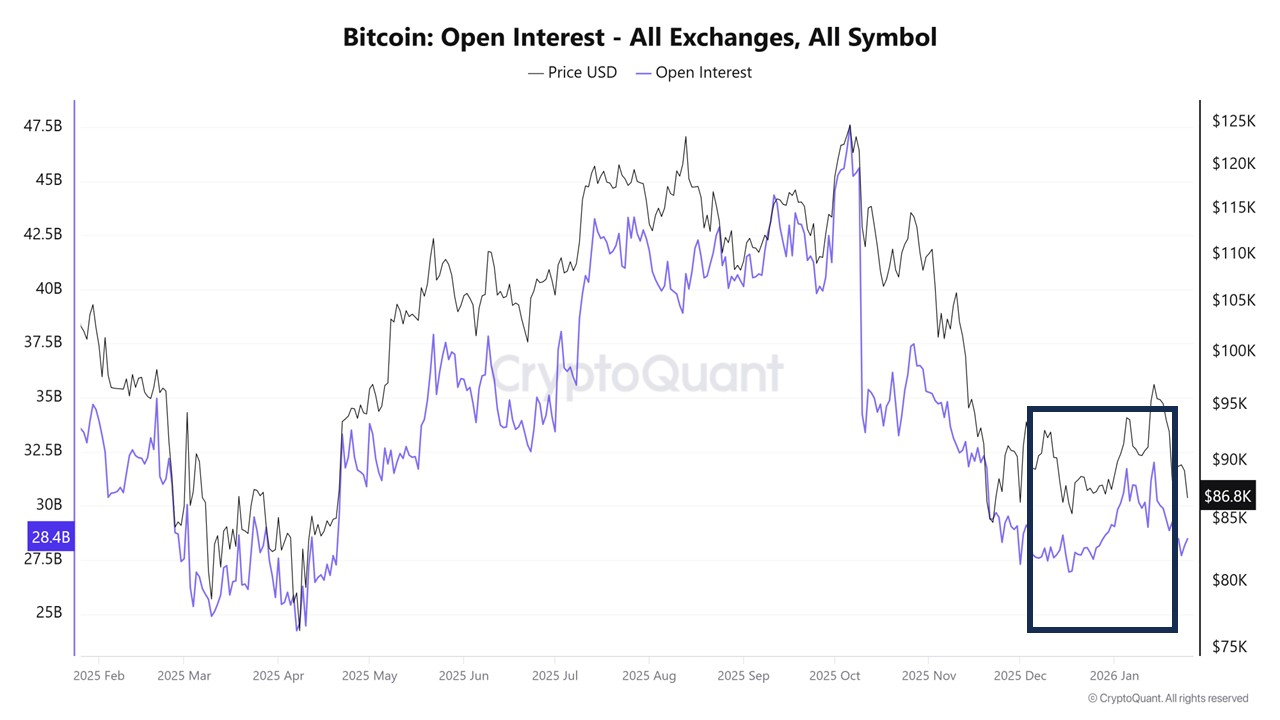

- Open Interest (OI) has decreased from a peak of $47 billion in late 2025 to about $28.4 billion, indicating reduced leverage but room for volatility.

Bitcoin's Resistance Levels

- Bitcoin is trading near $87,820, struggling under key resistance levels after failing to sustain momentum toward $98,000.

- The price is below crucial moving averages: the 50-period ($90,300), 100-period ($91,955), and 200-period ($90,756), now acting as resistance.

- Support is forming around the $87K–$88K range; failure to hold could lead to further declines toward $86,000 or mid-$84K.