16 4

Bitcoin Falls Below $90K Amidst Market Uncertainty and Liquidation Concerns

Bitcoin's value fell below $90,000 this week, a level not seen in seven months, trading around $90,700. This is approximately 25% lower than its recent peak of over $126,000 on October 6. A significant liquidation event on October 10 continues to impact market stability.

Analysts' Perspectives

- Tom Lee from BitMine highlighted the pressure from recent liquidations and uncertainty regarding potential US Federal Reserve rate cuts in December.

- Lee suggested that seller exhaustion and technical indicators might indicate an approaching bottom.

- Matt Hougan from Bitwise Asset Management described the current pricing as a "generational opportunity" for long-term investors, despite economic concerns and geopolitical tensions.

Selling Dynamics

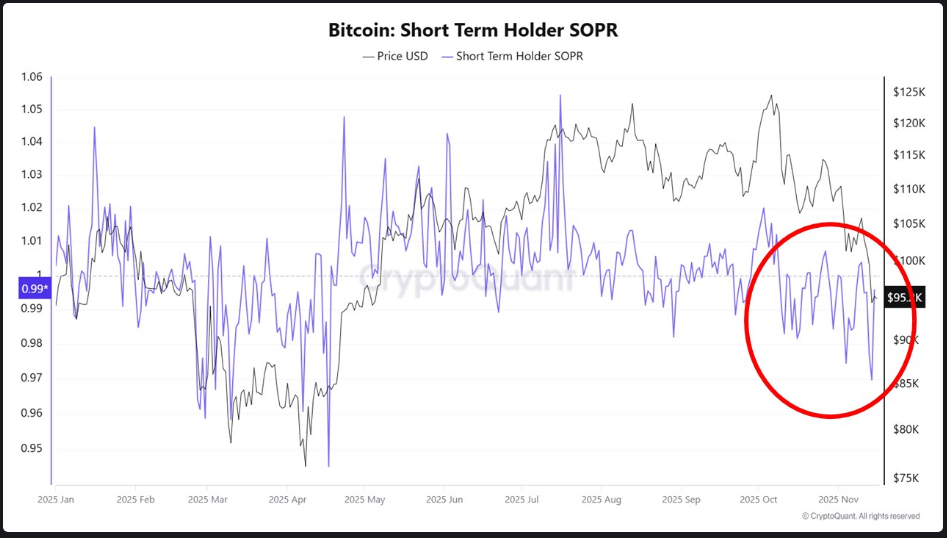

- XWIN Research identified short-term holders as the primary sellers in the recent downturn.

- The Short-Term Holder Spent Output Profit Ratio often dropped below 1, indicating sales at a loss by these holders.

- Coins younger than three months dominated the selling volume during the decline.

- Long-term holder behavior aligned with routine profit-taking rather than panic selling.

Market Influences

- Outflows from exchange-traded funds (ETFs) and whale sales added downward pressure.

- Geopolitical tensions introduced additional risk, with Bitcoin acting as an early indicator for broader market movements.

Future Outlook

- Lee predicts a Bitcoin rebound if stocks rally, potentially reaching new highs by year-end.

- Hougan sees an opportunity for investors willing to hold for at least a year.

- Traders are divided: some see signs of market fatigue, while others warn of further declines due to macroeconomic factors.